Freshworks has had an impressive run over the past six months as its shares have beaten the S&P 500 by 17.4%. The stock now trades at $16, marking a 24.9% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy FRSH? Find out in our full research report, it’s free.

Why Do Investors Watch FRSH Stock?

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Three Positive Attributes:

1. ARR Surges as Recurring Revenue Flows In

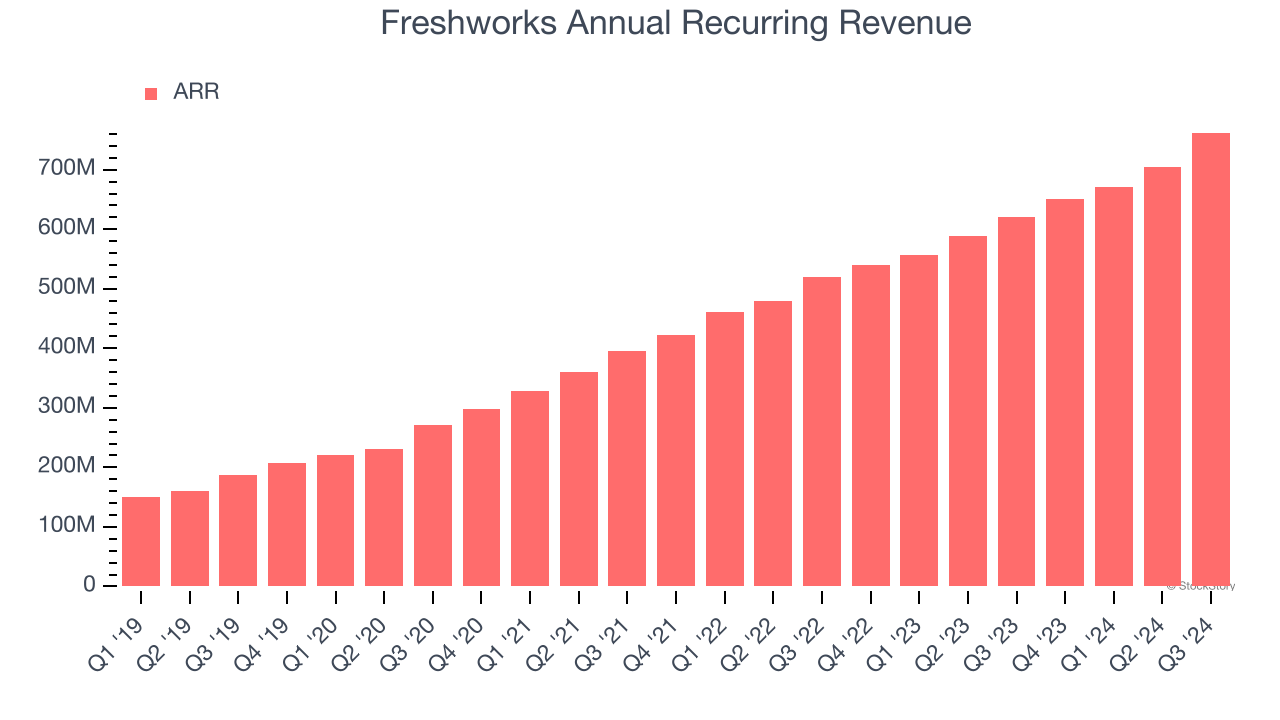

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Freshworks’s ARR punched in at $762.3 million in Q3, and over the last four quarters, its year-on-year growth averaged 20.9%. This performance was impressive and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Freshworks a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

