LEXINGTON, Ky., Dec. 22, 2025 (GLOBE NEWSWIRE) -- MiddleGround Capital (“MiddleGround”), an operationally focused private equity firm that makes control investments in middle-market B2B industrial and specialty distribution companies headquartered in North America and Europe, today announced its scores from the 2025 ‘Principles for Responsible Investment’ (“PRI”) Assessment Report, the world’s leading proponent of responsible investment.

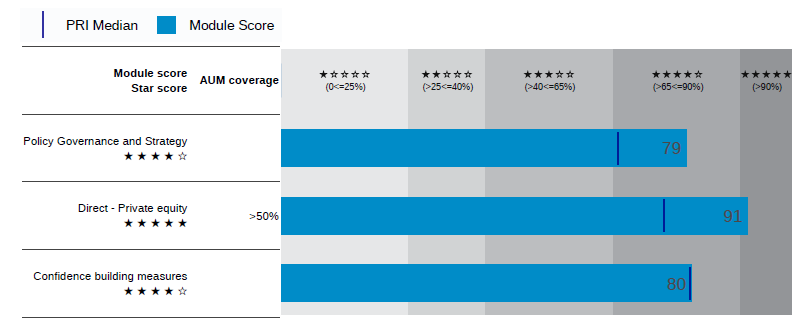

MiddleGround earned a rating of five stars in the Direct – Private Equity category, an improvement from last year’s four-star score, and four stars in both the Policy Governance and Strategy and Confidence Building Measures categories. Overall, the firm achieved strong results, maintaining scores above the median in two out of three modules in which it was eligible to report.

The following scores reflect PRI’s evaluation based on its published criteria:

- Policy Governance and Strategy: 4 stars

- Direct – Private Equity – Active fundamental: 5 stars

- Confidence Building Measures: 4 stars

MiddleGround Capital Summary Scorecard

*PRI ratings are based on signatories' annually reported information compared to peers. MiddleGround did not provide compensation for inclusion. Past performance does not guarantee future results.

“The PRI results underscore MiddleGround’s continued commitment to integrating ESG and sustainability principles into our work,” said John Stewart, Founding and Managing Partner of MiddleGround Capital. “We first joined the organization to hold ourselves to the largest global reporting project on responsible investing, and I’m very proud of our consistent performance since becoming a PRI signatory.”

MiddleGround joined the Principles for Responsible Investment in September 2020, becoming the first sub-$1 billion AUM industrials-focused buyout firm to join the global organization. As a PRI signatory, MiddleGround is part of an international organization dedicated to integrating ESG considerations into investment practices and ownership policies.

The PRI is the world’s largest scale report for investors committed to advancing responsible investment and embedding sustainability factors into their processes. Supported by the United Nations, the PRI works with its global network of signatories to foster transparency, strengthen accountability, and promote long-term value creation. The organization aims to deepen understanding of ESG-related risks and opportunities and help signatories align their activities with a more resilient and sustainable global financial system.

Important Disclosures:

PRI Ratings and Methodology

“The Principles for Responsible Investment (PRI) ratings referenced in this press release are based on PRI’s methodology signatories' annually reported information compared to peers. MiddleGround Capital did not provide compensation for inclusion or scoring the PRI Assessment Report.”

Past Performance

“Any references to historical ratings, improvements, or performance over prior years are provided for informational purposes only. Past performance does not guarantee future results.”

Limitations of Ratings

“PRI ratings reflect PRI’s assessment of ESG-related practices as of the reporting period and do not constitute investment advice, nor do they guarantee investment success or future outcomes.”

Forward Looking Statements

“Certain statements in this press release may constitute forward-looking statements regarding ESG commitments and sustainability goals. These statements are subject to risks and uncertainties and should not be interpreted as assurances of future performance.”

About MiddleGround Capital

MiddleGround Capital is a private equity firm based in Lexington, Kentucky with over $4.1 billion of assets under management. MiddleGround makes control equity investments in middle market B2B industrial and specialty distribution businesses. MiddleGround works with its portfolio companies to create value through a hands-on operational approach and partners with its management teams to support long-term growth strategies. For more information, please visit: https://middleground.com/.

MiddleGround Capital Media Contacts

Doug Allen/Maya Hanowitz

Dukas Linden Public Relations

MiddleGround@dlpr.com

+1 (646) 722-6530