Dell Technologies’ (DELL) third-quarter results turned out to be strong, especially in terms of margins. Thanks to its improved margins and an upbeat full-year earnings outlook, investors reacted positively, pushing the stock higher in the pre-market session.

Notably, Dell has been witnessing significant demand for its artificial intelligence (AI)-optimized servers. However, AI has proved to be a double-edged sword for Dell’s Infrastructure Solutions Group (ISG), the division responsible for servers and storage. Earlier this year, the division felt margin strain because high-growth AI servers carried lower profitability. That pressure eased in the third quarter. In Q3, ISG’s operating income rate improved by 360 basis points sequentially to 12.4% of revenue, driven by a healthier mix of AI products, improving margins on those servers, and stronger performance in storage solutions. This shift signals that Dell is beginning to scale AI in a way that boosts earnings power.

The bottom line reflected this operational progress. Dell’s adjusted earnings came in at $2.59 per share, comfortably ahead of Wall Street expectations. Strong execution across both the ISG and the Client Solutions Group (CSG), combined with disciplined cost controls, boosted its bottom line.

Thanks to strong AI-driven demand and improved margins, management raised full-year EPS guidance to $9.92 at the midpoint, a 22% increase from last year and above the prior forecast of $9.55.

Despite the AI-led tailwinds, Dell’s stock performance has been relatively muted. Shares are up just 11.9% for the year, trailing the broader market’s 15% gain.

But with ISG posting double-digit growth, storage profitability back on track, and AI server margins stabilizing, Dell stock could be poised for a solid uptrend.

Dell’s Growth Engine Is Not Slowing Soon

Dell is a compelling investment option in the AI hardware space. The company continues to report exceptional demand for its AI-focused server lineup, and the second half of the year is witnessing stronger momentum. In the third quarter, Dell booked $12.3 billion in AI server orders, bringing year-to-date orders to a record $30 billion.

Notably, Dell’s customer base continues to broaden beyond major cloud platforms to include second-tier cloud service providers, sovereign cloud buyers, and large enterprises, which augurs well for growth.

Shipments of AI servers reached $5.6 billion in the quarter and $15.6 billion so far this year, while Dell’s backlog climbed to a new high of $18.4 billion. Further, its pipeline of future opportunities across all regions remains large, suggesting demand is unlikely to slow soon.

Traditional server demand is also rebounding. Double-digit growth in both North America and EMEA reflects continued IT modernization driven by AI-related workloads. Customers are shifting toward high-performance configurations, benefiting Dell’s newer platforms and improving profitability.

The story in its storage solutions is more mixed, with revenue dipping slightly from last year. Still, demand for Dell’s proprietary storage lineup remains strong. Its all-flash portfolio has now delivered two straight quarters of double-digit growth, and higher margins are strengthening the value of these offerings.

Personal computing is holding up better than expected as commercial customers refresh aging PCs and migrate toward Windows 11. While consumer revenue slipped in Q3, the underlying demand trend improved.

Overall, the strength of its businesses indicates that Dell is well-positioned to deliver strong growth in the coming quarters.

Is Dell Stock a Buy, Sell, or Hold?

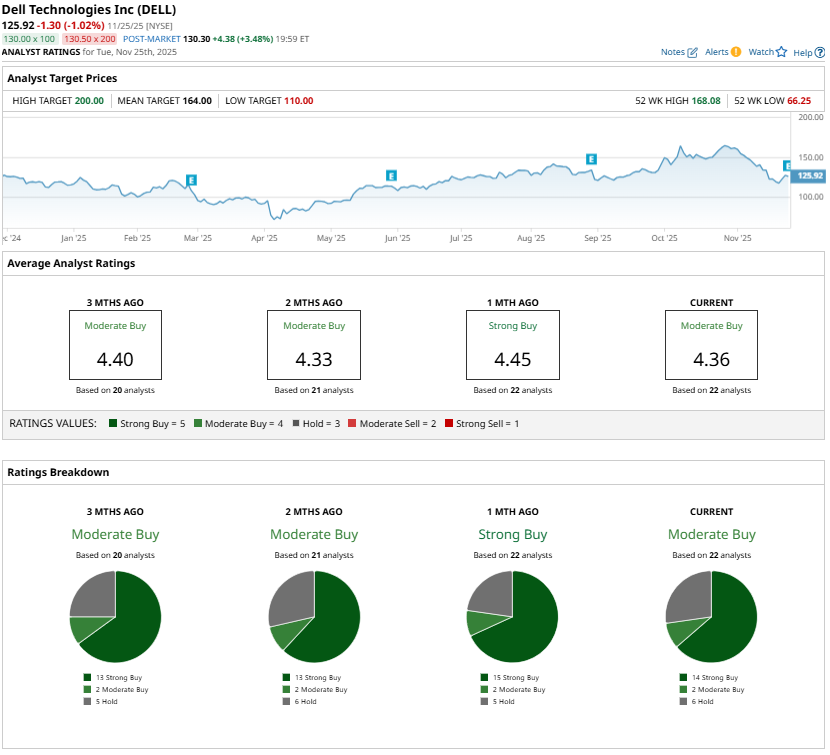

Looking ahead, while analysts maintain a “Moderate Buy” outlook, Dell’s opportunity in AI infrastructure appears strong. Record orders, a swelling backlog, a growing global customer base, and profit expansion point to sustained growth.

Dell trades at a forward price-earnings ratio of 14.7x, a modest valuation given analysts’ projections of more than 18% earnings growth in fiscal 2027, making it a buy near current levels.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?