GSilver continues determined consolidation of the Guanajuato Mining District.

VANCOUVER, BC / ACCESS Newswire / November 24, 2025 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF), a growing Mexico-based precious metals producer, has entered into a definitive agreement (the "Agreement") dated November 21, 2025 to acquire the Bolanitos gold-silver mine ("Bolanitos") located in Guanajuato, Mexico, from Endeavour Silver Corp. ("Endeavour") (TSX:EDR) for total consideration of up to US$50 million (the "Transaction"), consisting of (i) upfront consideration of US$40 million to be paid on closing and (ii) contingent consideration of US$10 million (see transaction details below); the Transaction is expected to close in January 2026.

Highlights

Bolanitos will be Guanajuato Silver's 5th producing precious metals mine in Mexico. Upon the completion of the Transaction, the Company will operate three primary silver mines (Topia, Valenciana, and El Cubo) and two primary gold mines (Bolanitos and San Ignacio).

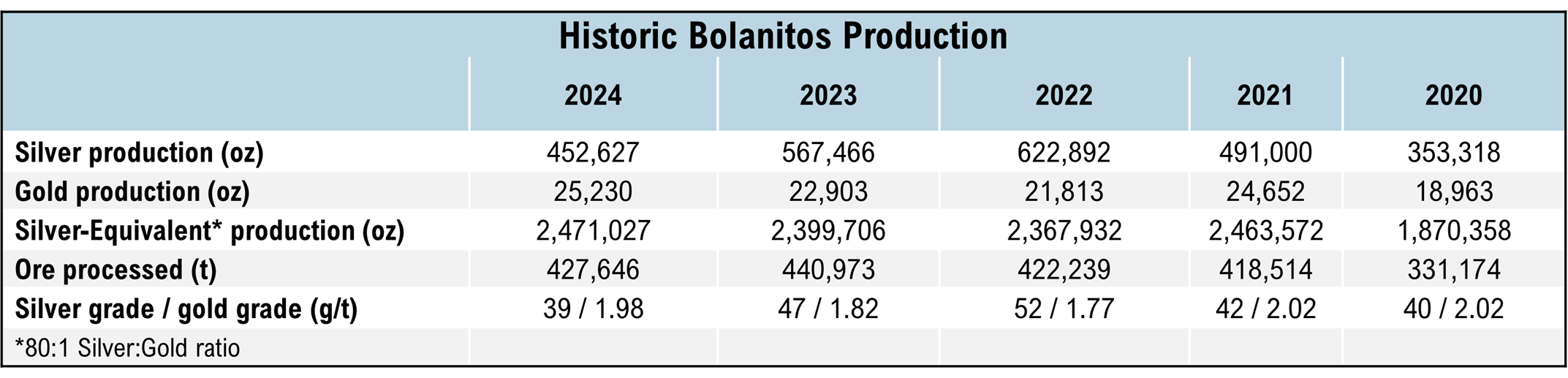

2024 Production at Bolanitos totaled 2,471,027 silver-equivalent (AgEq) ounces from 427,646 tonnes grading 39 g/t silver and 1.98 g/t gold for 452,627 ounces of silver and 25,230 ounces of gold. Silver and gold recoveries were 84.4% and 92.7% respectively. AgEq calculated at 80:1 silver to gold ratio (see Endeavour MD&A for the year ended December 31, 2024).

