California-based Advanced Micro Devices (AMD) wasn’t always the market’s favorite chipmaker. But it flipped the script after the Ryzen era, evolving into a powerhouse in high-performance computing and gaming. Now, it is stepping up again with a billion-dollar project set to reshape the future of science, medicine, and national security – because it’s not every day a chipmaker lands that kind of spotlight.

Teaming up with the U.S. Department of Energy (DOE) and Oak Ridge National Laboratory, the company is powering two next-gen supercomputers – Lux and Discovery – that aim to redefine America’s edge in AI and high-performance computing. Beyond running increasingly complex experiments that require harnessing enormous amounts of data-crunching capability, the machines will tackle everything from curing cancer to unlocking fusion energy and securing the nation’s digital backbone.

Backed by $1 billion in public and private investment, this move cements AMD as more than a semiconductor player. It is now a key architect of America’s AI-powered future. So, what makes the partnership with DOE such a game-changer for AMD and its investors? Let’s take a closer look…

About Advanced Micro Devices Stock

Founded in 1969, Santa Clara-based AMD has spent over five decades redefining what high-performance computing can do. Currently valued at around $421.4 billion by market capitalization, the company stands as a global force in semiconductors, powering everything from gaming systems to hyperscale data centers with its Instinct MI350 GPUs – built for efficiency, speed, and accessibility.

AMD’s 2025 rally has been spectacular. After months of quiet buildup, the chipmaker ignited – soaring 115% on a year-to-date (YTD) basis, easily outpacing the Semiconductor Ishares ETF’s (SOXX) 41.1% climb. The real fireworks came in the last six months, with shares skyrocketing nearly 169%, fueled by AI chip euphoria, strong analyst upgrades, and fresh investor confidence. Just last week, AMD touched a high of $267.08.

The fuel was a string of powerful catalysts; soaring demand for AI chips; a landmark partnership with the U.S. DOE; a multibillion-dollar deal with OpenAI; and an expanded alliance with Oracle (ORCL) to power next-gen AI superclusters.

Plus, AMD stock jumped 7.6% on Friday, Oct. 24, after a Reuters report revealed that International Business Machines Corporation (IBM) could use AMD chips to power quantum computing error-correction algorithms. This news sparked excitement over AMD’s role in next-gen computing. Softer inflation data added fuel, boosting investor sentiment and extending the stock’s impressive rally. Each headline pushed confidence, as well as stock prices, higher. Trading volumes remain strong, underscoring the heavy buying appetite.

Yet, technicals hint that the stock might be catching its breath. AMD is now hovering just below its upper Bollinger Band, suggesting a near-term cooldown after an intense run. The widening of the bands signals growing volatility – momentum is alive and kicking. Meanwhile, the 14-day RSI hovers near 70, flashing overbought territory.

AMD stock has been on an absolute roll lately, sending its valuation into rare air. The stock is now trading around 74.8 times forward adjusted earnings and 15.9 times sales – definitely pricey compared to its historical median and the broader chip sector. Investors seem to be thinking AMD’s AI momentum is worth every extra dollar.

But if AMD’s earnings and sales keep growing at the double-digit pace as analysts expect, those lofty ratios could ease over time. In other words, strong future growth might make today’s expensive-looking stock seem a lot more reasonable down the road.

Advanced Micro Devices’ Q2 Earnings Snapshot

AMD’s Q2 earnings report, which dropped on Aug. 5, was mixed. On paper, the numbers looked strong. The chip company generated a revenue of $7.7 billion, up 32% year-over-year (YoY) and beating estimates. But adjusted EPS slipped 30% annually to $0.48, exactly in line with expectations. The market wasn’t feeling generous – AMD’s stock slid more than 5% the next day, as investors zeroed in on one sore spot – data center AI revenue.

That dip seemed odd at first glance. AMD’s core engines were humming. For example, client revenue hit a record $2.5 billion, up 67% thanks to red-hot Ryzen CPU sales. Also, gaming revenue soared 73% to $1.1 billion, boosted by fresh GPU launches and console restocks. Even Data Center grew 14% YoY to $3.2 billion, with EPYC CPUs gaining traction in cloud and enterprise. Still, AI accelerator sales took a hit, weighed down by U.S. export curbs on China-bound chips and a brief pause as customers awaited the next-gen MI350 launch.

But AMD isn’t losing stride. CEO Lisa Su doubled down on the company’s AI roadmap, with the MI350 series ramping later this year and the MI400 already drawing strong early interest. Add in fresh cloud wins for the MI300 and MI325 accelerators, and it is clear AMD’s temporary stumble might just be the setup for its next leap in the AI race.

AMD is gearing up to release its Q3 numbers next Tuesday, on Nov. 4, after the market closes. Management guided for around $8.4 billion in revenue, give or take $300 million, expecting sequential growth driven by the AI and client segments. The long-term vision is even bolder – scaling AI data center revenue into the tens of billions as adoption accelerates across hyperscalers and sovereign AI projects worldwide.

To back that vision, AMD has been quietly strengthening its AI ecosystem through strategic team acquisitions from ZT Systems, Brium, and Lamini, sharpening both its hardware and software edge.

