- home

- about us

- Investment Approach

- Client Service Approach

- Market Analysis Summary

- Mission Statement

- Value Proposition

- Team Biographies

- Firm ADV PDFs

- Form CRS

- Firm Brochure-Part 2A of Form ADV

- Brochure Supplement Amit Stavinsky

- Brochure Supplement Frank Parks

- Brochure Supplement Dominick Savo

- Brochure Supplement Richard Mason

- Brochure Supplement Joe Estes

- Brochure Supplement Jonathan Ezra

- Statement Of Financial Strength

- Job Opportunities

- Letter to Clients

- member log-in

- contact us

Wheaton Precious Metals Corp Common Shares (Canada) (NY:WPM)

All News about Wheaton Precious Metals Corp Common Shares (Canada)

Gold Steadfast Amidst Stock Market Jitters and Fed Rate Cut Speculation

November 19, 2025

Via MarketMinute

Gold and Silver Navigate a Turbulent November 2025: A Battle of Bullish and Bearish Forces

November 19, 2025

Via MarketMinute

Topics

Economy

Via MarketMinute

TD Cowen Elevates Royal Gold Price Target Amidst Robust Performance and Sector Optimism

November 19, 2025

Via MarketMinute

Topics

Economy

Silver's Enduring Shine: From Olympic Podium to Economic Powerhouse

November 18, 2025

Via MarketMinute

Silver Premiums Plummet as Import Surge Eases Market Prices

November 18, 2025

Via MarketMinute

Via MarketMinute

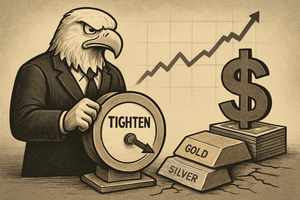

Federal Reserve's Hawkish Grip Tightens, Sending Gold and Silver into Retreat Amidst Dollar Surge

November 17, 2025

Via MarketMinute

Topics

Economy

Via MarketMinute

Market Grapples with Valuation Fears Amidst Accelerating Sector Rotation

November 17, 2025

Via MarketMinute

Silver's Shimmering Ascent: A Dual-Powered Bull Run Ignites the Market

November 13, 2025

Via MarketMinute

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.