Biotech stocks can be some of the market’s most unpredictable movers. Breakthrough trial wins can send shares soaring overnight, while failed readouts can erase billions in market value just as fast. This is what happened with Novo Nordisk (NVO) on Monday, Nov. 24. The company’s stock has plunged sharply to its 4-year low after a closely watched Alzheimer’s trial for semaglutide failed to hit its main cognitive goal. The study had long been viewed as a “lottery ticket,” but with shares sliding to a four-year low, investors are asking whether this massive dip represents a rare buying opportunity, or a warning sign as competition intensifies and guidance cuts stack up.

For long-term investors evaluating the damage and the upside, here’s what you need to know about Novo Nordisk’s latest setback.

About NVO Stock

Novo Nordisk is a Danish pharmaceutical heavyweight best known for its blockbuster GLP-1 drugs like Ozempic and Wegovy. It dominates in diabetes and obesity care, and is aggressively investing in its pipeline to expand into new areas.

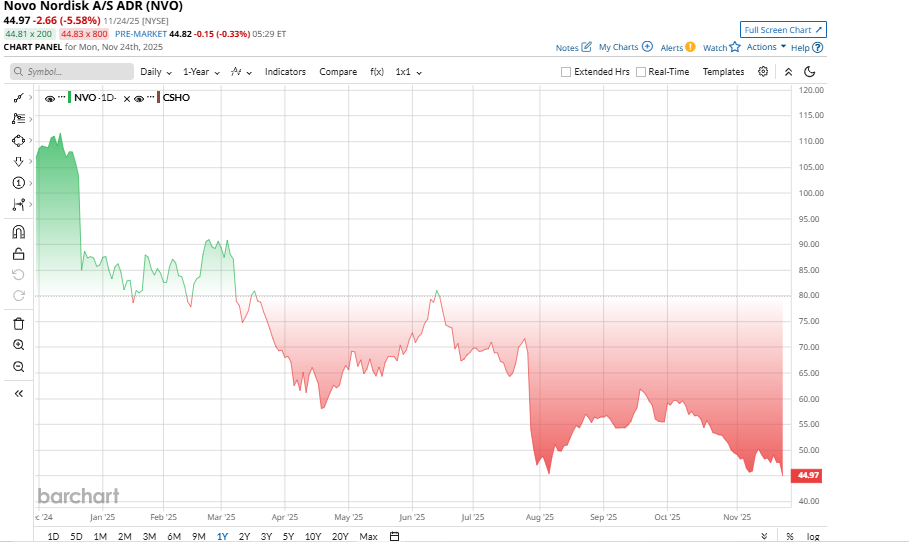

This has not been a kind year for Novo Nordisk’s stock. Shares have dropped more than 45% year-to-date (YTD), driven by a mix of slowing GLP-1 growth, rising competition, especially from Eli Lilly (LLY), pricing pressure, and disappointment from its pipeline. Investors had pinned hope on the Alzheimer’s program as a potential growth lever until now.

Valuation-wise, the dip makes the stock look more attractive, but it’s not a bargain. Novo trades at a price-earnings (P/E) ratio of about 38x, and an EV/EBITDA multiple of 26x.

The market still prices in the strength of its GLP-1 franchise, but the current valuation looks closer to “fair” than “expensive” given its growth outlook.

Alzheimer’s Trial Failure Sparks Massive Selloff

Novo Nordisk stock fell by approximately 6% on Nov. 24 after the firm announced that two Phase 3 trials of oral semaglutide in early Alzheimer's disease failed to meet their primary endpoints. The EVOKE and EVOKE+ trials enrolled nearly 3,800 patients over 2 years. Although the drug gave some disease biomarkers a slight boost, it failed the primary clinical endpoint and did not outperform the placebo by a substantial margin.

