Meta Platforms (META) stock tumbled 11% following its Q3 report, the steepest decline since October 2022. While the company delivered solid financial results that exceeded analyst expectations, investors balked at management's plans to significantly increase spending on artificial intelligence.

The social media giant reported adjusted earnings of $7.25 per share on revenue of $51.24 billion, which beat consensus estimates. Its revenue in Q3 of 2025 rose 26% year-over-year (YoY), the company’s strongest growth rate in 18 months. Meta also absorbed a $15.93 billion one-time tax charge related to President Trump's recent tax legislation, which will reduce future cash tax payments.

However, Meta's revised capital expenditure guidance spooked Wall Street. The tech behemoth projected capital spending to range between $70 billion and $72 billion in 2025, above the previous midpoint guidance of $69 billion.

CEO Mark Zuckerberg defended this aggressive investment strategy, emphasizing that the company must build capacity ahead of potential breakthroughs in superintelligence. He claimed Meta is already seeing returns in its core business that justify heavier spending.

Meta isn't alone in ramping up AI infrastructure costs. Alphabet (GOOG) (GOOGL) raised its capital expenditure (capex) forecast to $91 billion to $93 billion, while Microsoft (MSFT) indicated accelerated spending growth for this fiscal year. Meta recently invested $14.3 billion in AI startup Scale AI and struck multiple cloud deals to expand its AI capabilities.

The Reality Labs division continues to burn cash, posting a $4.4 billion operating loss on just $470 million in sales during the quarter. Cumulative losses since late 2020 now exceed $70 billion as Meta pursues virtual and augmented reality ambitions. However, the company's Ray-Ban AI glasses are gaining traction, with the $799 display version selling out quickly.

Meta Continues to Focus on AI

During the earnings call, Zuckerberg outlined an ambitious vision for establishing the company as the leading frontier AI laboratory. The social media platform serves 3.5 billion daily active users across its family of apps, with Instagram reaching a major milestone of three billion monthly active users.

Its AI-driven recommendation systems delivered substantial engagement gains across its platforms. Facebook saw a 5% YoY increase in time spent, while Threads jumped 10%.

Video consumption on Instagram surged over 30% compared to last year, with Reels now generating an annual revenue run rate exceeding $50 billion. These improvements stem from unified AI models that handle recommendations more efficiently while delivering better performance.

Advertising revenue reached $50.1 billion for the quarter, up 26% YoY, primarily driven by AI-powered ad ranking improvements. The company's Advantage+ automated advertising solutions now process $60 billion in annual revenue as more advertisers adopt end-to-end automation.

Meta consolidated roughly 100 specialized ad ranking models into larger, more capable systems using its Lattice architecture, with plans to merge another 200 models in the coming years.

Meta AI usage continues to scale rapidly, with over one billion monthly active users. The platform has generated more than 20 billion images since launching its media creation tools. The recently introduced Vibes feature, which produces AI-generated video content, has driven a tenfold increase in media generation within Meta AI since its September launch.

Business messaging represents another significant growth opportunity. Click-to-WhatsApp ads grew revenue 60% YoY, while business AI tools are expanding into new markets. Meta has rolled out turnkey AI solutions that help businesses generate leads and drive sales in Mexico and the Philippines, with millions of conversations taking place since July.

Meta expects its compute needs to expand meaningfully in 2026 and estimates making aggressive infrastructure investments through both owned facilities and third-party cloud providers.

Management indicated capital expenditure dollar growth will be notably larger in 2026 than in 2025, with total expenses growing at a faster percentage rate due to infrastructure costs, including cloud expenses and depreciation.

Is META Stock Undervalued Right Now?

Despite the ongoing pullback, META stock has returned over 600% over the last three years. Analysts tracking the tech stock forecast revenue to increase from $164.5 billion in 2024 to $340 billion in 2029, indicating an annual growth rate of 15.6%.

Compared to the previous year, adjusted earnings are forecast to increase from $23.86 per share to $39.12 per share, representing a 10.4% annual growth. META stock trades at 22.8x forward earnings, which is in line with its five-year average. If it is priced at 20x earnings, it could gain 20% by the end of 2028.

