If you've scouted different categories of stocks with the potential to grow fast, you may have wondered, "What is consumer discretionary?"

Consumer discretionary stocks are often among the top performers, particularly during a bull market. Companies in the consumer discretionary sector make goods or offer services that people want but may not be necessities. The largest consumer discretionary stocks include Amazon.com Inc. (NASDAQ: AMZN), Tesla Inc. (NASDAQ: TSLA), Home Depot Inc. (NYSE: HD), Nike Inc. (NYSE: NKE) and McDonald's Corp. (NYSE: MCD).

Because they often outperform the broader market, you may want to add consumer discretionary stocks to your portfolio.

What is Consumer Discretionary?

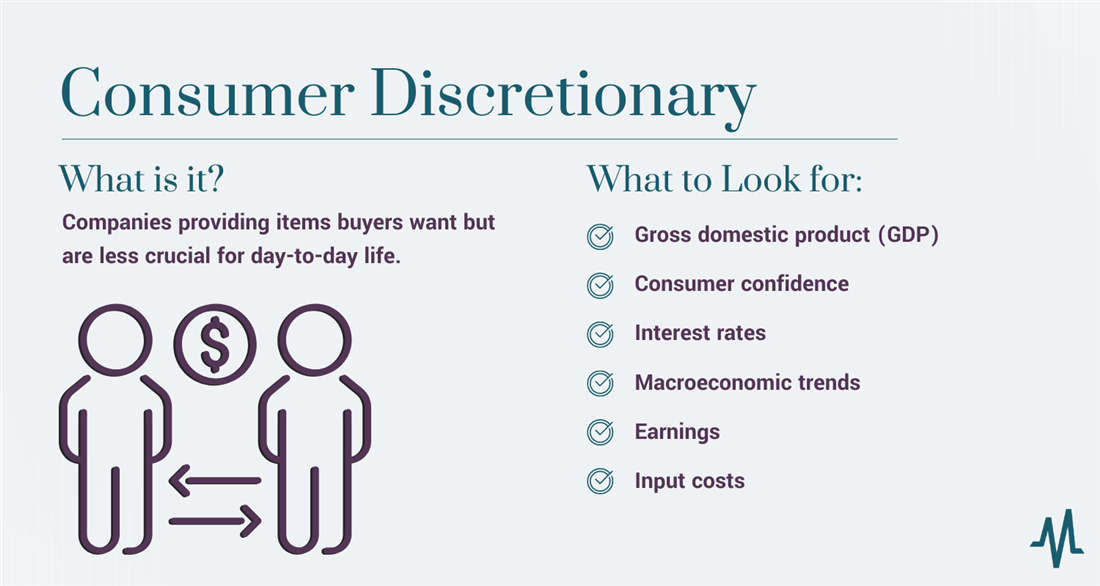

What is consumer discretionary sector, exactly? The consumer discretionary definition includes companies providing items buyers want but are less crucial for day-to-day life, unlike groceries or grooming products. Those items fall under the consumer staples sector.

Consumer discretionary includes home electronics, leisure services, restaurants, travel companies and even automakers.

Overview of the Consumer Discretionary Sector

When choosing portfolio investments, you should learn more about consumer discretionary stocks. The consumer discretionary meaning refers to companies that tend to be sensitive to interest rates and economic conditions.

Consumer discretionary stocks are cyclical, meaning they tend to follow economic cycles. When the economy expands, companies that sell consumer discretionary goods and services tend to see a booming business. That changes as consumers spend less money in a recession. As the economy begins to recover, consumer discretionary companies again show growth.

Consumer discretionary stocks often yield high returns in a robust economy. Because its strength links to overall economic conditions, it's relatively straightforward to understand when the consumer discretionary sector will perform well.

Types of Consumer Discretionary Companies

Consumer discretionary stocks include restaurants and travel companies, household furniture, leisure-related items, hotels and casinos and general retail. All these industries are among the most sensitive to economic cycles. If you're afraid of losing your job in a recession, it's easy to postpone that vacation or buy fewer pairs of new shoes before you stop buying groceries and shampoo.

