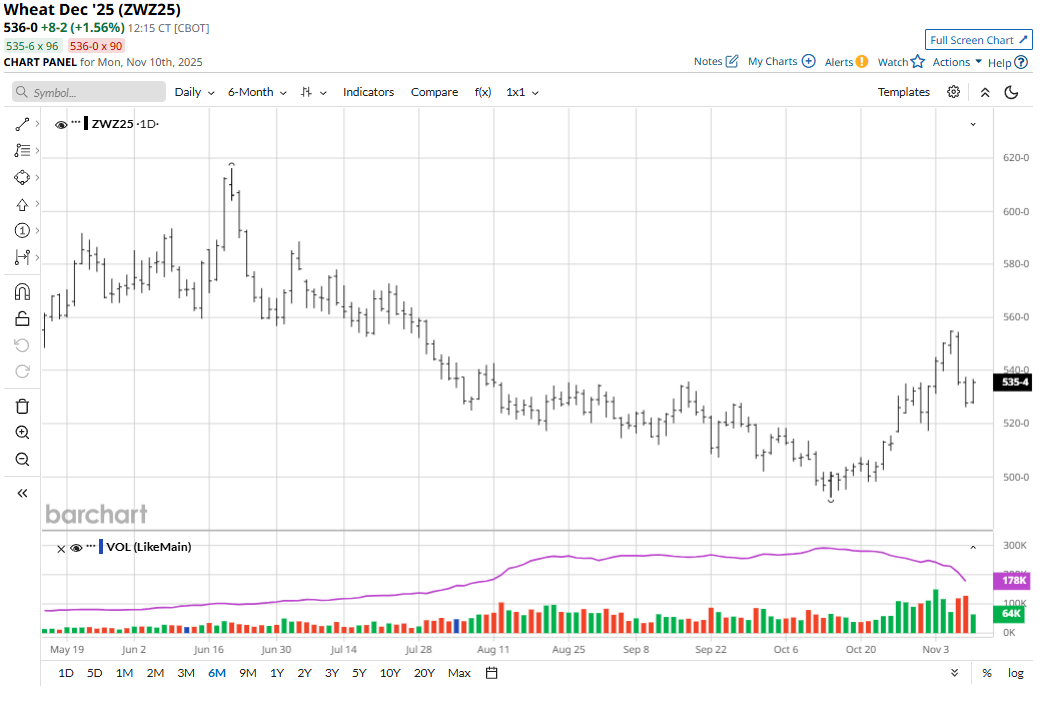

The corn (ZCZ25) and winter wheat futures (KEZ25) (ZWZ25) markets sputtered late last week. December corn was down 4 1/4 cents for the week. December soft red winter wheat fell 6 1/4 cents on the week and December hard red winter wheat lost 5 1/4 cents for the week. Friday’s technically bearish weekly low close in December corn and the winter wheat futures markets puts the bulls on the defensive early this week.

A price uptrend on the daily chart for December corn may be rolling over, and bulls need to show fresh power soon to keep it alive. The December winter wheat futures markets late last week saw their price uptrends on the daily charts negated. Soybeans (ZSF26) fared better late last week, as January beans rose 9 1/2 cents on Friday, near the daily high and for the week were up 1 3/4 cents. December soybean meal (ZMZ25) on the week was down $4.50. For soy complex futures traders, the meal market is the one to watch most closely. As goes the meal futures market in the near term, so will likely go soybeans.

Grain Traders Get Some Fresh USDA Data Friday

The Friday, Nov. 14 crop production and supply and demand updates from USDA at 12:00 p.m. Eastern will be the weekly highlight for the grain futures markets.

Over the past five weeks, traders have had to more closely monitor spreads and cash basis levels to get a better view of the markets.

Friday’s USDA report will include objective yield data. Don’t be surprised if grain futures markets this week mostly pause in anticipation of the fresh USDA data.

There are rumblings that U.S. lawmakers may reach an agreement to reopen the federal government imminently. That would give grain traders the much-needed fundamental data to drive daily price action. The government reopening would likely be a bit price-friendly for the grains because of the reduced uncertainty.

My bias is that U.S. lawmakers will come to agreement, and the federal government will probably reopen late this week. U.S. air travel is being curtailed and scheduled flights are being delayed because of overworked, understaffed air traffic controllers who are not getting paychecks. This scenario makes for some very unhappy voters as the holidays approach.

South American Planting, Growing Seasons Coming into View

Focus of grain traders is turning more to growing weather in South America corn, soybean, and wheat regions. Weather forecasters say central and northern Brazil will see increasing rain and improvements in soil moisture and conditions for planting, germination, establishment, and development of crops through the next two weeks, while there should be adequate breaks between rounds of rain to allow for some fieldwork to advance.