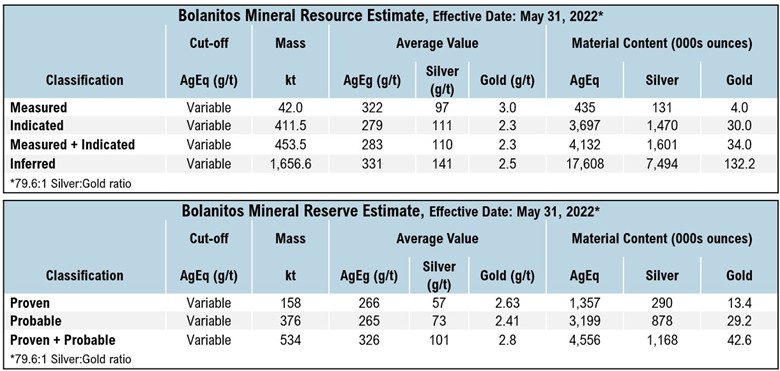

The acquisition of Bolanitos significantly increases Guanajuato Silver's resource base; see Bolanitos resource and reserve estimates below.

The incorporation of the San Ignacio Mine into the Bolanitos Mines Complex is expected to rapidly generate improved economics and expanded mine life; mineralized material mined at San Ignacio will now be transported to the nearby 1,600 tonnes per day Bolanitos flotation plant; as Bolanitos and San Ignacio are contiguous to one another, this is expected to dramatically reduce transportation costs and increase utilization at the Bolanitos mill.

The Transaction also includes the acquisition of the historic Cebada mine, which is located contiguous and to the north of theCompany's Valenciana Mines Complex (VMC). The Company intends to reactivate Cebada, which is currently on care and maintenance, as an important exploration and development project.

James Anderson, Chairman and CEO said, "The numerous advantages of integrating our San Ignacio Mine into the Bolanitos Mines Complex are obvious; we have already begun preparations to ensure seamless integration of this asset into our production portfolio, allowing us to quickly realize the economic rewards from this acquisition. By expanding our production platform within the prolific Guanajuato Mining District we have taken another positive step towards building Mexico's next mid-tier precious metals producer."

Transaction Summary

Under the terms of the Agreement, Guanajuato Silver will acquire all of the outstanding shares of Minera Bolanitos S.A. de C.V., a subsidiary of Endeavour, that holds all the mining assets located in the Guanajuato district currently held by Endeavour. Bolanitos is being acquired for total upfront consideration at closing of US$40 million (the "Upfront Consideration"), which is comprised of US$30 million in cash and US$10 million of Guanajuato Silver common shares ("Guanajuato Shares") at a deemed price of US$0.2709413 (Cdn$0.3815) per share. In addition to the Upfront Consideration, Guanajuato Silver will make two contingent payments to Endeavour (the "Contingent Payments"), each being US$5 million, upon achieving production of two million ounces of silver-equivalent and four million ounces of silver-equivalent, respectively. Each Contingent Payment will be satisfied 50% in cash and 50% in Guanajuato Shares ("Contingent Shares"), subject to the Maximum Percentage (as defined below).

The number of Contingent Shares issuable to Endeavour is subject to a maximum ownership percentage of 9.9% (the "Maximum Percentage"). If the issuance of Contingent Shares would result in Endeavour holding more than the Maximum Percentage, the value of any excess contingent payment amount (after issuing shares up to 9.9%) shall be payable in cash.

Any Contingent Shares shall be issued at a price (the "Contingent Share Issue Price") equal to the greater of (i) the volume weighted average trading price of the shares ("VWAP") on the TSX Venture Exchange ("TSXV") for the 10 consecutive trading days immediately preceding the applicable milestone payment date (the "Market Price"), and (ii) the minimum price permitted by the TSXV (which is currently the "Discounted Market Price" as of the issuance of the news release regarding the applicable contingent payment, as defined in the TSXV Corporate Finance Manual), in each case converted to United States dollars using the average exchange rate posted by the Bank of Canada on the day preceding the applicable milestone payment date. If applicable, Guanajuato Silver will make a cash payment to Endeavour equal to any shortfall between the aggregate Contingent Share Issue Price and the Market Price, at the time of each Contingent Payment.

The Transaction is arm's length and no finder's fees are payable in connection with the Transaction.