Analysts seem to share the optimism, forecasting Q3 revenue of roughly $8.75 billion, up 28.3% YoY, with EPS at $0.97, up 27.6%. Looking further ahead, Wall Street expects earnings to jump nearly 20% to $3.14 per share in fiscal 2025 and surge another 68.2% in 2026 to $5.28 per share.

A Billion-Dollar Proof of Power for AMD

The partnership between AMD and the U.S. DOE is not just another government contract, but a landmark collaboration shaping the future of American innovation. Together, they are building two powerhouse supercomputers, Lux and Discovery, at Oak Ridge National Laboratory. And they are engineered to drive breakthroughs in science, medicine, energy, and national security.

Lux, powered by AMD’s Instinct MI355X GPUs, EPYC CPUs, and Pensando networking, is set to debut in early 2026 as the first U.S. “AI Factory” supercomputer. Discovery, the more advanced sibling built on AMD’s MI430 chips and expected by 2029, will push the boundaries of AI and HPC even further.

For AMD, this partnership is a strategic jackpot. It cements the company as a trusted player in sovereign AI infrastructure – a space that’s about to explode as nations race to secure their AI capabilities. The visibility from powering federally-backed systems boosts AMD’s credibility across industries from defense to biotech.

Financially, it is a billion-dollar validation of AMD’s technology stack and HPC leadership. With AI demand surging and prominent competitors watching closely, this DOE alliance positions AMD as a national asset in the global AI race.

What Do Analysts Expect for AMD Stock?

Recently, UBS reaffirmed its “Buy” rating and $265 price target on AMD ahead of Q3 earnings, signaling confidence in the chipmaker’s AI and data center momentum. The brokerage firm expects results near the high end of AMD’s $9 billion Q3 guidance, fueled by strong server and client CPU sales. Additionally, it sees data center GPU revenue hitting $1.7 billion.

For Q4, UBS projects revenue between $9.3 billion and $9.5 billion and $2.4 billion in GPU sales, driven by demand from Meta and Oracle ramping AMD’s MI355X chips. Though early 2026 could see seasonal softness, UBS believes AMD’s data center growth story remains firmly intact.

CNBC’s Mad Money host Jim Cramer called AMD’s new $1 billion deal with the U.S. Department of Energy a “nice win,” praising the chipmaker’s growing momentum in the AI and supercomputing race.

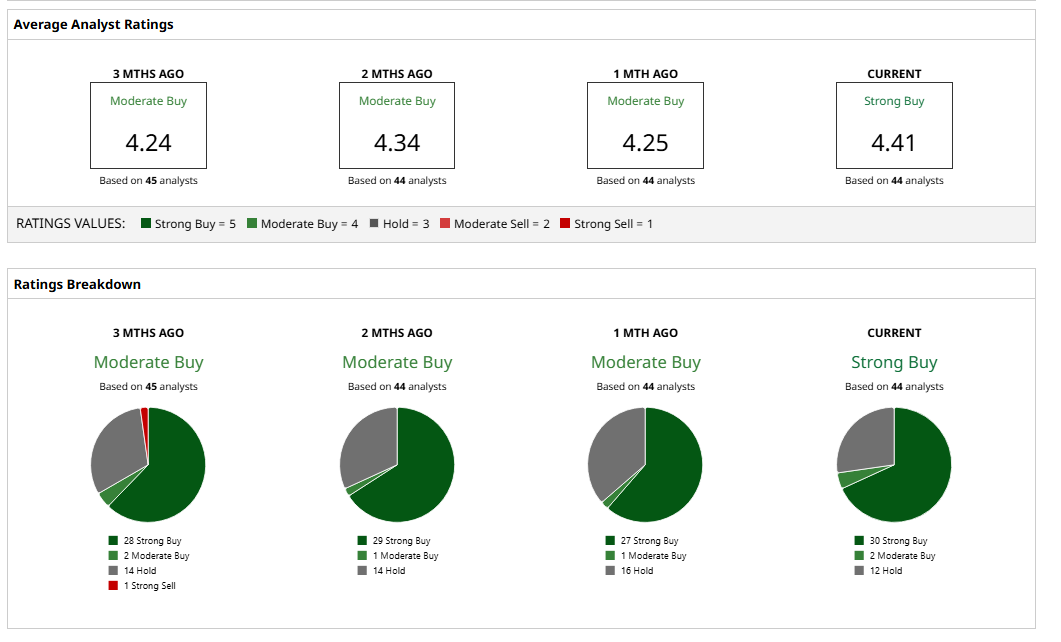

Wall Street’s confidence in AMD is rising. The stock now carries a “Strong Buy” consensus, marking an upgrade from a “Moderate Buy” just a month ago. Among the 44 analysts tracking the stock, 30 issue a “Strong Buy,” two give a “Moderate Buy,” and 12 advise a “Hold.”

While AMD stock already trades at a premium to its average analyst price target of $254.38, the Street-high target of $310, set by HSBC, suggests that the chip stock can still rally as much as 19.4% from current levels.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart