What a fantastic six months it’s been for Teradyne. Shares of the company have skyrocketed 49.5%, hitting $136. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Teradyne, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Teradyne Not Exciting?

Despite the momentum, we're sitting this one out for now. Here are three reasons you should be careful with TER and a stock we'd rather own.

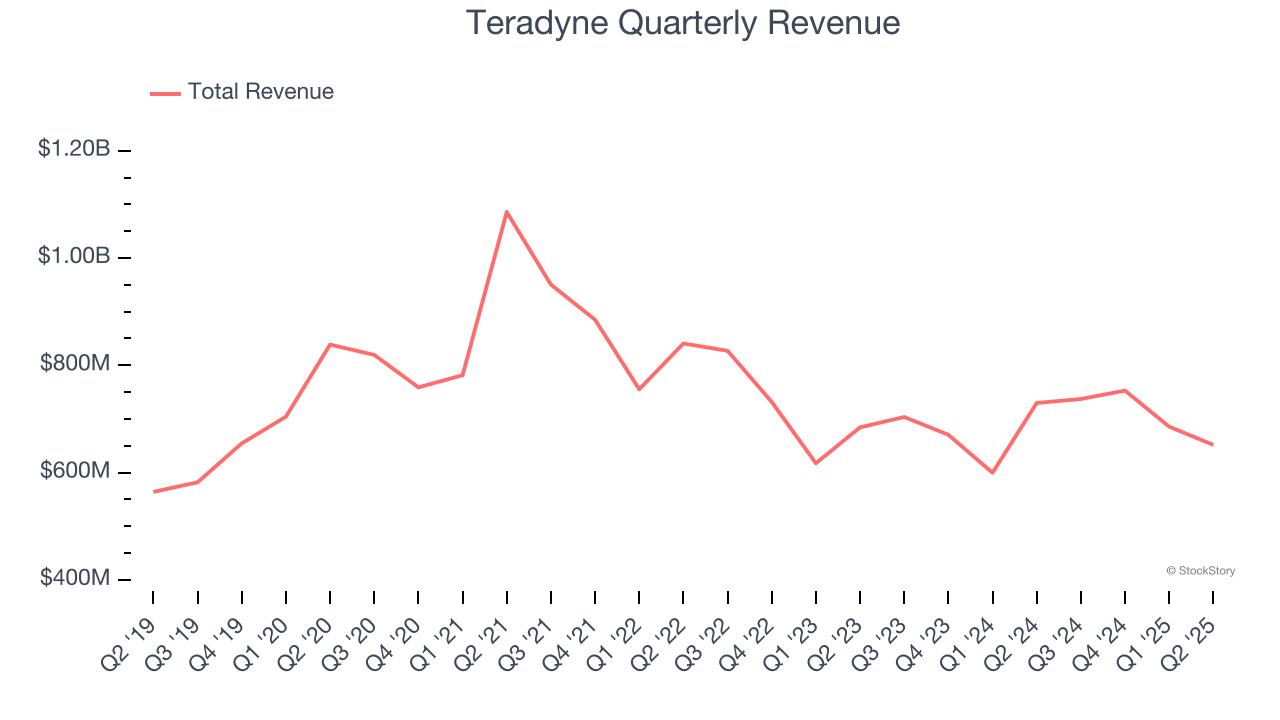

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Teradyne struggled to consistently increase demand as its $2.83 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a lower quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Shrinking Operating Margin

