All News about DB US Dollar Index Bearish -1X Fund Invesco

US and Canada Report on Jobs as G7 Fin Mins Talk Taxes

June 04, 2021

Via Talk Markets

Topics

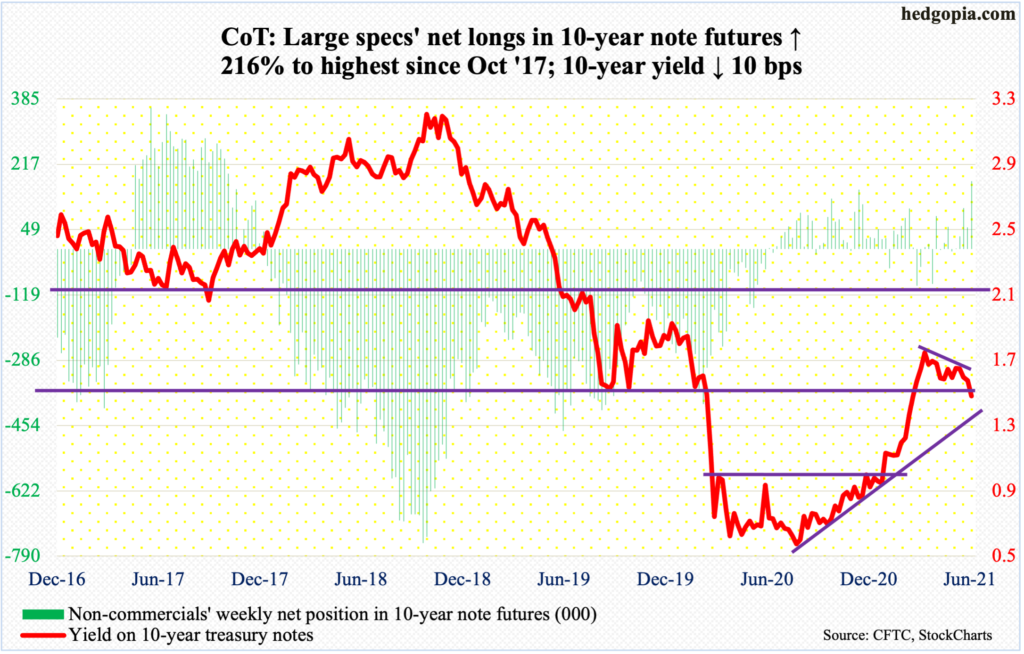

Bonds

Exposures

Debt Markets

Futures Coiled Ahead Of Closely Watched Jobs Report

June 04, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.