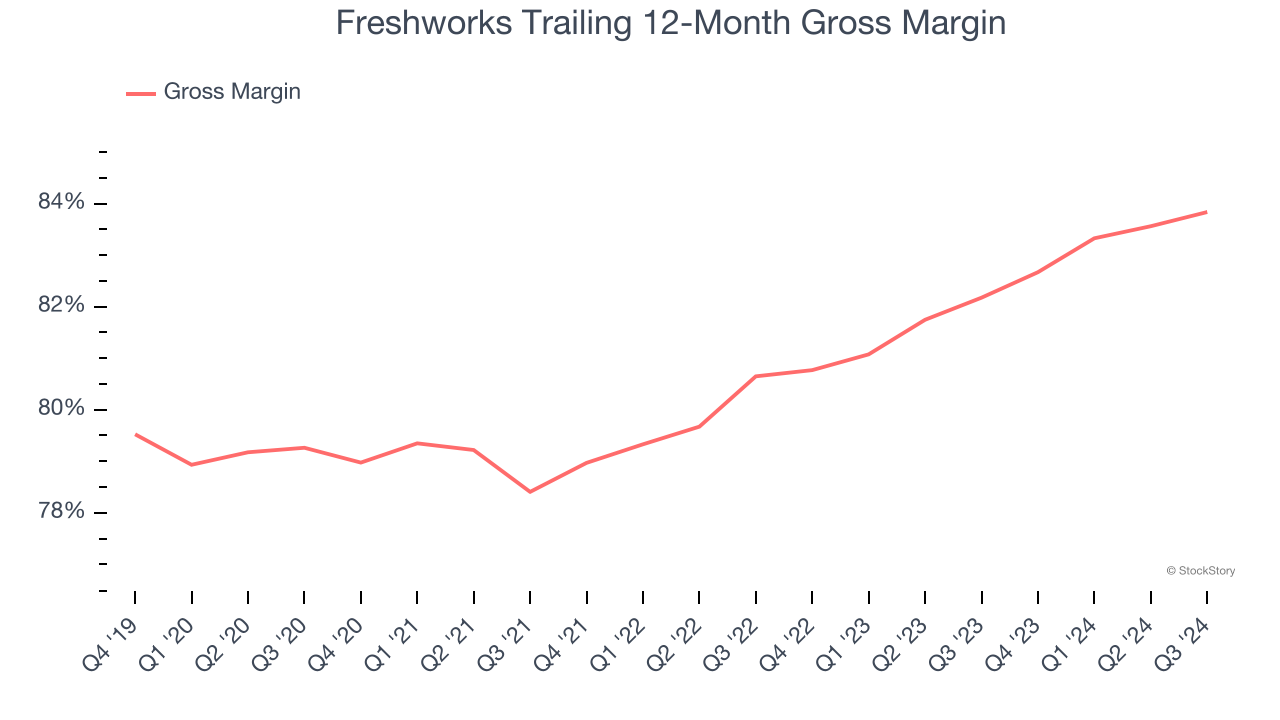

2. Elite Gross Margin Powers Best-In-Class Business Model

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Freshworks’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 83.8% gross margin over the last year. Said differently, roughly $83.84 was left to spend on selling, marketing, and R&D for every $100 in revenue.

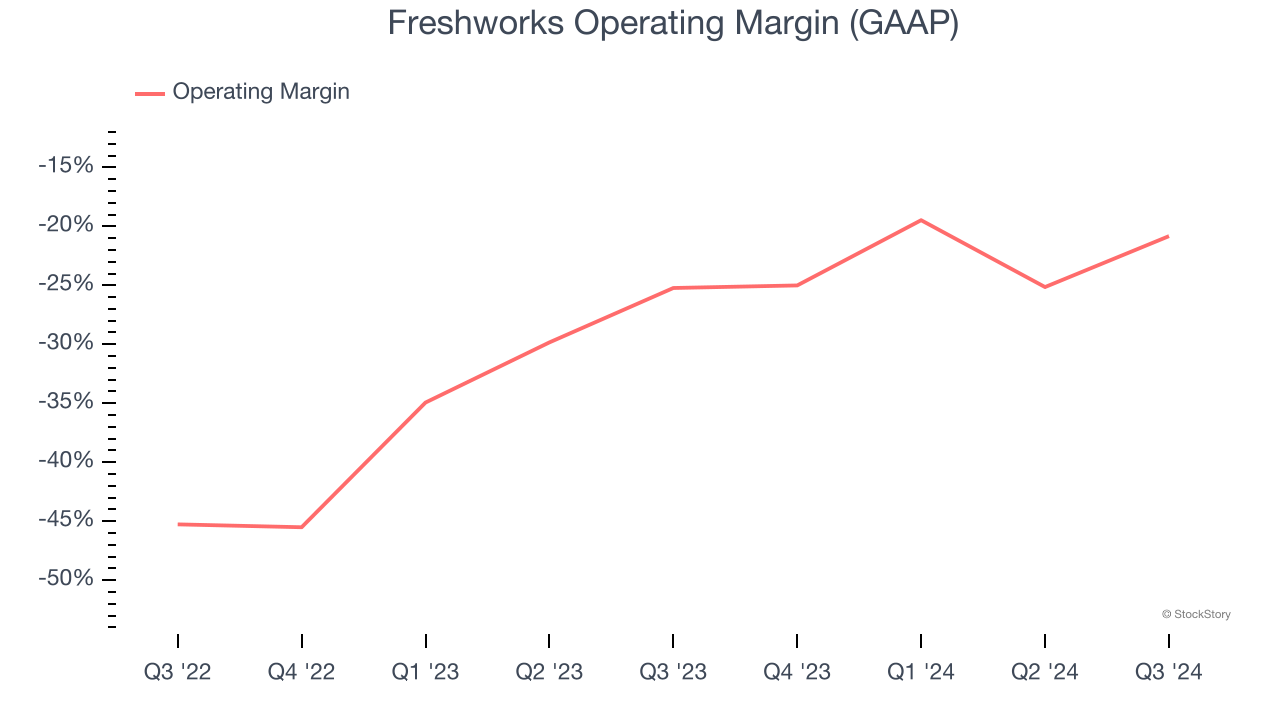

3. Operating Margin Rising, Profits Up

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Over the last year, Freshworks’s expanding sales gave it operating leverage as its margin rose by 10.9 percentage points. Although its operating margin for the trailing 12 months was negative 22.6%, we’re confident it can one day reach sustainable profitability.

Final Judgment

Freshworks possesses several positive attributes, and with its shares topping the market in recent months, the stock trades at 6.1× forward price-to-sales (or $16 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Freshworks

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.