Other than the Alzheimer’s failure, Novo is experiencing some hiccups. It has recently announced a reduction of 9,000 employees as part of a cost-saving initiative. On the positive side, it is pursuing new pipeline deals, and more than its metabolic and rare-disease bets still have the backing of early stage investors. Yet the weight-loss industry is becoming saturated, and competition on prices is escalating, particularly in the US.

Novo Nordisk Posts Mixed Q3 Earnings

On Oct. 29, Novo reported its Q3 2025 earnings, and its results were mixed. The company beat earnings estimates but missed on revenue. It posted revenue of $11.7 billion, up 5.2% YoY.

Looking forward, Novo narrowed its outlook for fiscal 2025. It now expects sales growth of 8% to 11% (CER) and operating profit growth of 4% to 7%, factoring in about $1.23 billion in restructuring costs. Net financial items are expected to be a gain, and CapEx is expected to be around $9.26 billion.

What Analysts Are Saying About NVO Stock

Analyst reactions to Novo Nordisk’s sharp post-trial selloff have been critical. Morgan Stanley took the most cautious stance, cutting its rating to “Underweight” and lowering its U.S. ADR price target to $47 from $59. The firm cited slowing prescription trends, ongoing pricing pressure in the GLP-1 category, and the loss of a potentially meaningful pipeline catalyst following the Alzheimer’s trial failure.

HSBC also moved to the sidelines, downgrading the stock to “Hold” and reducing its target to DKK 300 from DKK 445. Analysts there argued that the Alzheimer’s setback, combined with increasing competitive and regulatory headwinds in diabetes and obesity treatments, meaningfully weakens the near-term growth narrative.

However, not all firms are bearish. UBS maintained a more constructive view, arguing that the market’s reaction appears disproportionate relative to the impact on Novo’s core business.

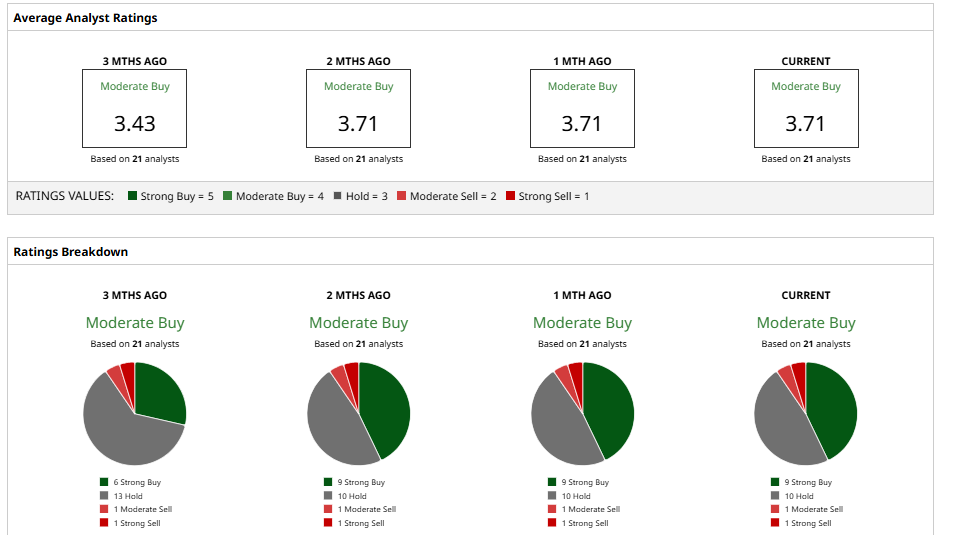

Overall, Wall Street is moderately bullish on NVO stock, with a consensus “Moderate Buy” rating and a mean price target of $54.40, suggesting 15% upside potential from here.

So, Should You Buy the Dip?

The Alzheimer’s setback is real and disappointing, but that will not pull Novo back on its long-term thesis when you are into the GLP-1 mojo, development pipeline, and huge cash holdings. This could be a juicy place to buy if you can afford to ignore the short-term noise.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart