Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Kimball Electronics (NASDAQ:KE) and the best and worst performers in the electrical systems industry.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 15 electrical systems stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 7.2% on average since the latest earnings results.

Kimball Electronics (NASDAQ:KE)

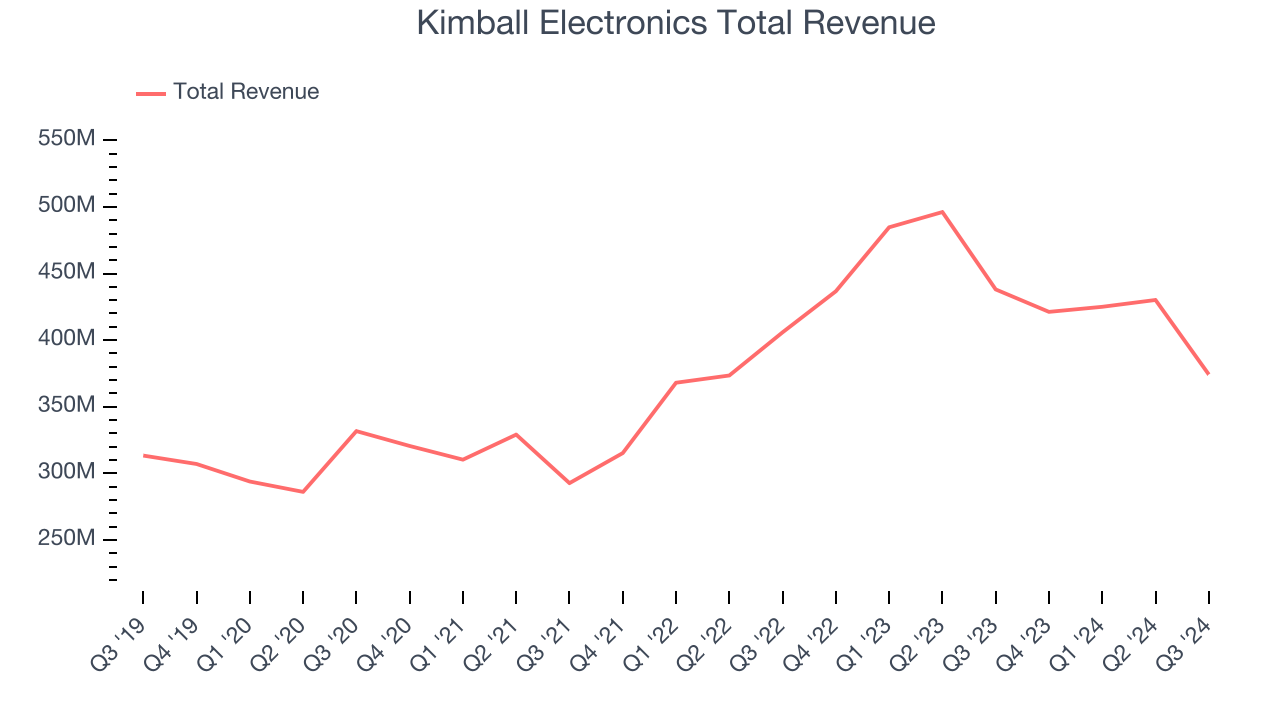

Founded in 1961, Kimball Electronics (NYSE:KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

Kimball Electronics reported revenues of $374.3 million, down 14.6% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Commenting on today’s announcement, Richard D. Phillips, Chief Executive Officer, stated, “Q1 represents another chapter of ‘controlling what we can control’ while navigating the challenging operating environment stemming from sustained end market weakness.”

Interestingly, the stock is up 8.1% since reporting and currently trades at $20.

Read our full report on Kimball Electronics here, it’s free.

