Memory chips are experiencing a surge in demand driven by artificial intelligence (AI) operations. AI and consumer electronics companies now fight for the dwindling supply of these chips. Against this backdrop, TD Cowen analyst Krish Sankar sees significant potential for 2026 in Applied Materials (AMAT), a materials engineering solutions company.

This chip manufacturing equipment firm is exposed to strong tailwinds from the demand for dynamic random access memory (DRAM) and the leading-edge foundry industry, both of which are seeing heightened demand driven by AI. As a result, TD Cowen analysts raised the price target on Applied Materials from $260 to $315 while maintaining a bullish “Buy” rating, implying 16.9% upside from current levels.

Let's take a closer look at Applied Materials role in this frenzied market environment.

About Applied Materials Stock

Applied Materials, headquartered in Santa Clara, California, is a pioneer in materials engineering technology for the semiconductor industry. The company develops and supplies cutting-edge equipment for essential manufacturing processes, including deposition, etching, ion implantation, metrology, inspection, and planarization.

The company operates through divisions such as Semiconductor Products, Applied Global Services, and Display, serving a diverse customer base across the U.S., China, Korea, Taiwan, Europe, and more. With multiple R&D centers worldwide, Applied Materials supports high-volume production for emerging technologies. The company has a market capitalization of $214 billion.

Robust financial results and surging demand for AI-enabled chips, advanced memory, denser DRAM, and logic chips have boosted the semiconductor equipment sector. Over the past 52 weeks, Applied Materials’ stock has gained 56%, while it is up 64% over the past six months. It reached a 52-week high of $273.59 today, Dec. 5, and is down only 1.6% from that level.

Applied Materials’ price sits at 31.02 times earnings, which is marginally higher than the industry average of 30.77 times.

Applied Materials’ Q4 Results Topped Expectations

On Nov. 13, Applied Materials reported its fourth-quarter and full-year results for fiscal 2025 (the period that ended on Oct. 26). The company’s quarterly net revenue decreased by 3% year-over-year (YoY) to $6.80 billion.

However, this was higher than the Wall Street analysts’ estimate of $6.70 billion. For fiscal 2025, Applied Materials’ topline increased 4% annually to $28.37 billion, marking the company’s sixth consecutive year of growth.

The company’s non-GAAP EPS for the fourth quarter declined by 6% YoY to $2.17. However, the figure exceeded the $2.11 that analysts had expected. For the full year, its non-GAAP EPS increased 9% annually to $9.42.

Applied Materials’ President and CEO, Gary Dickerson, believes the company is well-positioned at the “highest value technology inflections in the fastest growing areas of the market.” Brice Hill, Senior Vice President and CFO, stated that, based on the conversations with customers and partners, the company is preparing for higher demand in the second half of 2026.

Applied Materials expects spending on chipmaking equipment in China to fall next year, as export controls curb the market access in the country. However, the effect is expected to be partially offset by the strong memory output associated with rising AI investments. The company expects current-quarter revenue of $6.85 billion, plus or minus $500 million.

Wall Street analysts have a mixed view about Applied Materials’ bottom-line trajectory. For the current quarter, its EPS is expected to decline by 7.1% YoY to $2.21. On the other hand, for fiscal 2026, the company’s EPS is projected to increase marginally annually to $9.51, followed by a 16.7% YoY increase to $11.10 in fiscal 2027.

What Do Analysts Think About Applied Materials Stock?

Apart from TD Cowen’s bullish sentiment, Wall Street analysts are also optimistic about the stock’s prospects. Recently, analysts at KeyBanc raised the price target from $240 to $285 while maintaining an “Overweight” rating on the stock. KeyBanc analysts believe the company has a superior valuation compared to its peers and a multi-year demand tailwind from AI use and devices.

In November, UBS analysts upgraded Applied Materials from “Neutral” to “Buy” and raised the price target from $250 to $285. Analysts see the company benefiting from growth in wafer fabrication equipment (WFE) and prospects in China. Needham analyst Charles Shi reiterated a “Buy” rating on the stock while maintaining a price target of $260.

