- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

CoStar Group, Inc. - Common Stock (NQ:CSGP)

All News about CoStar Group, Inc. - Common Stock

From CoStar Group

Via Business Wire

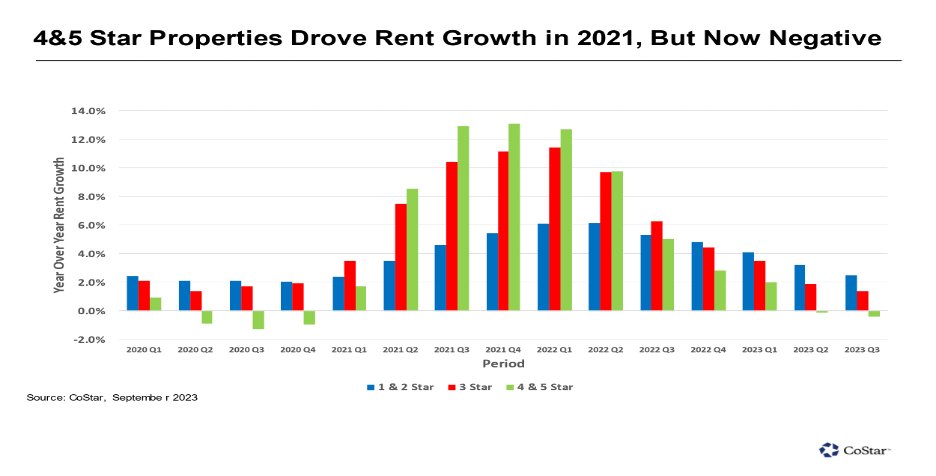

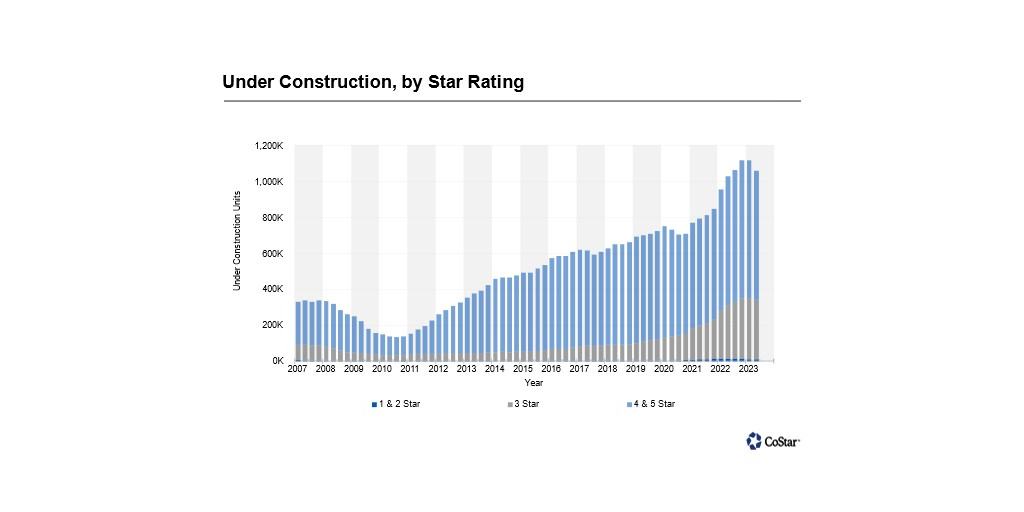

Apartments.com Releases Rent Growth Report for Third Quarter of 2023

October 06, 2023

From CoStar Group

Via Business Wire

$100 Invested In This Stock 20 Years Ago Would Be Worth $2,800 Today ↗

September 28, 2023

Via Benzinga

Via Benzinga

From CoStar Group

Via Business Wire

Homes.com Skyrockets Past 100 Million Unique Visitors in September

October 02, 2023

From CoStar Group

Via Business Wire

Andy Florance Honored with Gold Globee for CEO of the Year by Globee Business Awards

September 26, 2023

From CoStar Group

Via Business Wire

Andy Florance Named 2023 Tech Titan By Washingtonian Magazine

September 07, 2023

From CoStar Group

Via Business Wire

$1000 Invested In CoStar Gr 10 Years Ago Would Be Worth This Much Today ↗

September 05, 2023

Via Benzinga

Redfin CEO Glenn Kelman Talks About Real Estate Disruption ↗

September 03, 2023

Via The Motley Fool

Via Benzinga

CoStar Group Appoints Angelique Brunner to Board of Directors

August 01, 2023

From CoStar Group

Via Business Wire

From CoStar Group

Via Business Wire

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.