Best Q3: OSI Systems (NASDAQ:OSIS)

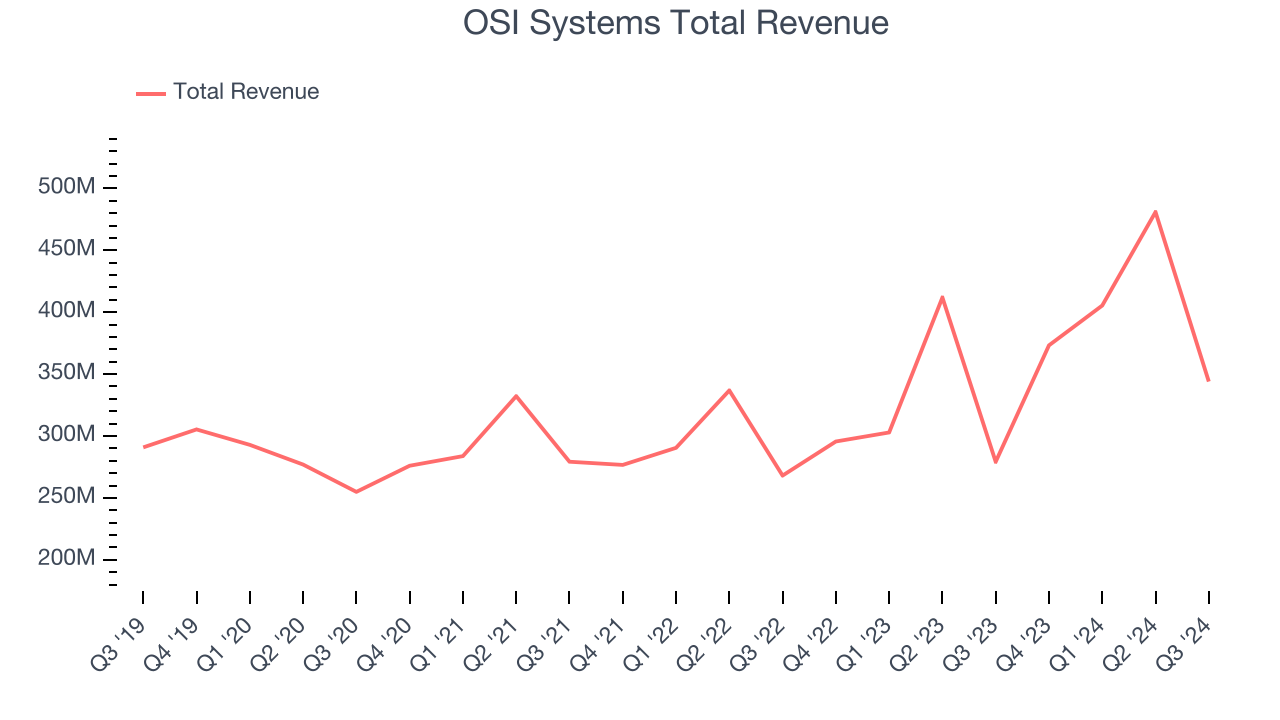

With a name reflecting its initial focus on optical sensors, OSI Systems (NASDAQ:OSIS) is a designer and manufacturer of specialized electronic systems and components.

OSI Systems reported revenues of $344 million, up 23.2% year on year, outperforming analysts’ expectations by 8%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

OSI Systems delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 23.3% since reporting. It currently trades at $175.28.

Is now the time to buy OSI Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Napco (NASDAQ:NSSC)

Napco Security Technologies, Inc. (NASDAQ:NSSC) is a leading manufacturer and designer of high-tech electronic security devices, cellular communication services for intrusion and fire alarm systems, and school safety solutions.

Napco reported revenues of $44 million, up 5.6% year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Napco delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 2.8% since the results and currently trades at $39.68.

Read our full analysis of Napco’s results here.

Powell (NASDAQ:POWL)

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE:POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Powell reported revenues of $275.1 million, up 31.8% year on year. This result lagged analysts' expectations by 4%. Overall, it was a mixed quarter for the company. Powell exceeded analysts’ EBITDA expectations. On the other hand, its revenue missed significantly.

Powell scored the fastest revenue growth among its peers. The stock is down 14.2% since reporting and currently trades at $267.99.

Read our full, actionable report on Powell here, it’s free.

Acuity Brands (NYSE:AYI)

One of the pioneers of smart lights, Acuity (NYSE:AYI) designs and manufactures light fixtures and building management systems used in various industries.

Acuity Brands reported revenues of $1.03 billion, up 2.2% year on year. This number beat analysts’ expectations by 0.8%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates.

The stock is up 16.5% since reporting and currently trades at $320.91.

Read our full, actionable report on Acuity Brands here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.