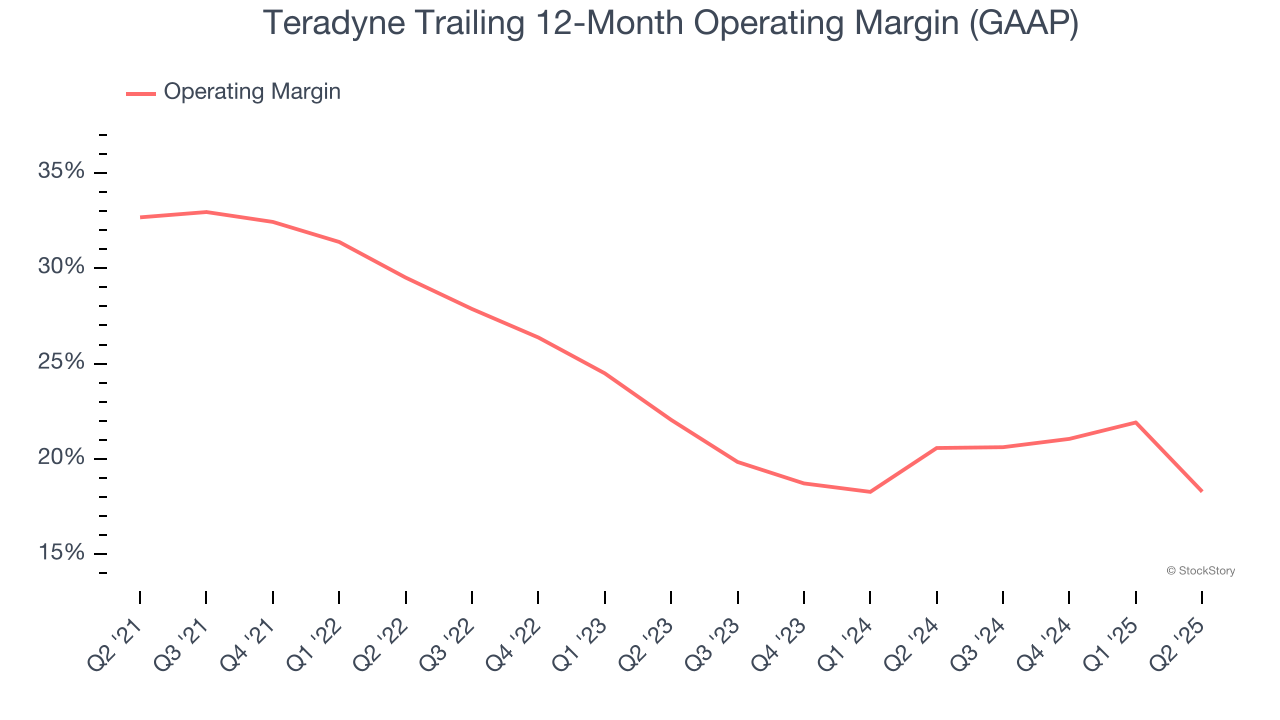

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Analyzing the trend in its profitability, Teradyne’s operating margin decreased by 14.4 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see Teradyne become more profitable in the future. Its operating margin for the trailing 12 months was 18.3%.

3. EPS Trending Down

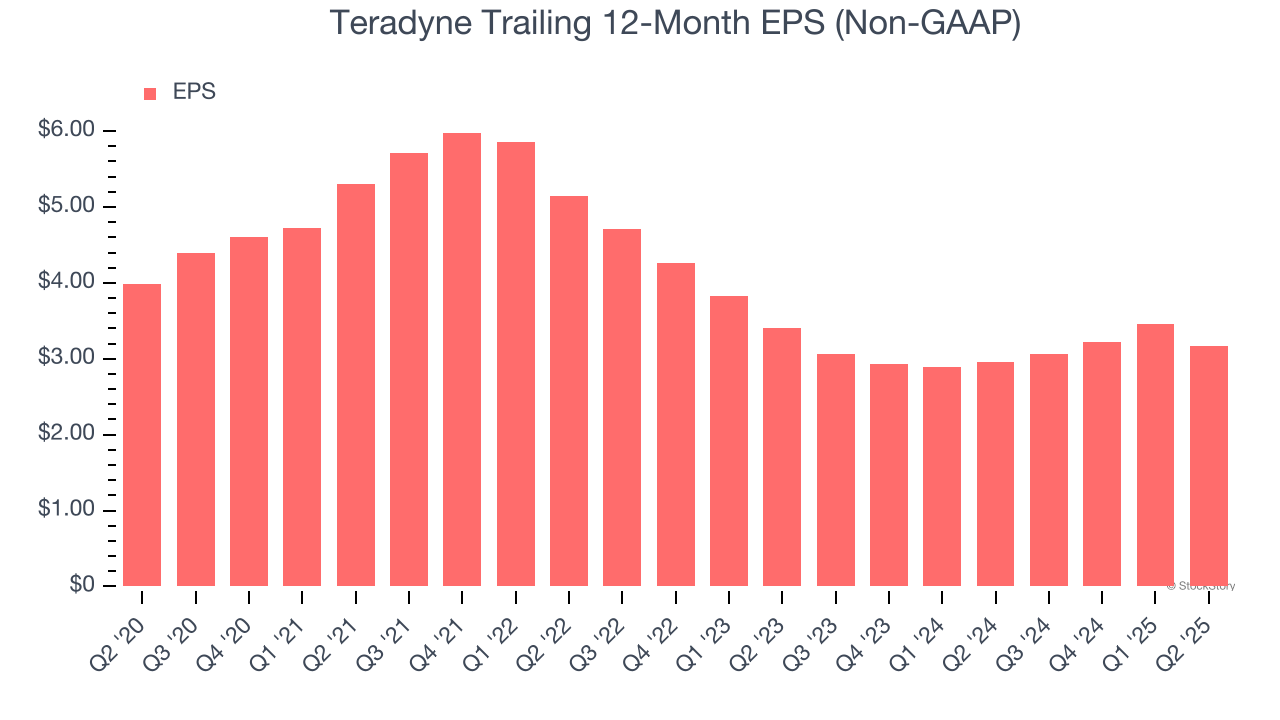

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Teradyne, its EPS declined by 4.4% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

Teradyne isn’t a terrible business, but it isn’t one of our picks. After the recent rally, the stock trades at 34× forward P/E (or $136 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Teradyne

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.