- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

(TSV:SLVR)

0.9400

-0.0200

(-2.08%)

Streaming Delayed Price

Updated: 4:17 PM EST, Feb 24, 2026

Add to My Watchlist

All News about SLVR

Silver Trading Strategy Silver Analysis & Silver Forecast - Saturday, November 30 ↗

November 30, 2024

Via Talk Markets

Topics

Commodities

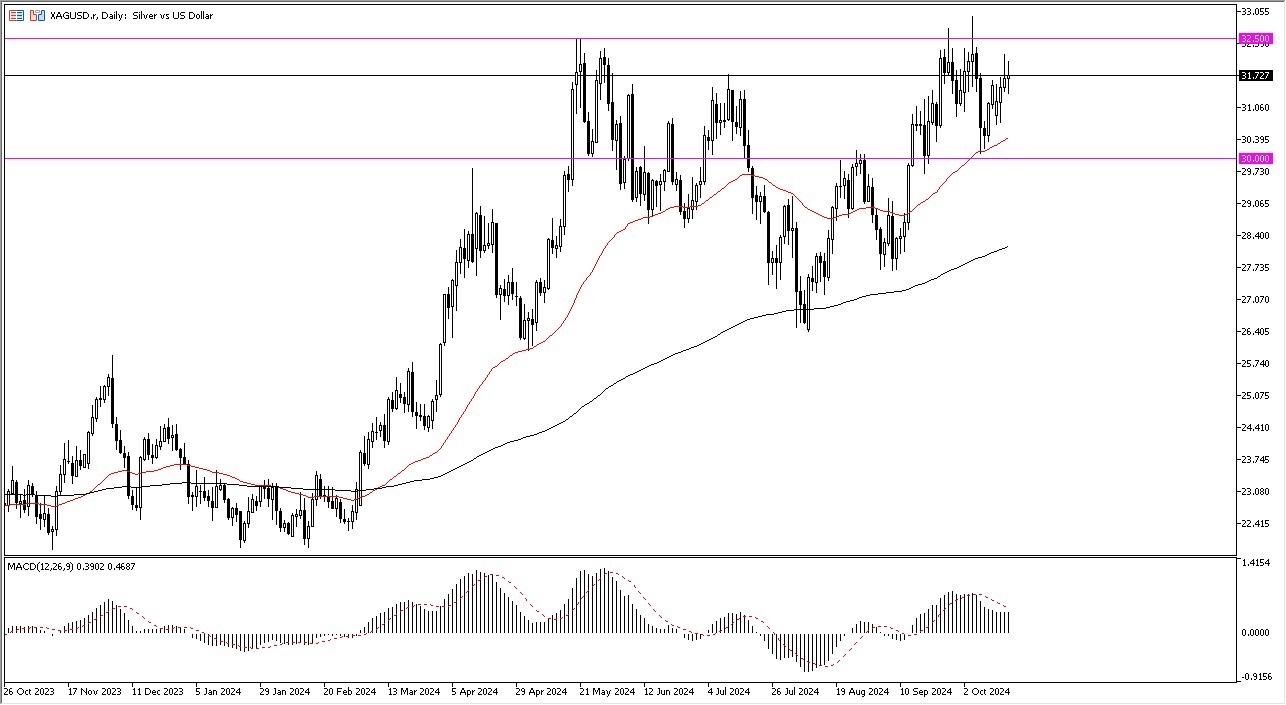

Silver Price Forecast: XAG/USD Shines And Climbs Above 100-Day SMA ↗

November 30, 2024

Via Talk Markets

Topics

Commodities

Silver Price Forecast: XAG/USD Bounces Back Strongly On Fresh Escalation In Russia-ukraine War ↗

