- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Blackstone Inc. Common Stock (NY:BX)

All News about Blackstone Inc. Common Stock

Via Benzinga

Via Benzinga

Blackstone-Backed Legence Stock Makes A Weak Nasdaq Debut ↗

September 12, 2025

Via Stocktwits

Via Benzinga

Blackstone, Hamilton Lane, Ally Financial, and DigitalBridge Stocks Trade Down, What You Need To Know

September 30, 2025

Via StockStory

Topics

Economy

Q2 Earnings Outperformers: Artisan Partners (NYSE:APAM) And The Rest Of The Asset Management Stocks

September 29, 2025

Via StockStory

Topics

Retirement

$100 Invested In Blackstone 15 Years Ago Would Be Worth This Much Today ↗

September 24, 2025

Via Benzinga

AI Stocks Weigh on Wall Street as Fed Cautions on Risks ↗

September 24, 2025

Via Chartmill

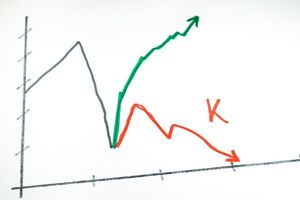

Evolving Investment Strategies for an Uncertain Market

September 23, 2025

Via MarketMinute

US Tech Giants To Invest £150B In The UK ↗

September 19, 2025

Via Benzinga

Blackstone Real Estate Announces Key Leadership Appointments

September 19, 2025

From Blackstone

Via Business Wire

Via MarketMinute

The Housing Affordability Paradox: How Lower Rates Could Still Drive Up Home Prices

September 17, 2025

Via MarketMinute

Topics

Economy

Via Benzinga

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.