Since October 2020, the S&P 500 has delivered a total return of 97%. But one standout stock has more than doubled the market - over the past five years, Hubbell has surged 202% to $423.79 per share. Its momentum hasn’t stopped as it’s also gained 31.9% in the last six months thanks to its solid quarterly results, beating the S&P by 7.1%.

Is now still a good time to buy HUBB? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does HUBB Stock Spark Debate?

A respected player in the electrical segment, Hubbell (NYSE: HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Two Things to Like:

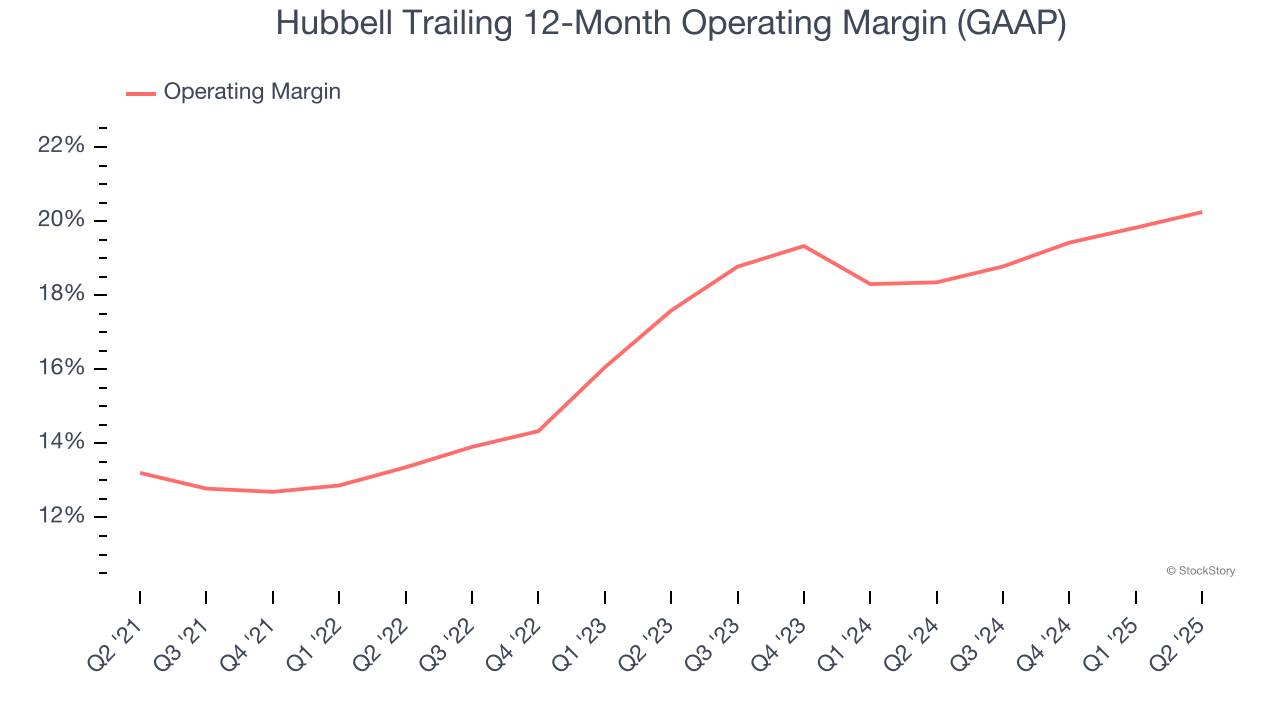

1. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Hubbell’s operating margin rose by 7 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 20.2%.

