Dick's currently trades at $247.31 and has been a dream stock for shareholders. It’s returned 435% since January 2020, blowing past the S&P 500’s 84% gain. The company has also beaten the index over the past six months as its stock price is up 19%.

Following the strength, is DKS a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does DKS Stock Spark Debate?

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Two Positive Attributes:

1. Surging Same-Store Sales Show Increasing Demand

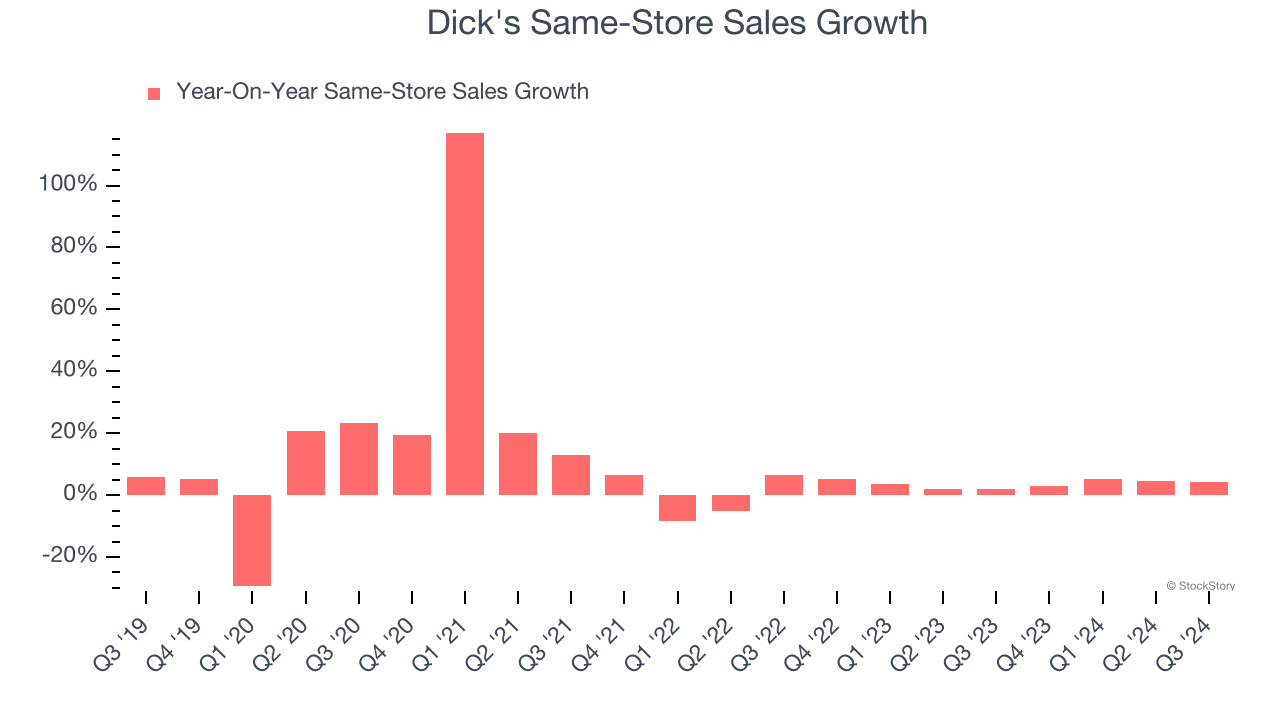

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Dick’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.7% per year.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