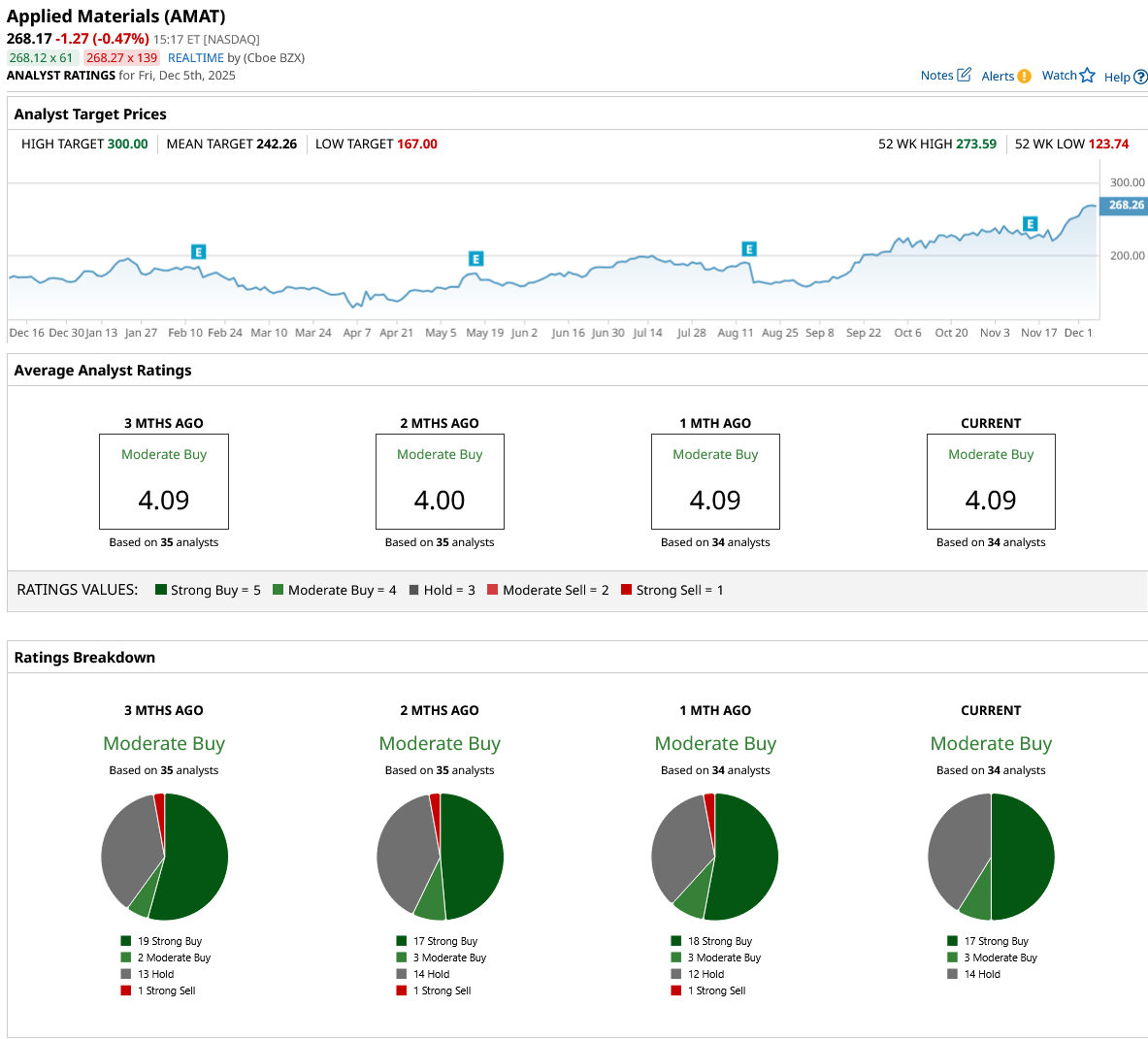

Applied Materials has become quite popular on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 34 analysts rating the stock, 17 analysts have given it a “Strong Buy” rating, three analysts rated it “Moderate Buy,” while 14 analysts are playing it safe with a “Hold” rating. The consensus price target of $242.26 represents 10% downside from current levels.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Legendary Investor Muddy Waters Is Making a Rare Bullish Bet on This Gold Stock. Should You Buy It Too?

- TD Cowen Says This Memory Chip Maker Is One of the Best Stocks to Buy for 2026

- SoFi Stock Breaks Below Key Moving Averages on $1.5B Offering. Should You Buy the Dip?

- Netflix Is Buying Warner Bros. Discovery. Should You Buy NFLX Stock?