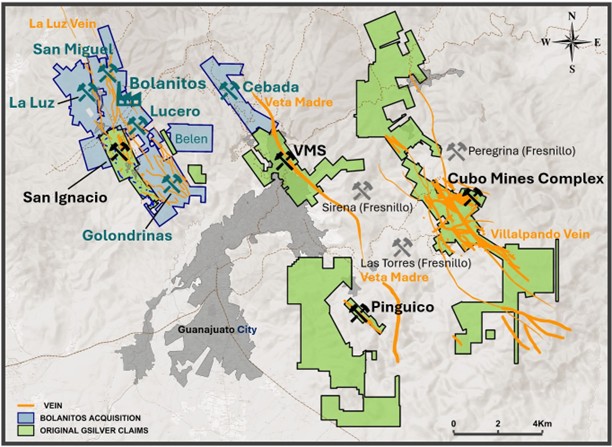

Figure 1: Map of the Guanajuato Mining District showing the main epithermal veins and other significant geological structures. Bolanitos is located along the La Luz Vein structure.

Bolanitos Operations

2024 production at Bolanitos totaled 2,471,027 silver-equivalent (AgEq) ounces from 427,646 tonnes grading 39 g/t silver and 1.98 g/t gold for 452,627 ounces of silver and 25,230 ounces of gold. Silver and gold recoveries were 84.4% and 92.7% respectively. AgEq was calculated at 80:1 silver to gold ratio (see Endeavour MD&A for the year ended December 31, 2024). Production at Bolanitos has been relatively consistent for several years and will add incrementally to Guanajuato Silver's total annual production.

Table 1: Historic Bolanitos production from 2020-2024. Source: See Endeavour Management's Discussion & Analysis for the Years Ended December 31, 2024, December 31, 2023, December 31, 2022, December 31, 2021 and December 31, 2020 filed by Endeavour on SEDAR+.

Figure 2: Bolanitos processing facility - 1,600 tonnes per day standard flotation plant.

Figure 3: Bolanitos processing facility - Bolanitos is a producing precious metals mining operation.

Figure 4: The Bolanitos mine was purchased by Endeavour Silver in 2007 from Penoles S.A. de C.V. The plant and ancillary infrastructure have been upgraded over the years.

Bolanitos consists of 26 mining concessions totaling 2,537 hectares. The land package, located 12km northwest of the city of Guanajuato, includes three producing mines: San Miguel, La Luz and Lucero. The past-producing Golondrinas mine, located in the southern portion of the Bolanitos concessions, is scheduled for production restart in 2026. The Bolanitos land package is contiguous with, and partially surrounds, GSilver's San Ignacio concessions on three sides.

The mining method used at Bolanitos is primarily long-hole stoping and conventional cut and fill mining. Mineralized material is brought to surface for crushing and grinding. The 1,600 tonnes per day flotation processing facility produces a bulk gold-silver concentrate, and currently operates at approximately 75% capacity, allowing for processing of mined material from San Ignacio. Endeavour purchased the Bolanitos Mine from Penoles S.A. de C.V. in 2007 and has made incremental expansions and improvements since acquisition.

Figure 5: Bolanitos mill interior. The mill is currently operating at approximately 75% capacity; the Company expects to achieve increased capacity at Bolanitos through the addition of mineralized material from San Ignacio.

Reserve and Resource Estimates

Table 2: Bolanitos Resource Estimate. Source: NI 43-101 Technical Report - Updated Mineral Resource and Reserve Estimates for the Bolanitos Project, Guanajuato State, Mexico, effective date: November 9, 2022.

Mineral Resources are reported exclusive of Mineral Reserves.

Mineral resources and mineral reserves have been reduced due to mining depletion from production at the property as set out in Endeavour's continuous disclosure record. Refer to production table above.