For corn, strong domestic and export demand continues to be the ace in the hole for corn market bulls and should keep a price floor under the futures market. Many corn producers have held off on marketing their crops for better price levels. A resumption of USDA export sales and inspections data will be welcomed by corn traders.

The soybean and meal futures bulls showed rebounding price strength to end trading last week, which is important given the solid losses posted Thursday. The soybean and meal bulls now have a bit of momentum on their side heading into trading this week. Technicals remain bullish for beans and meal as prices are still in uptrends on the daily bar charts.

Soybean traders are still trying to gauge specifically how much Chinese demand for U.S. soybeans has been and will be coming in the months ahead, following the recent U.S.-China thaw in trade relations. Fresh economic data from the USDA in the coming weeks, or sooner, as the U.S. government hopefully reopens soon, will be a main fundamental topic for soybean traders in the next few months.

The recent news that China has purchased some U.S. wheat gave a lift to wheat futures prices. Global demand for U.S. wheat will need to continue to improve in the coming months for the futures markets to sustain price uptrends. When the U.S. government reopens, wheat traders will be looking forward to digesting the resumption of supply and demand data.

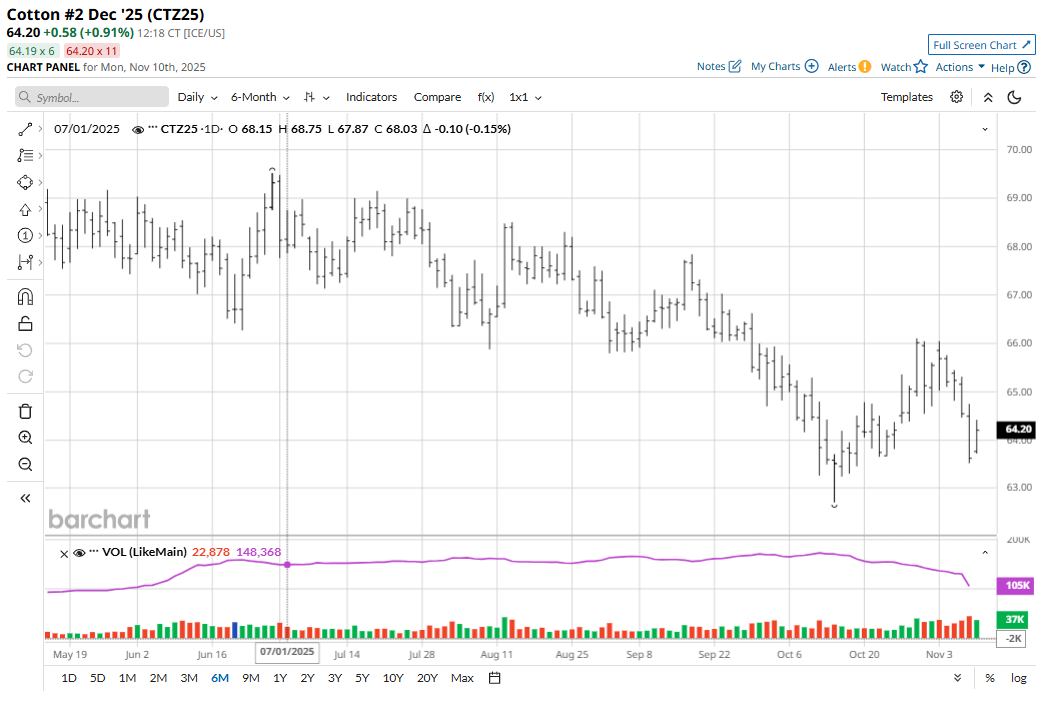

Cotton Bulls Run Out of Gas

December cotton (CTZ25) futures on Friday fell 92 points to 63.62 cents and for the week were down 192 points. The cotton bulls laid an egg last week, allowing Friday’s technically bearish weekly low close to set the table for follow-through, chart-based selling from the speculators early this week. Recent price history shows fledgling price uptrends in cotton futures, like the one that was just negated by Friday’s price action, tend to fizzle out after only a few weeks.

Friday’s crop production and supply and demand updates from USDA will also be the weekly highlight for the cotton futures market.

At least part of the selling pressure in the cotton futures late last week came from the selloff in the U.S. stock indexes. The stock market has become wobbly, which if continues, could dent consumer demand for apparel heading into the holiday buying season. That would be a bearish scenario for cotton futures market.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart