- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Invesco CurrencyShares Swiss Franc Trust (NY:FXF)

All News about Invesco CurrencyShares Swiss Franc Trust

China Goes Big, And Market (Initially) Gives It The Benefit Of The Doubt ↗

September 24, 2024

Via Talk Markets

Currency Speculators Pared Back Bets Before Fed Interest Rate Reduction ↗

September 22, 2024

Via Talk Markets

Topics

Economy

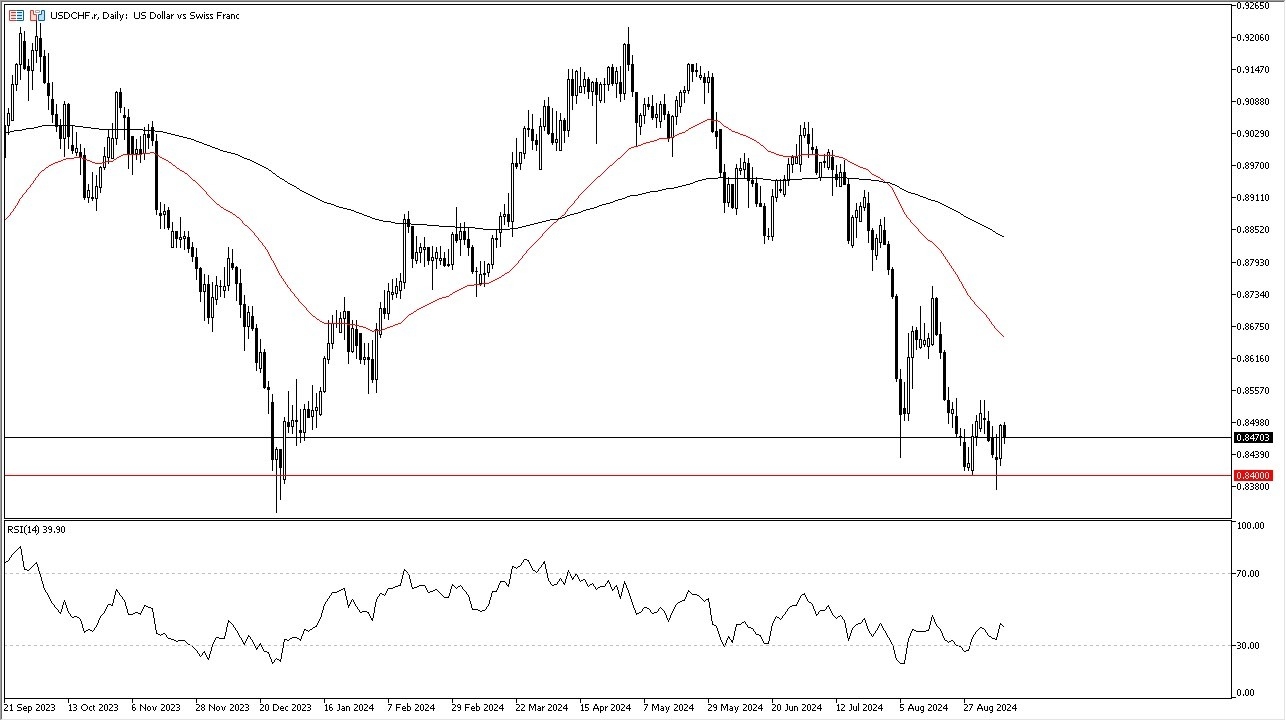

USD/CHF Weakens Below 0.8500 Amid Bearish US Dollar ↗

September 20, 2024

Via Talk Markets

Topics

Economy

USD/CHF Price Forecast: Remains Sluggish Near 0.8450 As Fed Large Rate Cut Bets Surge ↗

September 17, 2024

Via Talk Markets

Topics

Economy

Forex Speculators Push Japanese Yen Bets Higher For Record 10-Week Gain ↗

September 15, 2024

Via Talk Markets

Week Ahead: Four G10 Central Banks Meet, Only The Fed Moves ↗

September 14, 2024

Via Talk Markets

Topics

Economy

Via Talk Markets

Topics

Economy

USD/CHF Falls To Near 0.8500 As Recent Data Increase Odds Of A Bumper Fed Rate Cut ↗

September 13, 2024

Via Talk Markets

Topics

Economy

.thumb.png.6277762ab1434b02ea5f66f1607d9714.png)

Dow Jones Index Elliott Wave Technical Analysis - Monday, September 9 ↗

September 09, 2024

Via Talk Markets

Topics

Stocks

Via Talk Markets

Daily Market Outlook, Wednesday, September 4 ↗

September 04, 2024

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.