Silver equivalent calculation (AgEq) for the Bolanitos Mineral Reserve and Mineral Resource estimate is based on a 79.6:1 silver to gold price ratio. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Except as otherwise specified herein, all scientific and technical information related to Bolanitos in this Press Release is based on a technical report entitled "NI 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the Bolanitos Project, Guanajuato State, Mexico" with an effective date of November 9, 2022, filed on SEDAR+ by Endeavour on January 26, 2023 (the "Bolanitos Report"). To the best of the Company's knowledge, information, and belief, the Bolanitos Report is considered current pursuant to National Instrument ("NI") 43-101 and there is no new material scientific or technical information that would make the disclosure of the mineral resources, mineral reserves or results of the Bolanitos Report inaccurate or misleading. Furthermore, as required under applicable securities laws, the Company will file an updated technical report on Bolanitos, in accordance with NI 43-101, within 180 days of this press release.

For additional details on San Ignacio please refer to Guanajuato Silver's technical report dated March 7, 2024 (effective date December 31, 2023) titled "Technical Report on the San Ignacio Property, Guanajuato, Mexico" available on SEDAR+ at www.sedarplus.ca.

Figure 6: Proximity of the primary stockpiles at Bolanitos and San Ignacio. The Bolanitos mill is located within two kilometres of the San Ignacio project; the two properties are contiguous and share the same geology.

Additional Exploration and Development Projects

The Transaction includes the past-producing Cebada mine, which is located on trend along the Veta Madre vein system, directly to the north of GSilver's Valenciana Mines Complex. Additionally, the Bolanitos acquisition includes the Belen exploration project, which is located to the east of San Ignacio (see Figure 1 for location); Belen will also be a focus for future exploration drilling.

Bolanitos Geology

The Guanajuato mining district hosts three major mineralized fault systems, the La Luz, Veta Madre and Villalpando systems; Bolanitos is situated along the La Luz structure. Mineralized veins at Bolanitos consist of the classic banded and brecciated epithermal variety. Silver occurs primarily in dark sulfide-rich bands within the veins. Economic concentrations of precious metals are present as shoots that are distributed vertically and laterally between non-mineralized segments of the veins. Overall, the style of mineralization is pinch-and-swell with some flexures resulting in closures and others generating wide sigmoidal breccia zones.

Figure 7: Bolanitos is a primary gold mine centered on the epithermal vein structures of the La Luz fault system.

Additional Transaction Details

In connection with the Transaction, Endeavour and the Company will enter into an investor rights agreement (the "Investor Rights Agreement") at closing which will include, among other things, participation rights in favour of Endeavour. Pursuant to the Investor Rights Agreement, Endeavour has also agreed to vote its Guanajuato Shares in accordance with recommendations of the Company's board of directors in respect of general matters for a period of 12 months and to certain restrictions on transfer on the Guanajuato Shares issuable pursuant to the Agreement as part of the Upfront Consideration (the "Base Shares"). All Base Shares will be subject to voluntary restrictions on transfer for a period of 12 months, after which 50% of the Base Shares will be subject to restrictions for an additional two years.

Closing the Transaction is subject to customary conditions for a transaction of this nature, including the approval of the TSXV and the execution of the Investor Rights Agreement, and is expected to occur in January 2026. The Agreement provides for a reciprocal termination fee of US$2.5 million (the "Termination Fee"), payable by Endeavour or the Company in certain circumstances. The Termination Fee may be satisfied either (i) entirely in cash or, at the election of the applicable payor, (ii) by paying US$1 million in cash and settling the remaining US$1.5 million through the issuance of common shares of the payor, subject to stock exchange approval.

Any such shares will be issued at a deemed price per share (the "Termination Share Issue Price") equal to the greater of (i) the 10-day VWAP on the applicable exchange as of the termination date (the "Termination Share Market Price"), and (ii) the minimum price permitted by the TSXV or Toronto Stock Exchange (as applicable) after giving effect to the maximum discount permitted thereby, in each case converted to U.S. dollars using the Bank of Canada's average daily exchange rate on the business day immediately preceding the termination date. If applicable, the party paying the Termination Fee will make an additional cash payment to the other party equal to any aggregate shortfall in value between the Termination Share Market Price and the Termination Share Issue Price.

