Tesla (TSLA) is pushing higher on Monday after Elon Musk wrote “we expect to build chips at higher volumes ultimately than all other AI chips combined” on his social media platform X.

Musk’s remarks arrive at a time when valuation concern and uncertainty about the Federal Reserve’s stance on monetary policy have been catalyzing significant selloffs in high-flying tech stocks.

Amid this broader tech rout, Tesla shares are down nearly 10% versus their year-to-date high.

Musk Reinforces That AI Will Drive Tesla Stock Higher

TSLA stock is inching higher today because Musk’s bold claim underscores the firm’s ambition to vertically integrate its AI hardware stack, powering everything from autonomous driving to its Optimus humanoid robots.

According to Elon Musk, the automaker has already deployed millions of custom AI chips across its vehicles and data centers.

It’s currently finalizing the AI5 chips while the AI6 is already in development. In fact, Tesla plans on releasing a new artificial intelligence chip design every 12 months, far outpacing the traditional semiconductor cycle.

These claims support Musk’s conviction that AI and robotics will drive the EV stock much higher over the long term.

Melius Research Makes the Case for Owning TSLA Shares

Tesla stock’s pullback in November has pushed it below its 50-day moving average (MA), indicating continued bearish momentum in the near term.

Still, Melius Research’s senior analyst Rob Wertheimer believes it will prove temporary only since the company “remains a step ahead of its peers.”

In a research note today, he wrote: “After a very long and gradual period of improvement, autonomy is coming very soon – and it will change everything about the driving ecosystem.”

Melius Research maintains a “Buy” rating on the EV stock with a price objective of $520 indicating potential upside of a whopping 24% from current levels.

Wall Street Recommends Caution on Tesla

Investors should note, however, that other Wall Street firms aren’t nearly as bullish on Tesla shares as Melius Research.

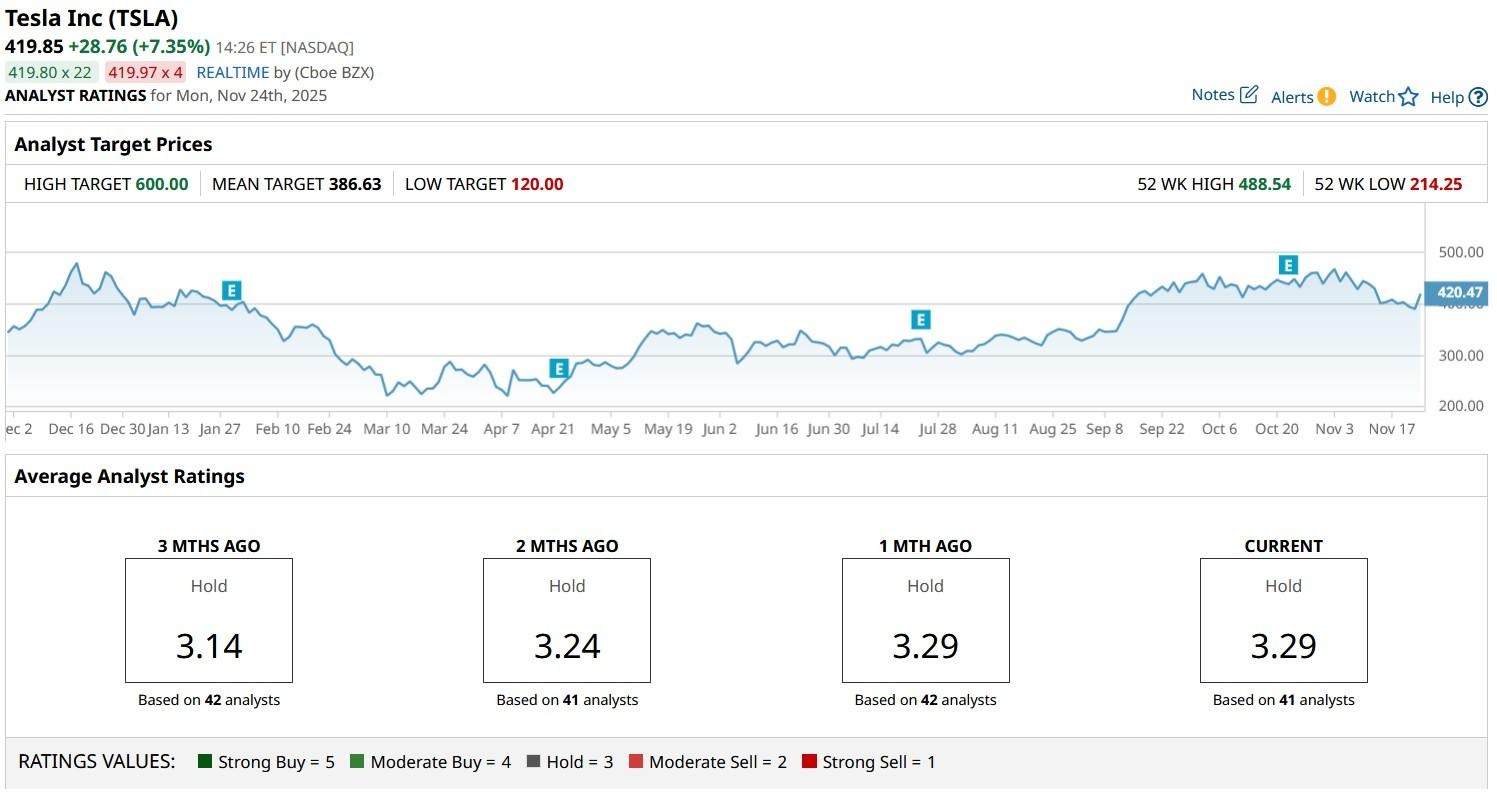

The consensus rating on TSLA stock currently sits at “Hold” only with the mean target of roughly $387 indicating potential downside of more than 7% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Oscar Health Jumps in Hopes of Obamacare Extensions. Should You Buy OSCR Stock Here?

- I Paid for Michael Burry’s New $400 Substack So You Don’t Have To

- Bridgewater Associates Is Giving Up on Lyft Stock. Should You?

- Warren Buffett Warns Not to Listen to Investing Gurus, ‘The Only Value of Stock Forecasters Is to Make Fortune Tellers Look Good’