- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Cleveland-Cliffs Inc. Common Stock (NY:CLF)

All News about Cleveland-Cliffs Inc. Common Stock

Beyond the Tech Boom: Unearthing Robust Growth in America's Foundational Industries

September 12, 2025

Via MarketMinute

Manufacturing Malaise: The Looming Shadow of Renewed Trump Tariffs

September 12, 2025

Via MarketMinute

Via MarketMinute

Trump's Second Term: Ushering in "Trade Wars 2.0" and Global Repercussions

September 12, 2025

Via MarketMinute

Global Markets Brace for Impact as U.S. Tariff Policies Escalate Trade Wars

September 12, 2025

Via MarketMinute

Small-Cap and Value Stocks Poised for Resurgence as Federal Reserve Rate Cuts Loom

September 12, 2025

Via MarketMinute

Tariffs: The Hidden Tax Silently Eroding American Pockets

September 10, 2025

Via MarketMinute

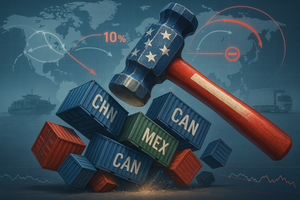

Trump's Global Tariff Hammer: A New Era of Economic Nationalism Dawns

September 10, 2025

Via MarketMinute

Tariffs' Tightening Grip: A Looming Threat to U.S. Prosperity and Household Wallets

September 10, 2025

Via MarketMinute

Via MarketMinute

Via MarketMinute

Global Inflation Outlook: Navigating Moderation Amidst Persistent Tariff Pressures

September 09, 2025

Via MarketMinute

Global Markets Reel as Geopolitical Storms and Tariff Wars Brew Economic Instability

September 09, 2025

Via MarketMinute

Via Business Wire

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.