Management Transition

The Company also reports that COO Carlos Silva will retire as of December 31, 2025. The Company has greatly benefited from Mr. Silva's hard work, commitment to discipline, and astute leadership; he was particularly successful at enhancing Guanajuato Silver's social license to operate, having recently earned for the Company the Socially Responsible Company (ESR) distinction. Everyone at Guanajuato Silver wishes him well in his retirement - ¡Felicidades Carlos!

Rick Trotman will continue with the Company with the new title of Senior Vice President: Mining Operations. Since joining the Company in a full-time capacity, (See GSilver News Release dated July 29, 2025), Mr. Trotman has been invaluable in driving the Company toward sustained profitability. In his expanded role, he will be responsible for all mining, development, and exploration activities at all the Company's assets; Rick will also lead the integration of Bolanitos into the Company's operations.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed, approved and verified the technical data disclosed in this news release (including a review of the Bolanitos Technical Report on behalf of the Company) and has not detected any significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. The verification of data underlying the disclosed information includes reviewing compiled assay data; QA-QC performance of blank samples, duplicates and certified reference materials; and grade calculation formulas.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio Mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@GSilver.com

GSilver.com

Guanajuato Silver Bullion Store

Please visit our Bullion Store, where Guanajuato Silver coins and bars can be purchased.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, GSilver's growth, statements and information related to the closing of the Transaction and the ability of the parties to satisfy the conditions and close the Transaction; details regarding; the terms of the proposed revolving line of credit and ability of the Company to complete this financing; the merits of Bolantios; the Company's plans and objectives with respect to Bolanitos; the Company's plans to file an updated technical report for Bolanitos; other statements regarding future plans, expectations, guidance, projections, objectives, estimates and forecasts; the advantages of integrating our San Ignacio Mine into the Bolanitos Mines Complex; intention to reactivate the Cebada mine; intention to for Belen to become a focus for future exploration drilling; future focus areas for exploration, development and production, expansion; and GSilver's status as one of the fasting growing silver mining Company in Mexico.

Such forward-looking statements and information reflect management's current beliefs and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: that the parties are able to satisfy the conditions of the Transaction and close the Transaction; the Company is able to settle the terms of the revolving line of credit and complete this financing; the Company to accomplish its plans and objectives with respect to Bolanitos within the expected timing or at all; the ability of the Company to file an updated technical report for Bolanitos; the potential quantity, grade and metal content of the mineralized material at Bolanitos, El Cubo and San Ignacio, the geotechnical and metallurgical characteristics of such material conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, risks related to the ability of the parties to satisfy the conditions of the Transaction and close the Transaction; the ability of the Company to settle the terms of the revolving line of credit and complete this financing; the ability of the Company to accomplish its plans and objectives with respect to Bolanitos within the expected timing or at all; the ability of the Company to file an updated technical report for Bolanitos; availability of financing, currency rate fluctuations, high inflation and interest rates, geopolitical conflicts including wars, actual results of exploration, development and production activities, actual grades and recoveries of silver, gold and other metals from the Company's existing mines including El Cubo, Pinguico, San Ignacio, VMC and Topia, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, environmental risks, future prices of gold, silver and other metals, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to continue to increase production, tonnage milled and recoveries rates, improve grades and reduce costs at El Cubo, Pinguico, San Ignacio, VMC and/or Topia to process mineralized materials to produce silver, gold and other concentrates in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from El Cubo, Pinguico, San Ignacio, VMC and Topia is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected grades of gold and silver at El Cubo and San Ignacio and the anticipated level of production therefrom will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about impact of any future global pandemic, ongoing global conflicts, elevated inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR+ at www.sedarplus.ca including the Company's most recently filed annual information form. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE: Guanajuato Silver Company Ltd.

View the original press release on ACCESS Newswire