- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Huntington Ingalls Industries, Inc. Common Stock (NY:HII)

All News about Huntington Ingalls Industries, Inc. Common Stock

HII Announces New Vice President of Quality and Engineering of Ingalls Shipbuilding

December 10, 2024

From HII

Via GlobeNewswire

HII and Job Corps Partner to Build Careers at Ingalls Shipbuilding

December 10, 2024

From HII

Via GlobeNewswire

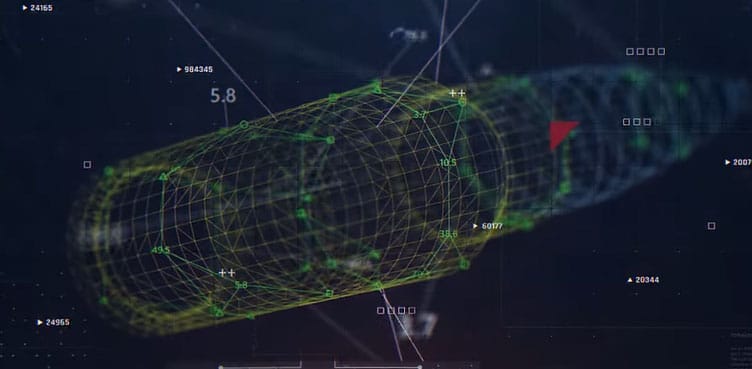

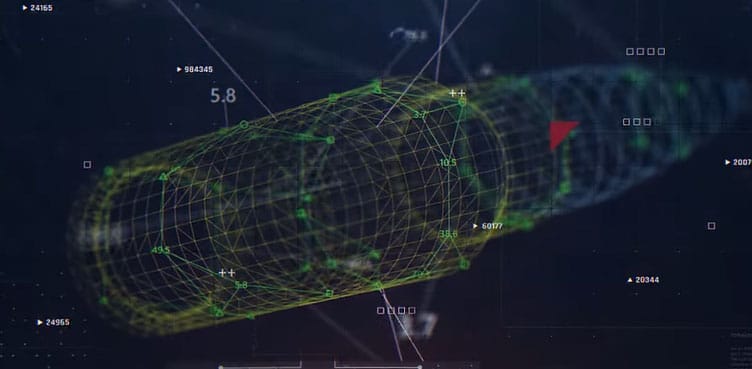

HII Christens Virginia-Class Attack Submarine Arkansas (SSN 800)

December 07, 2024

From HII

Via GlobeNewswire

HII’s Ingalls Shipbuilding Undocks USS Zumwalt (DDG 1000)

December 06, 2024

From HII

Via GlobeNewswire

HII is Awarded $6.7 Billion Contract to Support the U.S. Air Force’s Electronic Warfare Mission

December 05, 2024

From HII

Via GlobeNewswire

From HII

Via GlobeNewswire

Unpacking Q3 Earnings: Byrna (NASDAQ:BYRN) In The Context Of Other Aerospace and Defense Stocks

December 02, 2024

Via StockStory

Topics

Emissions

From HII

Via GlobeNewswire

Q3 Earnings Outperformers: Cadre (NYSE:CDRE) And The Rest Of The Aerospace and Defense Stocks

November 22, 2024

Via StockStory

Topics

Emissions

From HII

Via GlobeNewswire

HII Moves Enterprise (CVN 80) for First Time, Enabling Construction of Two Aircraft Carriers at Once

November 19, 2024

From HII

Via GlobeNewswire

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.