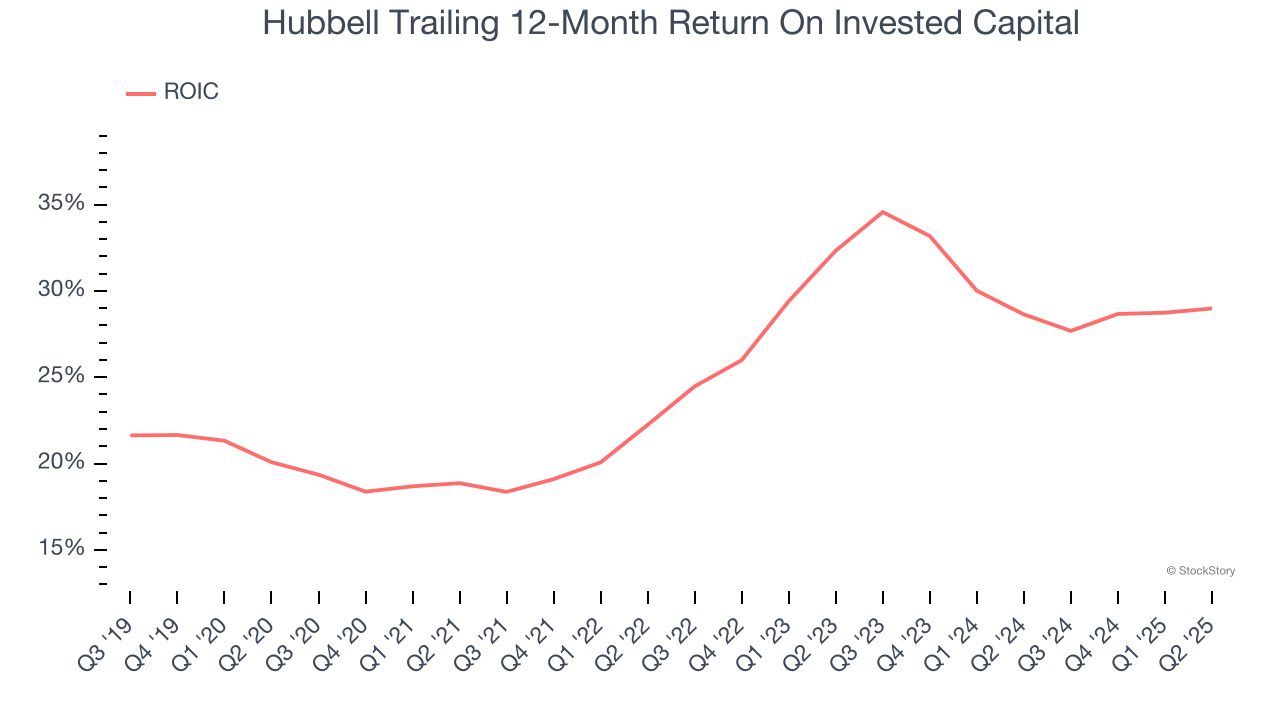

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Hubbell’s five-year average ROIC was 26.2%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

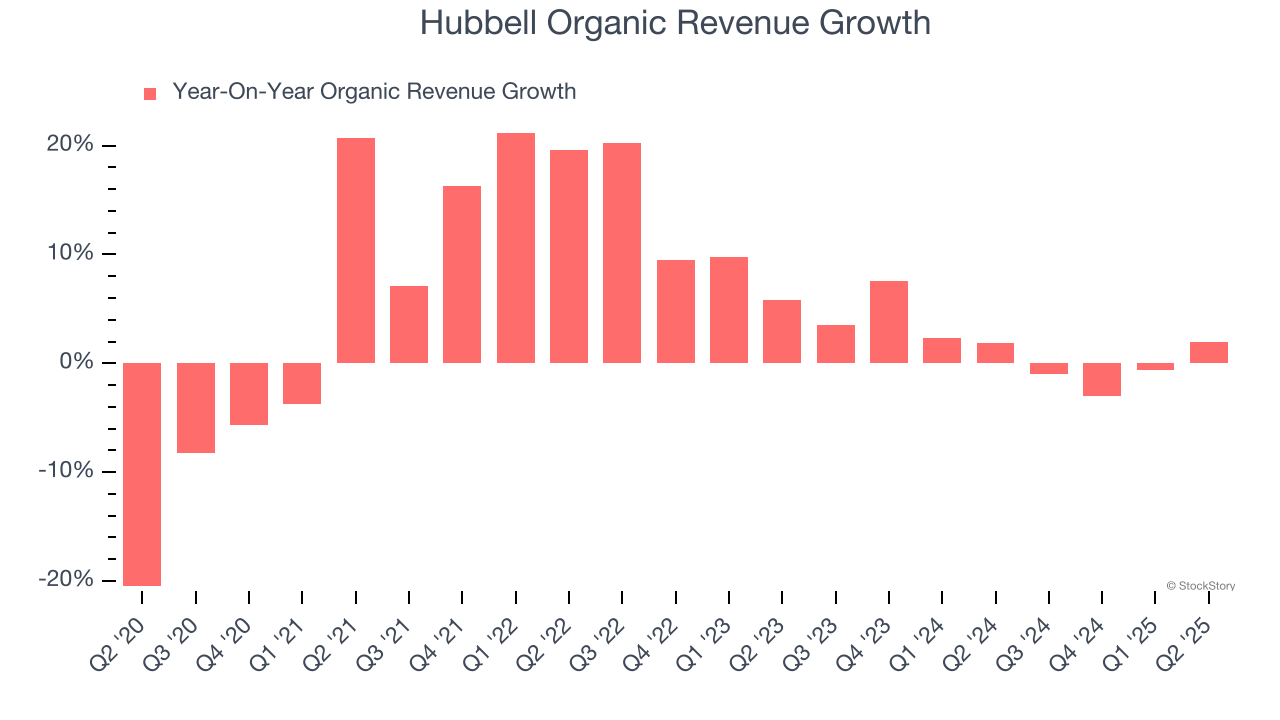

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

In addition to reported revenue, organic revenue is a useful data point for analyzing Electrical Systems companies. This metric gives visibility into Hubbell’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Hubbell’s organic revenue averaged 1.6% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Hubbell has huge potential even though it has some open questions, and with its shares outperforming the market lately, the stock trades at 23.1× forward P/E (or $423.79 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.