- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

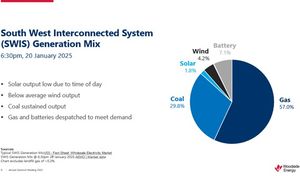

Woodside Energy Group Limited American Depositary Shares (NY:WDS)

Press Releases about Woodside Energy Group Limited American Depositary Shares

Woodside Energy Releases Annual Reserves Statement

February 16, 2026

From Woodside Energy

Via Business Wire

Woodside Energy Capital Markets Day 2025

November 04, 2025

Via Business Wire

Woodside Announces Louisiana LNG Partnership With Williams

October 22, 2025

From Woodside

Via Business Wire

Woodside Donates MXN$400,000 to Mexican Red Cross

October 17, 2025

From Woodside Energy

Via Business Wire

Woodside Energy releases 2025 half-year results

August 18, 2025

Via Business Wire

Woodside Completes Louisiana LNG Sell-Down to Stonepeak

June 24, 2025

Via Business Wire

Woodside Signs Gas Supply Agreement for Louisiana LNG

April 29, 2025

Via Business Wire

Via Business Wire

Woodside Signs LNG Supply Agreements With Uniper

April 16, 2025

Via Business Wire

Woodside Energy Responds to Media Speculation

April 16, 2025

Via Business Wire

Woodside Announces Louisiana LNG Partnership With Stonepeak

April 06, 2025

Via Business Wire

Woodside to Divest Greater Angostura Assets to Perenco

March 28, 2025

From Woodside

Via Business Wire

Woodside Releases Full-Year 2024 Results

February 24, 2025

Via Business Wire

From Woodside Energy

Via Business Wire

From Baker Hughes

Via GlobeNewswire

All aboard for Woodside Energy's Pluto Train 2

December 22, 2024

Via Business Wire

Woodside Simplifies Portfolio and Unlocks Long-Term Value

December 18, 2024

Via Business Wire

Woodside Signs Agreement for Louisiana LNG

December 04, 2024

Via Business Wire

Woodside Teams up With Baker Hughes and Bechtel to Pedal for a Purpose

November 12, 2024

From Woodside Energy

Via Business Wire

Woodside Releases Quarter Three 2024 Results

October 15, 2024

Via Business Wire

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.