November 28, 2024

Via Talk Markets

Topics

Commodities

Via Talk Markets

Topics

Commodities

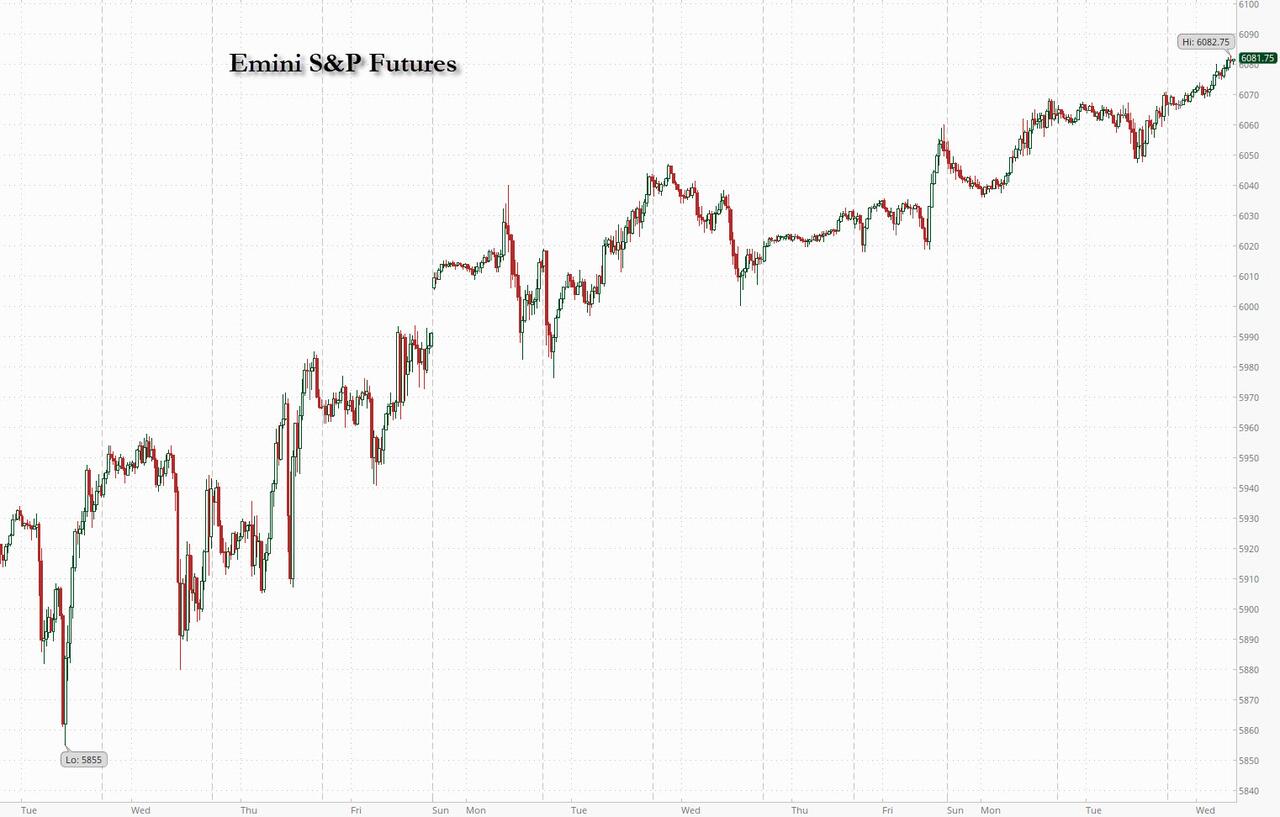

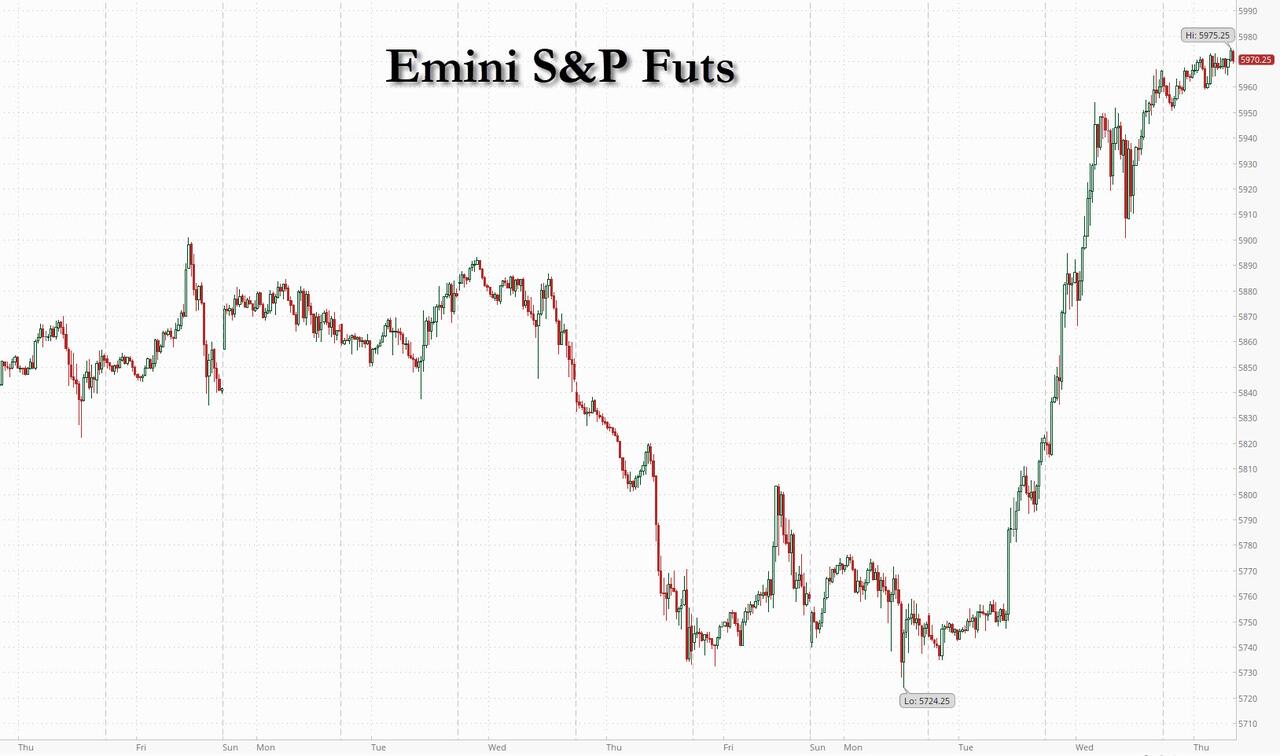

World Central Banks Continue To Cut Interest Rates. Us Stock Indices Break Records Again ↗

November 08, 2024

Via Talk Markets

Topics

Stocks

S&P Futures Extend Gains As Trump Trades Cool ↗

November 07, 2024

Via Talk Markets

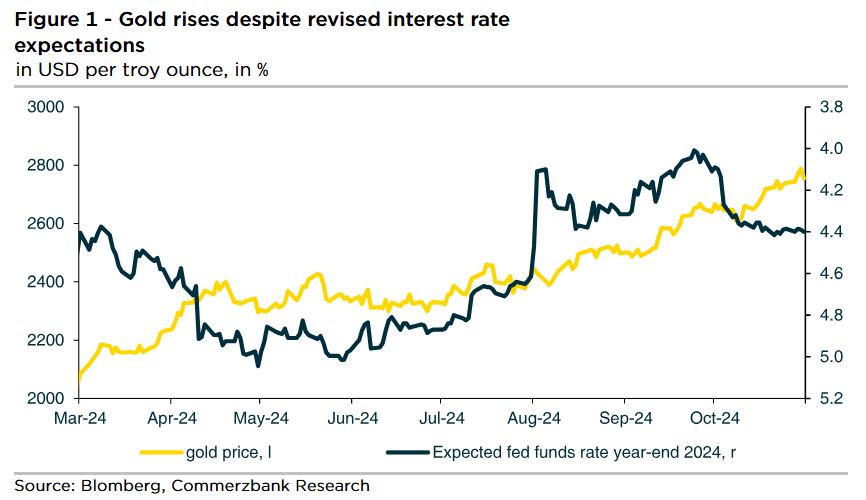

Gold Prices Likely To Dominate Further As Copper And Silver Keeps Upside Momentum ↗

November 04, 2024

Via Talk Markets

Topics

Government

Silver Price Forecast: XAG/USD Moves Above $32.50 Due To Caution Ahead Of Us Election ↗

November 04, 2024

Via Talk Markets

Topics

Government

Futures Jump After Blowout TSMC Earnings And Ahead Of ECB Rate Cut ↗

October 17, 2024

Via Talk Markets

Topics

Artificial Intelligence

Tomorrow's China Briefing Did Not Prevent The Continued Slide In Chinese Stocks Today ↗

October 11, 2024

Via Talk Markets

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.