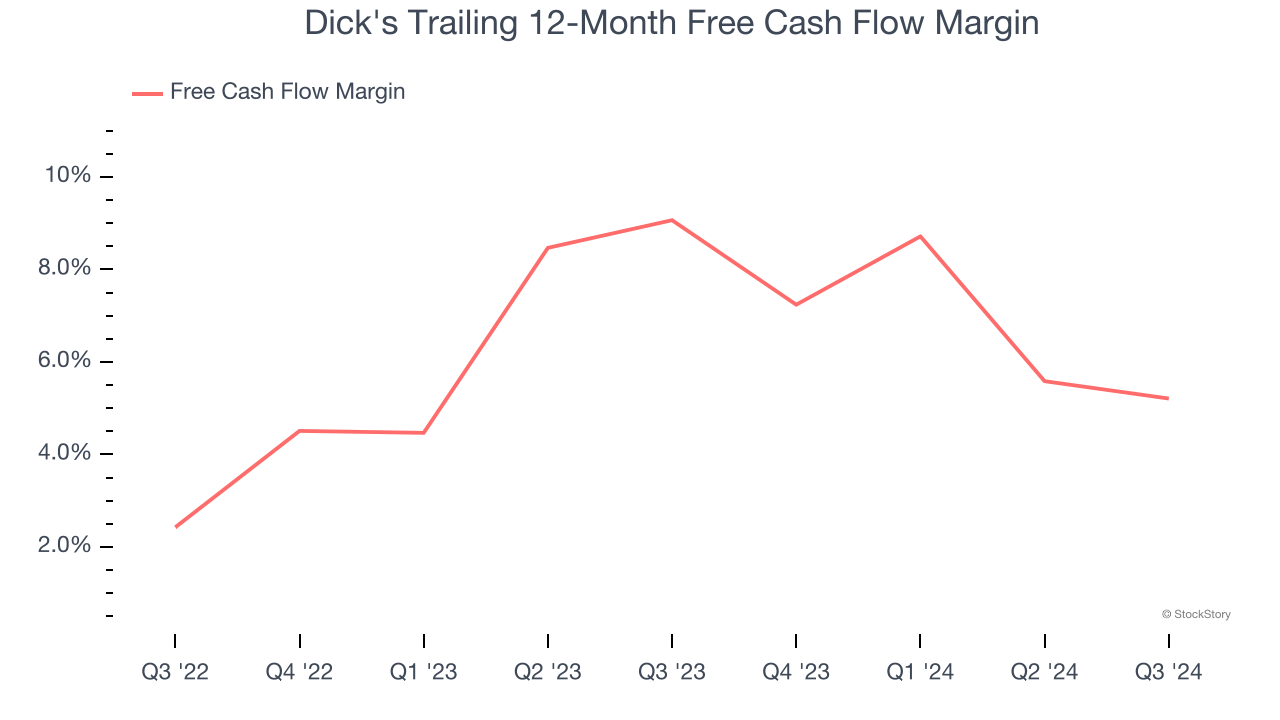

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Dick's has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.1% over the last two years, quite impressive for a consumer retail business.

One Reason to be Careful:

Lack of New Stores, a Headwind for Revenue

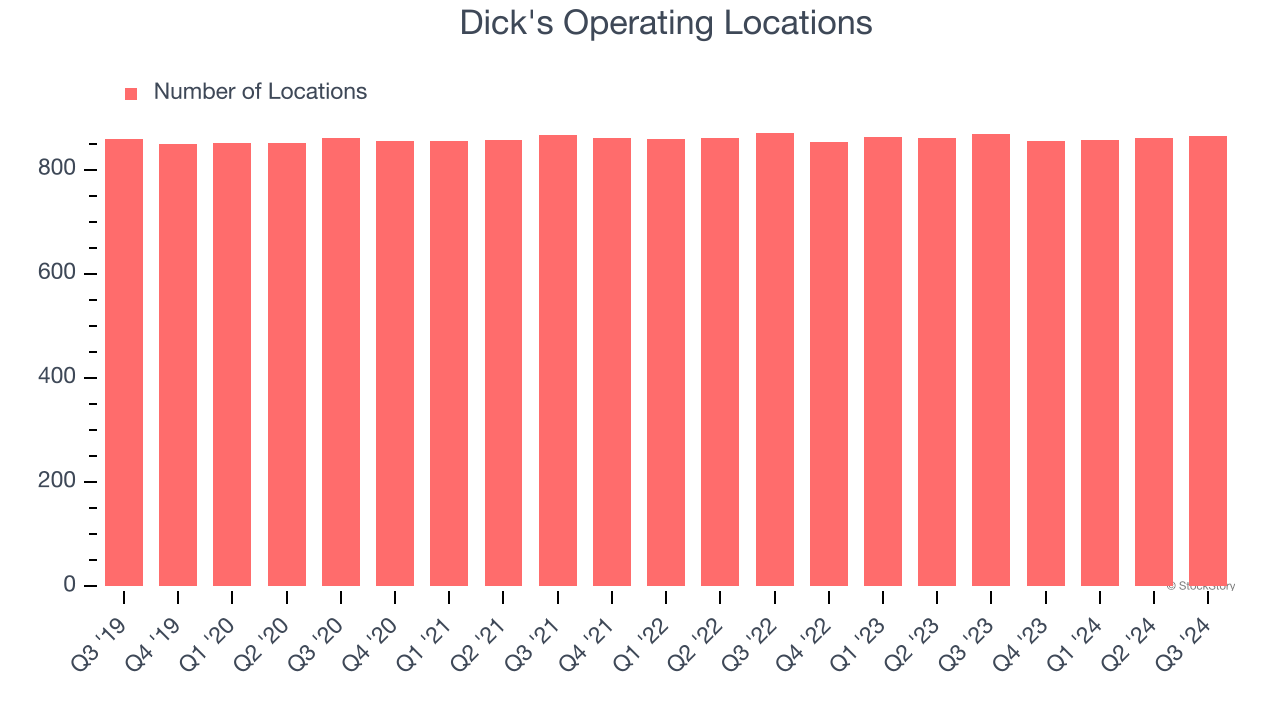

A retailer’s store count often determines how much revenue it can generate.

Dick's operated 864 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Final Judgment

Dick’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 17.1× forward price-to-earnings (or $247.31 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Dick's

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.