December live cattle (LEZ25) futures hit a 4.5-month low last Friday and for the week lost $4.70 a hundredweight. January feeder cattle (GFF26) futures also notched a 4.5-month low and on the week fell $6.325. December lean hog (HEZ25) futures last week were down 70 cents. Live and feeder cattle futures and lean hog futures markets are all in near-term price downtrends on their daily bar charts, which suggests the path of least resistance for prices will remain sideways or lower for at least the time being.

Still, livestock futures bulls can correctly argue their markets have taken a beating lately and the bears may now be exhausted. The high-range closes in live and feeder cattle futures markets on Friday begin to suggest that is the case.

The cattle futures markets saw stronger selling pressure early in Friday’s session, due in part to news the U.S. was dropping import tariffs on several Brazilian food products, including beef. Also bearish was active cash cattle trading late last week saw the USDA report that steers fetched an average price of $217.57 and heifers $218.55. That is well down from the prior week’s average cash cattle trade reported by USDA at $225.06.

Cattle Futures Traders Get a Bullish Reminder Friday Afternoon

Cattle futures traders Friday afternoon got their first USDA monthly cattle-on-feed report since Sept. 19. The agency Friday afternoon reported cattle and calves on feed for the slaughter market in the U.S. for feedlots with capacity of 1,000 or more head totaled 11.7 million head on Nov. 1. The inventory was 2% below Nov. 1, 2024, which was very close to market expectations. Placements in feedlots during October totaled 2.04 million head, 10% below 2024 and less than traders expected. Net placements were 1.99 million head. Placements were the lowest for October since the series began in 1996.

During October, placements of cattle and calves weighing less than 600 pounds were 515,000 head, 600-699 pounds were 420,000 head, 700-799 pounds were 445,000 head, 800-899 pounds were 384,000 head, 900-999 pounds were 195,000 head, and 1,000 pounds and greater were 80,000 head. Marketings of fed cattle during October totaled 1.70 million head, 8% below the same time in 2024 and close to market expectations. Other disappearance totaled 54,000 head during October, 2% below 2024.

Overall, the report leaned price-friendly for the cattle futures markets and underscored what traders have known for quite some time: Cattle supplies in the United States are historically very tight.

Despite High Prices, Consumers Want Beef on the Table

Despite the recent beat-down in cattle futures prices, cattle producers and traders need to keep in mind that U.S. consumer demand for beef remains robust, with better demand likely in the coming weeks due to beef cuts being selected for holiday meals. This should keep a floor under cash cattle prices and support wholesale boxed beef values and beef packer margins in the coming weeks, or longer.

U.S. consumer confidence will be an important element for cattle markets in the coming months. Recent good consumer confidence has led to better demand for beef at the meat counter. The wobbly and more volatile U.S. stock indexes recently is not a good signal for consumer confidence remaining high. In the coming months, the trajectory of the U.S. stock market will likely be a main influence on consumer confidence, and in turn, demand for beef at the meat counter.

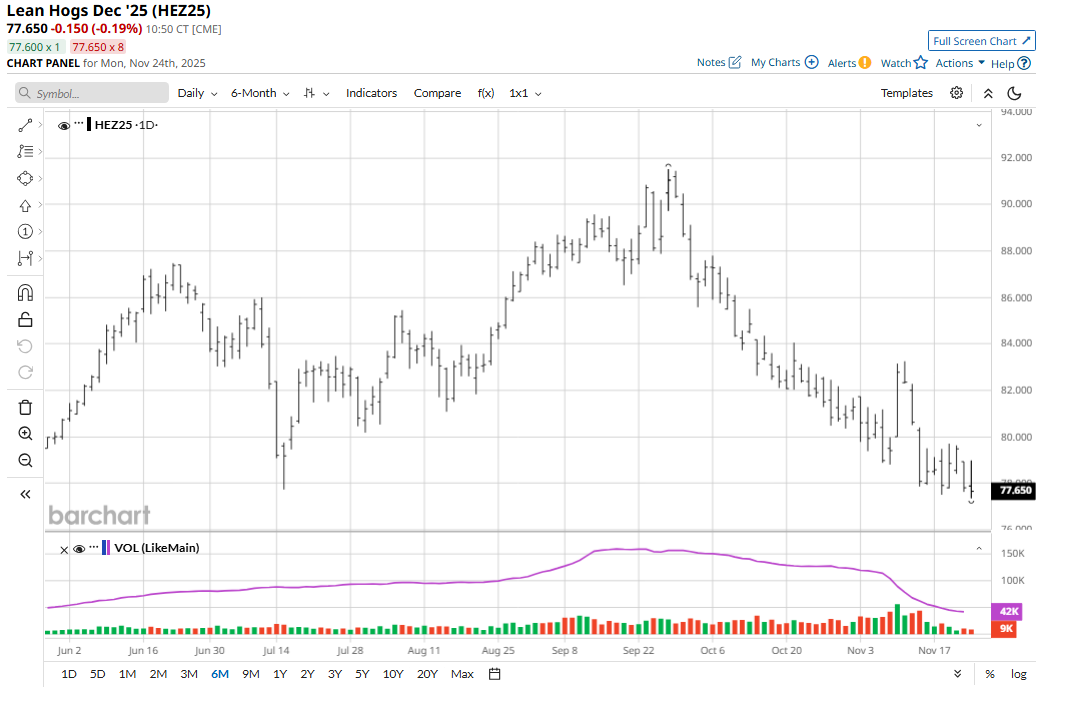

Technical Sellers Punishing the Lean Hog Futures Market

The lean hog futures market has seen technical selling featured as the near-term chart posture remains firmly bearish. December lean hogs remain in a price downtrend, and the chart-based speculative bears will likely continue looking to play the short side this week.

Falling cash hog prices will also continue to favor the hog bears until the cash market bottoms out. Lean hog futures’ present discounts to the CME cash hog index may work to limit selling interest in hog futures this week.

The latest CME lean hog index is down another 56 cents to $85.71. The national direct five-day rolling average cash price Friday was $74.35 — down around $9.00 from the prior Friday’s quote.

Holiday Hams, Pork Export Demand, Offer Dim Hopes for Lean Hog Bulls

Holiday demand for hams may be one factor that helps to stop the slide in cash hog and hog futures prices. However, longer-term charts for lean hog futures show prices are still in the upper half of the historical trading range dating back to the 1970s. With the highly cyclical nature of lean hog futures price action, don’t be surprised to see more downside price pressure in hog futures in the coming weeks.

Recent U.S. trade deals have hog producers hopeful for better global demand for U.S. pork in the coming months. China is a major pork importer, and U.S-China relations are presently on the upswing. That’s positive for the hog and pork futures markets.

Now that the U.S. government has opened back up, hog traders are anxious for the USDA to resume reporting its weekly U.S. export sales data for pork, as well as cold storage data.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart