Today, Apartments.com – a CoStar Group online marketplace – released an in-depth report of multifamily rent trends for the second quarter of 2024

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240710296231/en/

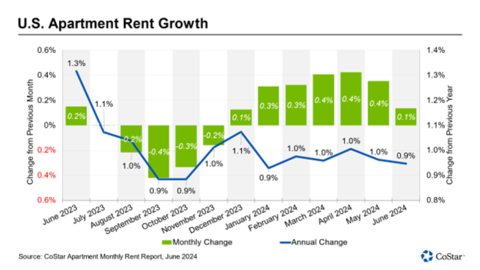

U.S. Apartment Rent Growth (Graphic: Business Wire)

The U.S. multifamily market continued a strong rebound in demand during the second quarter of 2024, with 170,000 units absorbed, the highest number since the third quarter of 2021. And while 180,000 new units were delivered in the last quarter, this was the smallest supply-demand gap in 11 quarters. So, the vacancy rate remained steady from the first quarter to the second quarter at 7.8%. This is the first quarter in which the vacancy rate has not risen in almost three years.

The national average annual asking rent growth dipped slightly to 0.9% in June compared to 1.0% in the four prior months. Since mid-2023, annual rent growth has hovered around 1% after a rapid deceleration in 2021 and 2022. Month-over-month rent growth decelerated to 0.1% after seeing three months in a row of 0.4% growth.

Midwest and Northeast markets have avoided oversupply conditions and tied with solid rent growth of 2.4% over the past four quarters, while markets in the West experienced rent growth of just 0.5% as weak demand and elevated completions have kept rent growth restrained but positive. Meanwhile, continued heavy oversupply conditions in the South have kept annual rent growth at zero.

At 4.9%, Louisville ended the second quarter with the strongest annual asking rent growth of the top 50 markets nationwide, with Cleveland and Washington DC close behind.

At the opposite end of the scale, rents fell by 5.7% over the past 12 months in Austin. Tucson, Raleigh, Jacksonville, and Atlanta were just a little behind, with rent losses ranging from 3.1% to 2.2% over the past 12 months. Eight of the bottom ten performing markets are in the South, where supply-demand imbalances remain challenging.

Absorption was led by 4&5-Star units, with just over 123,000 units in the quarter. However, with most new supply aimed at the luxury market, annual asking rent growth remained the weakest in that segment and finished June at 0.2%. This contrasts with mid-priced 3-Star properties, where net absorption increased from 33,000 units in the first quarter to 43,000 units during the second quarter, helping rent growth to accelerate to 1.5%. Improving consumer confidence, lower inflation, and sustained economic expansion helped boost 3-Star demand.

Improving consumer conditions can also be observed in demand for 1&2-Star properties. After two years of negative absorption, the lowest price point finally turned positive in 2024. Households at this price point struggled in 2022 and 2023 with higher housing costs and the elevated costs of everyday items, pushing some to seek alternative housing solutions such as moving in with roommates or returning to the family home. But in 2024, 1&2 Star demand has registered almost 6,000 units.

After completions of multifamily units reached a 40-year record in 2023, the outlook this year is for continued high supply. The multifamily market is projected to add 574,000 units in 2024, which is only a slight pullback from the prior year’s record. Property operations in the second half of 2024 could vary widely depending on the market and the price point. Markets in the South and luxury properties remain most at risk for weakness due to oversupply conditions, while Midwest and Northeast locations and mid-priced 3-star properties could outperform.

ABOUT COSTAR GROUP, INC.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France’s leading commercial real estate news service. Thomas Daily is Germany’s largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group’s websites attracted 170 million quarterly average monthly unique visitors for the first quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240710296231/en/

Contacts

NEWS MEDIA:

Matthew Blocher

Vice President

CoStar Group Corporate Marketing & Communications

(202)-346-6775

mblocher@costar.com