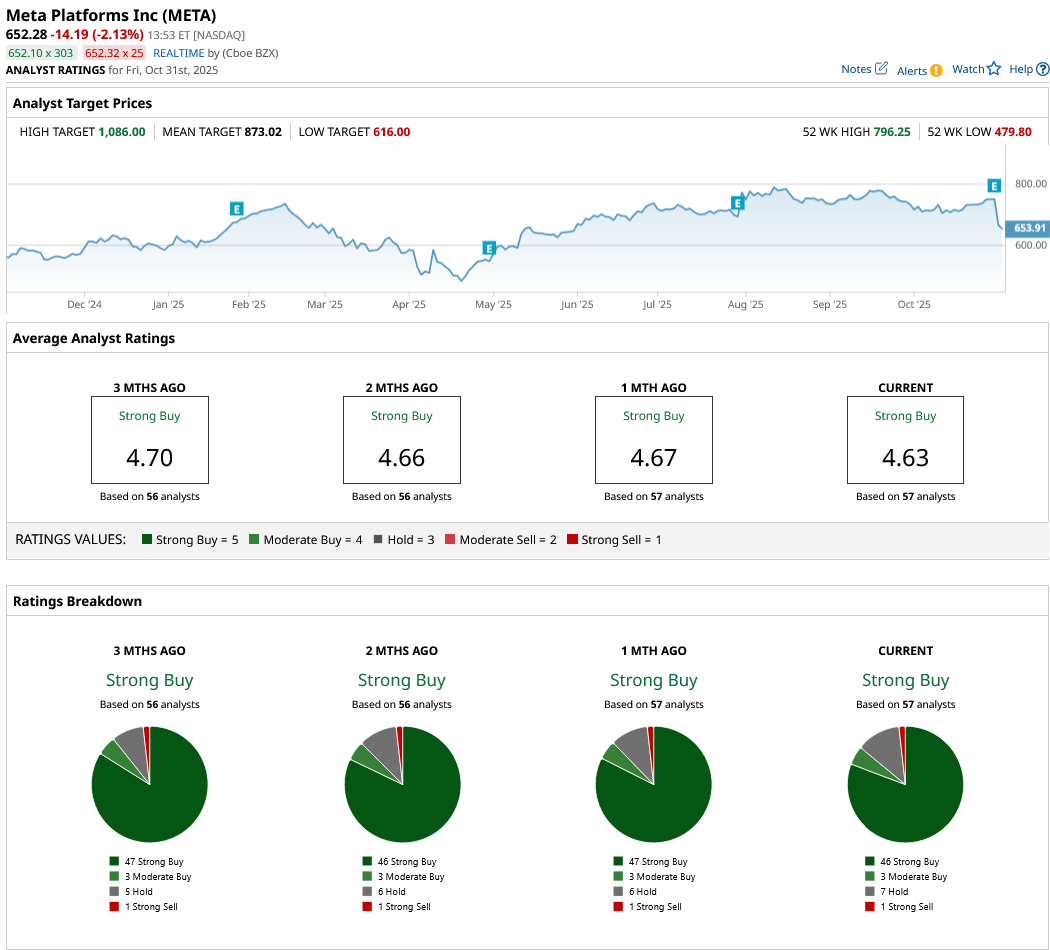

Out of the 57 analysts covering META stock, 46 recommend “Strong Buy,” three recommend “Moderate Buy,” seven recommend “Hold,” and one recommends “Strong Sell.” The average META stock price target is $872, above the current price of $652.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Qualcomm Is Becoming an AI Company. That Means Earnings on November 5 Could Supercharge QCOM Stock.

- Nvidia CEO Jensen Huang Says You Can ‘Tokenize Anything’ But You’ll Need ‘Thousands of Chips.’ That’s Good News for NVDA Stock.

- This Analyst Just Slashed His Fiserv Stock Price Target by 55%. Should You Jump Ship Now?

- 'Aggressive' Spending Spooks Meta Platforms Investors. Should You Buy the Dip in META Stock?