Wrapping up Q3 earnings, we look at the numbers and key takeaways for the specialized consumer services stocks, including LKQ (NASDAQ:LKQ) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 2% below.

In light of this news, share prices of the companies have held steady as they are up 3.8% on average since the latest earnings results.

LKQ (NASDAQ:LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ:LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.58 billion, flat year on year. This print fell short of analysts’ expectations by 1.9%. Overall, it was a mixed quarter for the company with a decent beat of analysts’ adjusted operating income estimates but full-year EPS guidance missing analysts’ expectations.

“The revenue headwinds we experienced across our global operations have been more impactful than projected in our prior guidance, and we currently do not expect these headwinds to abate in the fourth quarter. While our cost actions and synergy realization have boosted profitability, the benefits from these actions are not expected to offset the full impact of the lower revenue expectation in the fourth quarter,” stated Rick Galloway, Senior Vice President and Chief Financial Officer.

Interestingly, the stock is up 3% since reporting and currently trades at $38.92.

Read our full report on LKQ here, it’s free.

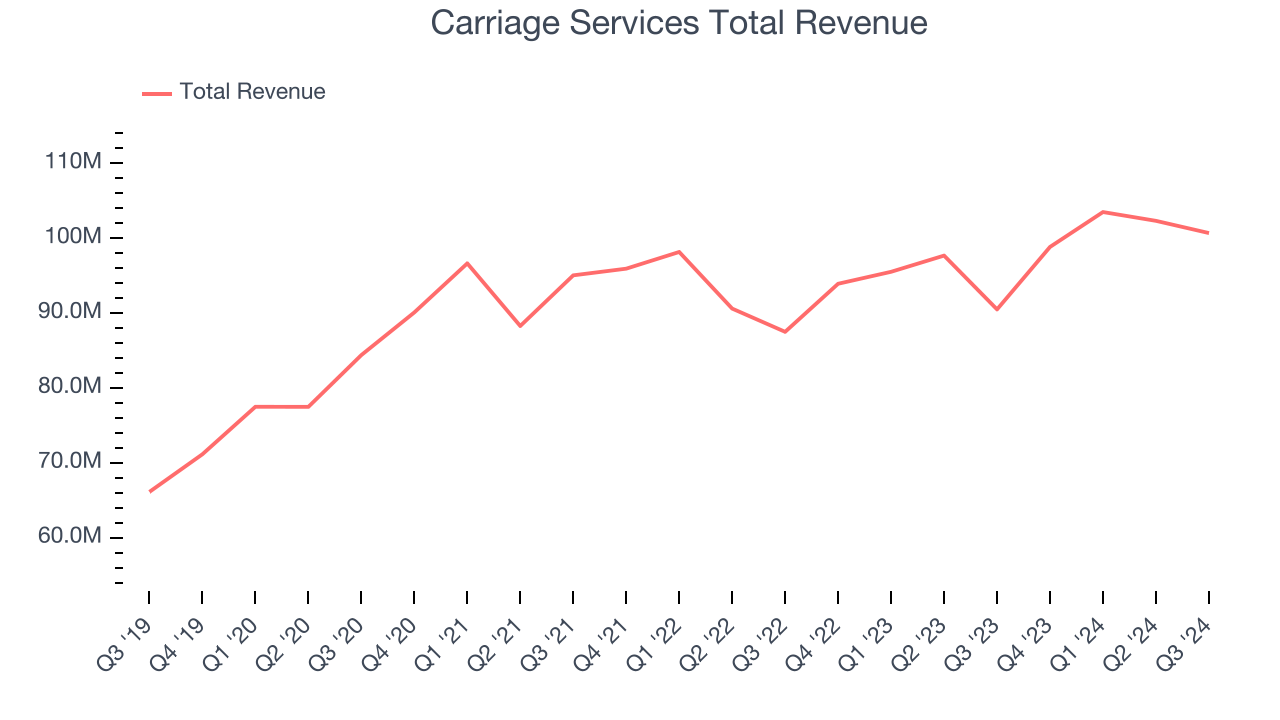

Best Q3: Carriage Services (NYSE:CSV)

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Carriage Services reported revenues of $100.7 million, up 11.3% year on year, outperforming analysts’ expectations by 8.1%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Carriage Services achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 19.7% since reporting. It currently trades at $39.09.

Is now the time to buy Carriage Services? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Matthews (NASDAQ:MATW)

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $427.8 million, down 10.9% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Matthews delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 15.5% since the results and currently trades at $23.71.

Read our full analysis of Matthews’s results here.

1-800-FLOWERS (NASDAQ:FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $242.1 million, down 10% year on year. This number missed analysts’ expectations by 1.6%. Overall, it was a slower quarter as it also logged a miss of analysts’ EBITDA estimates.

The stock is down 1.3% since reporting and currently trades at $7.89.

Read our full, actionable report on 1-800-FLOWERS here, it’s free.

ADT (NYSE:ADT)

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT reported revenues of $1.24 billion, up 5.4% year on year. This print surpassed analysts’ expectations by 1.7%. It was a strong quarter as it also put up a solid beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

ADT pulled off the highest full-year guidance raise among its peers. The stock is up 6.9% since reporting and currently trades at $7.40.

Read our full, actionable report on ADT here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.