VanEck Semiconductor ETF (NQ:SMH)

All News about VanEck Semiconductor ETF

Via Benzinga

Topics

Artificial Intelligence

Sunday ETF Review ↗

March 03, 2024

Via Talk Markets

Topics

ETFs

Nvidia Supplier Taiwan Semi Faces Water Shortage Challenge as Chip Production Demand Soars ↗

March 01, 2024

Via Benzinga

Topics

Supply Chain

Via Talk Markets

Topics

Stocks

As Oil Test $80, What About Natural Gas? ↗

February 29, 2024

Via Talk Markets

Topics

Energy

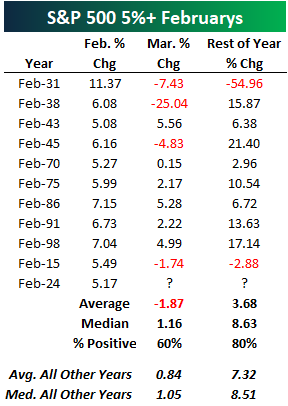

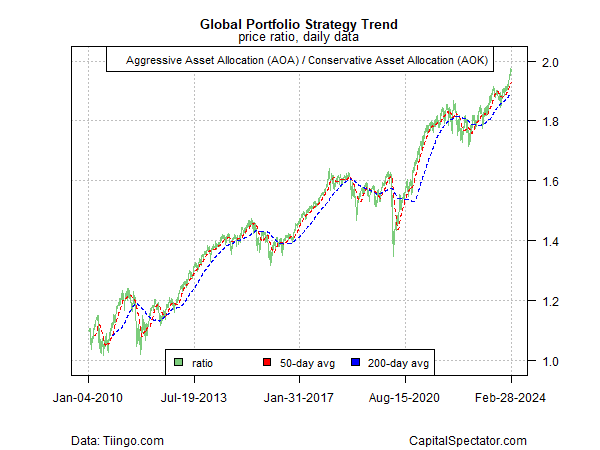

3 ETF Areas To Follow This Week ↗

February 19, 2024

Via Talk Markets

Topics

ETFs

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.