Examples of consumer discretionary stocks include:

- Restaurants: McDonald's Corp. (NYSE: MCD), Starbucks Corp. (NASDAQ: SBUX) and Chipotle Mexican Grill Inc. (NYSE: CMG).

- Automotive: Tesla and Ford Motor Company (NYSE: F).

- Hotels: Marriott International Inc. (NASDAQ: MAR) and Hyatt Hotels Corp. (NYSE: H).

- Furniture and appliances: Williams-Sonoma Inc. (NYSE: WSM), RH (NYSE: RH) and Whirlpool Corp.(NYSE: WHR).

- Leisure: The Walt Disney Co. (NYSE: DIS), Royal Caribbean Group (NYSE: RCL) and Planet Fitness (NYSE: PLNT).

Predicting Trends for the Consumer Discretionary Sector

It's relatively easy to predict where trends for the consumer discretionary sector may go.

Economic indicators, including consumer spending, the unemployment rate, interest rates and personal savings rates, all offer clues as to the future health of the consumer discretionary sector.

While factors such as rising interest rates can slow consumer spending, other factors, such as wage growth, can catalyze more spending. Consumer spending is a significant leading indicator for the broader economy.

GDP

Gross domestic product (GDP) includes four areas: Consumer spending, business spending, government spending and net exports. Combined, these indicate what a country produces and how people consume consumer products and services.

According to data compiled by the Bureau of Economic Analysis, consumer spending accounts for about 70% of GDP. The consumer discretionary sector plays a significant role in the overall health of the domestic economy.

Robust consumer spending can affect broad market sentiment. When consumer spending increases at a healthy clip or at rates larger than analysts expected, that's usually a sign that the economy hums along rather than contracting.

Consumer Confidence

The Consumer Confidence Survey, conducted monthly by the Conference Board, looks at prevailing business conditions and indicates economic developments that may be likely in the coming months. It compiles its data into the Consumer Confidence Index.

This index uses data from the monthly Consumer Confidence Survey, which tracks consumer sentiment, buying intentions, vacation plans and expectations for inflation, interest rates and stock prices.

Each month, institutional investors watch for updated consumer confidence numbers. Because consumer confidence affects spending, more upbeat data can boost the consumer discretionary sector, whereas lower numbers can pull it down.

Interest Rates

Interest rates, too, have an effect. Soon after the Federal Reserve began raising rates in March 2022, the consumer discretionary sector began declining. Consumer staples and most other sectors declined during that time frame, but consumer discretionary companies are more likely to suffer the effects of higher borrowing costs.

With higher interest rates, it eventually becomes more expensive for consumers to borrow, meaning their purchases of nonessential and luxury goods decreases. In addition, with interest rates rising on other items, consumers' overall cost of living increases, giving even more reason to cut back on nonessential purchases.

Macroeconomic Trends

Investors who want signals that the consumer discretionary sector is poised for growth can monitor indicators such as the Consumer Confidence Index and other well-publicized data, including the unemployment rate, consumer spending and personal savings rates. Combined, these can offer a good indication as to whether it's the right time to put money into consumer discretionary stocks.

The Consumer Price Index is one measure of consumer sentiment that affects stocks. What does the consumer price index measure? This index tracks the average change over time in the prices for a basket of consumer goods and services.

How does the consumer price index affect the stock market? If investors believe consumers are paying more for items they usually purchase, that could signal that economic growth may slow or a recession may be near. Consumer discretionary companies would be among the first to suffer an economic slowdown.

Earnings

Every quarter, the market pays attention to earnings from the biggest Consumer Discretionary companies to see whether consumers freely open their wallets. For example, weaker revenue and earnings from Amazon.com may indicate that consumers prefer to buy eggs at the local grocery store rather than a new fitness tracker or the latest celebrity tell-all from the online retailer.

