WESCO has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 7.8% to $176.41 per share while the index has gained 5.1%.

Is now the time to buy WESCO, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We don't have much confidence in WESCO. Here are three reasons why we avoid WCC and a stock we'd rather own.

Why Is WESCO Not Exciting?

Based in Pittsburgh, WESCO (NYSE:WCC) provides electrical, industrial, and communications products and augments them with services such as supply chain management.

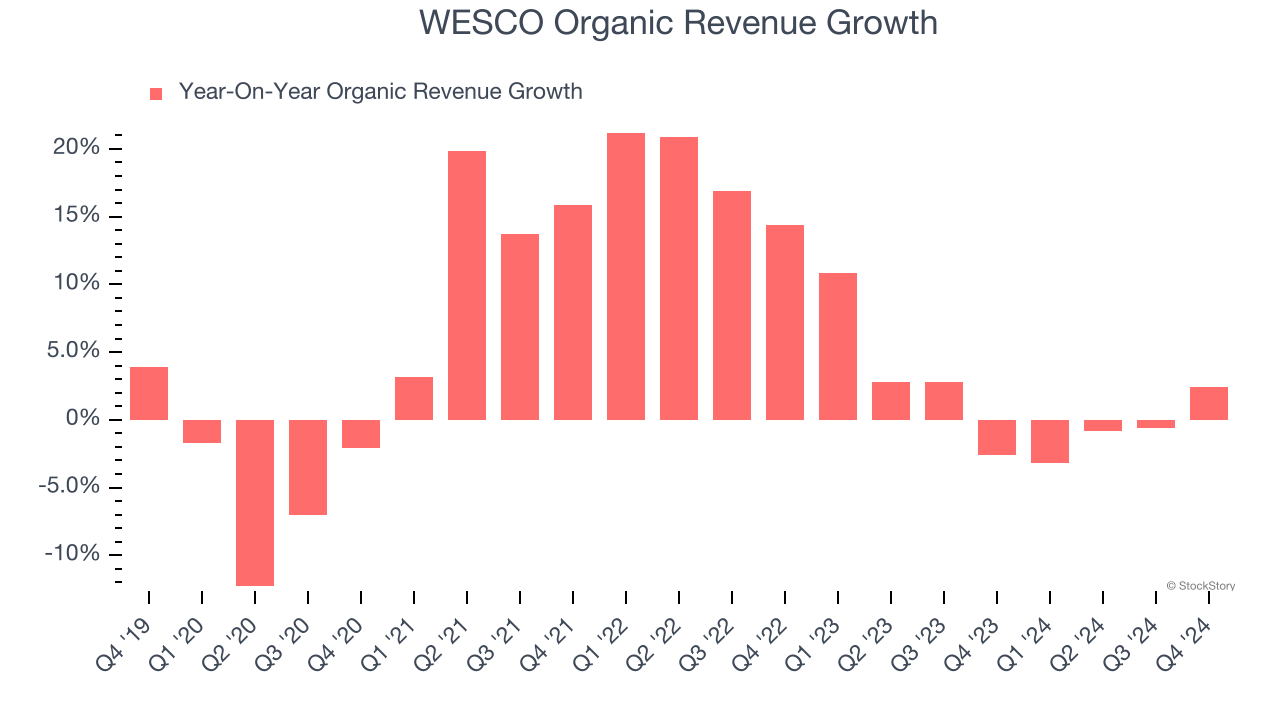

1. Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand Maintenance and Repair Distributors companies by analyzing their organic revenue. This metric gives visibility into WESCO’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, WESCO’s organic revenue averaged 1.4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect WESCO’s revenue to rise by 2.1%, close to its flat sales for the past two years. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

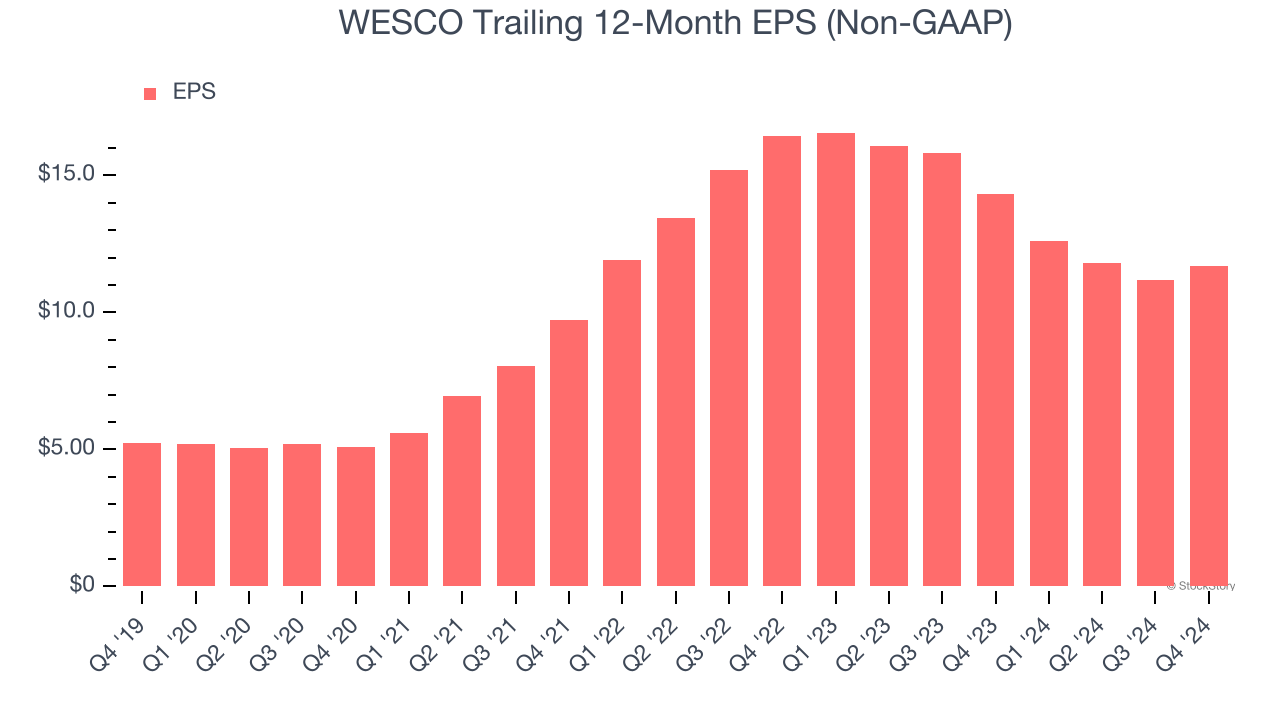

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for WESCO, its EPS declined by 15.7% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

Final Judgment

WESCO isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 12.6× forward price-to-earnings (or $176.41 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of WESCO

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.