Thermon has been treading water for the past six months, recording a small loss of 0.6% while holding steady at $32. The stock also fell short of the S&P 500’s 14% gain during that period.

Does this present a buying opportunity for THR? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does THR Stock Spark Debate?

Creating the first packaged tracing systems, Thermon (NYSE:THR) is a leading provider of engineered industrial process heating solutions for process industries.

Two Positive Attributes:

1. Elite Gross Margin Powers Best-In-Class Business Model

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

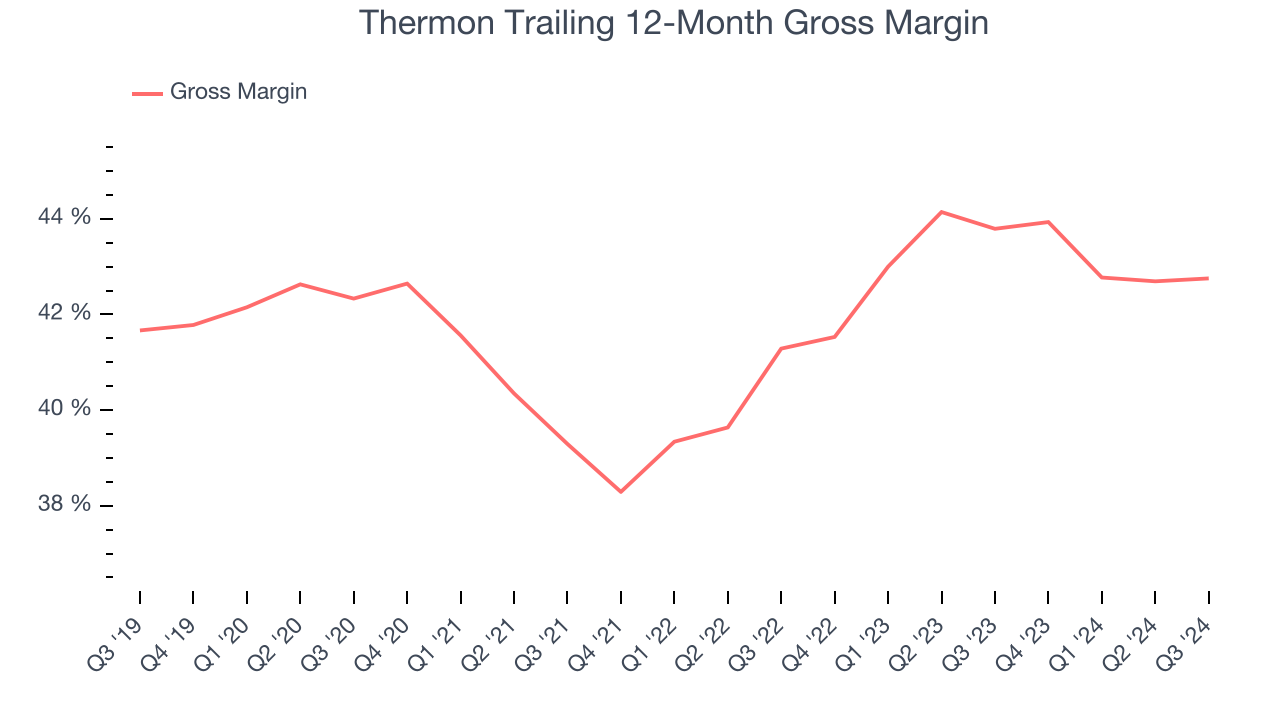

Thermon has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 42.1% gross margin over the last five years. That means Thermon only paid its suppliers $57.89 for every $100 in revenue.

2. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

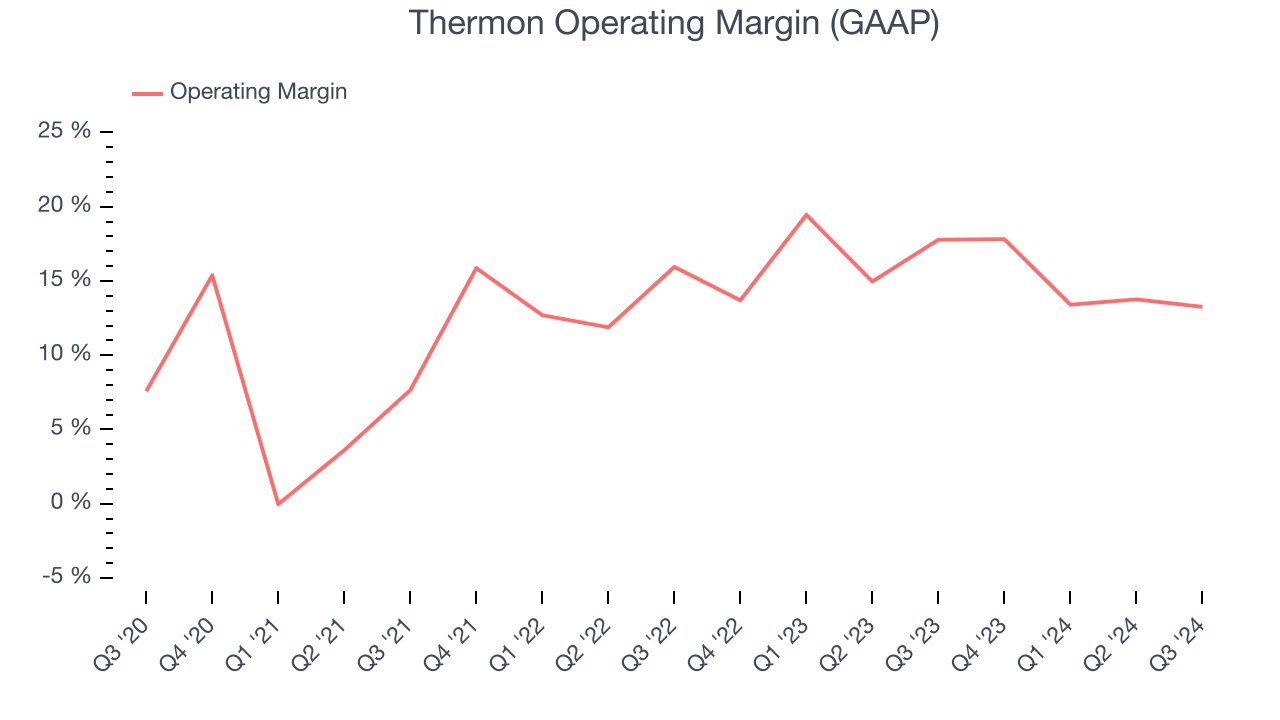

Analyzing the trend in its profitability, Thermon’s operating margin rose by 9.5 percentage points over the last five years, showing its efficiency has meaningfully improved. Its operating margin for the trailing 12 months was 14.7%.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

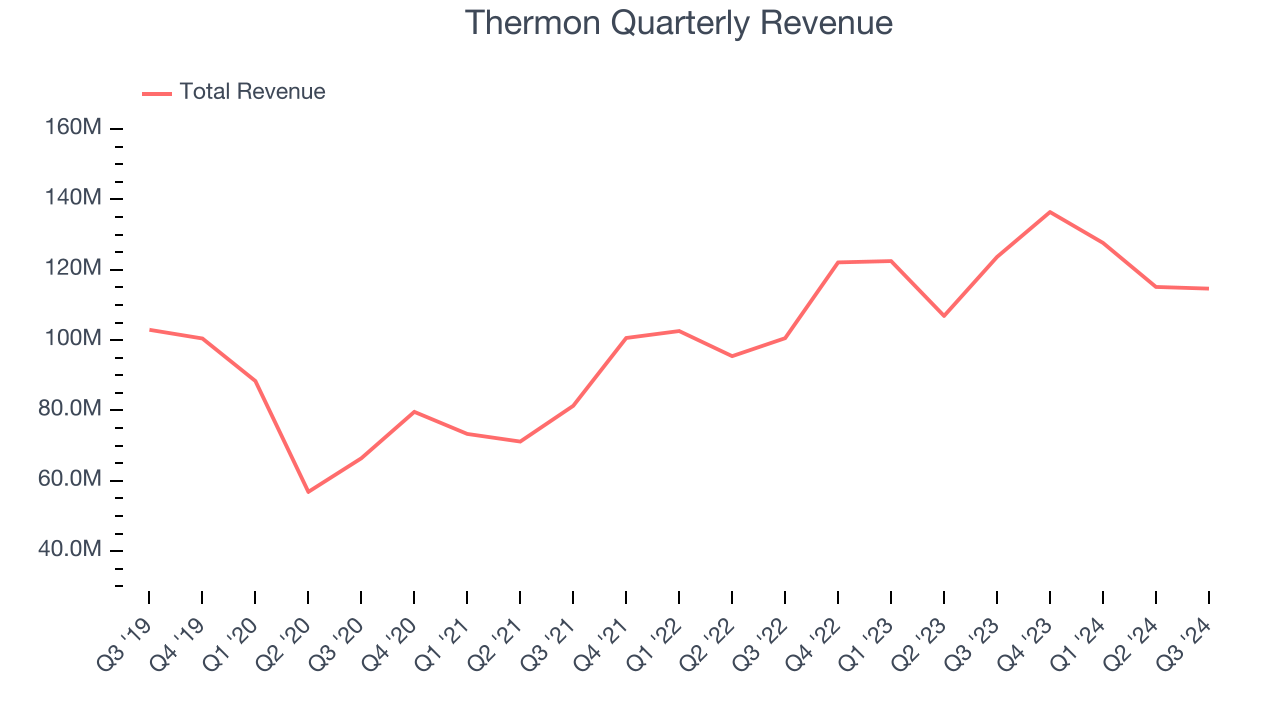

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Thermon grew its sales at a sluggish 2.9% compounded annual growth rate. This was below our standards.

Final Judgment

Thermon’s merits more than compensate for its flaws. With its shares lagging the market recently, the stock trades at 15.6x forward EV-to-EBITDA (or $32 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Thermon

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.