Input Costs

Like every other business, consumer discretionaries must grapple with conditions out of their control. Factors such as high shipping, energy and labor costs can cut into earnings in recent years. Supply-chain disruptions also made it difficult for many companies to get supplies or put goods on shelves, which dents revenue.

Lower earnings will bring down the performance of the consumer discretionary sector.

Consumer Discretionary vs. Consumer Staples

In an economic downturn, it's easy to spot the difference between consumer staples vs consumer discretionary. The consumer staples sector, which consists of necessities people buy regardless of the economy, holds up better as people purchase groceries, personal care products and clothing.

Consumer discretionary goods, however, may see decreased sales as people opt to forego a cruise or vacation in a weak economy.

Investors who want to track the two sectors visually can use the charts of popular exchange-traded funds. You can easily see the spreads and divergences between the Consumer Discretionary Select Sector SPDR Fund (NYSEARCA: XLY) and the Consumer Staples Select Sector SPDR Fund (NYSEARCA: XLP) to get an understanding of how the current market and economic cycle affects each.

How to Invest in Consumer Discretionary

Whether you prefer broad diversification within the sector or to focus on individual stocks, there are several approaches to investing in consumer discretionary stocks.

Approach 1: Use ETFs.

One easy way to access the basket of Consumer Discretionary stocks is by investing in an exchange-traded fund tracking the sector.

It's easy to invest in ETFs such as the Select Sector SPDR Consumer Discretionary Fund (NYSEARCA: XLY), the Vanguard Consumer Discretionary ETF (NYSEARCA: VCR) or the Fidelity MSCI Consumer Discretionary Index ETF (NYSEARCA: FDIS), among others.

ETFs can be bought and sold at any time during the trading day, just like individual shares of stock. They give you wide exposure to all the sector stocks, assuring you will get all the performance of the best sector stocks and sub-industries.

Learn more: Will consumer discretionary ETFs fit your portfolio?

Approach 2: Focus on specific industries.

Say you believe frappuccino will make a big comeback in the next few months. You may want to invest in Starbucks. Or you've been tracking the performance of the automotive industry. You see auto sales rising and want to capitalize on that trend. In that case, it would make sense to put money into Tesla, Ford or General Motors (NYSE: GM).

Approach 3: Use chart analysis.

If you learn to read stock charts and understand basic patterns and trend lines, you can easily spot consumer discretionary stocks rising in heavy volume. By understanding simple concepts like moving-average support, you can see when it may be time to buy a stock that has strong support from institutional investors but may be taking a breather before resuming its rally.

Approach 4: Use earnings data.

Consumer discretionary companies with growing sales and earnings are often good candidates for investment. If a company's product or service is in demand, revenue will increase at a healthy pace. Ideally, you'd like to see growth higher than the broader market, to indicate there's really something consumers like about this company, relative to what else is out there. Steady increases in earnings mean the company has operational efficiencies and can generate profit from its revenue stream.

Consumer Discretionary Stocks Reflect the Economy

Consumer discretionary stocks tend to rise when consumers are optimistic or have more money in their pockets due to higher wages. Conversely, they fall when consumers are concerned about a possible recession or when inflation or interest rates are high. For those reasons, broader economic conditions and consumer sentiment generally determine the sector's direction.

FAQs

Here are some frequently asked questions about investing in Consumer Discretionary stocks.

What is meant by consumer discretionary?

Consumer discretionary includes companies providing items that buyers want but aren't necessary in the same way that groceries, personal hygiene or healthcare products are required.

Consumer discretionary includes home electronics, restaurants, travel companies and even automakers.

What is discretionary vs. staples?

You can think of consumer discretionary goods as something people want, such as restaurant meals or vacations. However, when consumers pinch pennies in a weak economy, they continue spending on necessary consumer staples, such as food and household cleaning supplies.

Is McDonald's a consumer discretionary stock?

McDonald's is a perfect example of a consumer discretionary stock. Its earnings grow more slowly when consumers are concerned about inflation or a possible recession. In a booming economy, its earnings tend to grow faster.