Robinhood Markets (HOOD) stock has been in the thick of action in 2025. This is not surprising, considering higher trading volumes in equities and crypto have translated into robust growth for the company. As a result, HOOD stock has surged by 207% year-to-date (YTD).

However, from its October 2025 highs of $153.86, there has been a correction of more than 25%. This could be a good buying opportunity for investors who missed the big rally. In terms of significant buying activity, Bridgewater Associates has bought 807,514 shares of Robinhood in Q3. Considering the growth, driven by diversification, HOOD stock seems attractive.

About Robinhood Stock

Founded in 2013 and going public in 2021, Robinhood is a financial services company operating in the U.S. and internationally. Through its subsidiaries, Robinhood enables trading in stocks, options, futures, crypto, and retirement investments.

As of Q3 2025, the company had 26.8 million funded customers and 27.9 million investment accounts. Further, the total platform assets as of Q3 have swelled to $333 billion.

Amidst healthy growth, diversification, and solid fundamentals, HOOD stock has trended higher by 81% in the last six months.

Strong Q3 2025 Results

For Q3 2025, Robinhood reported robust numbers with revenue increasing by 100% year-over-year (YOY) to $1.27 billion. Further, adjusted EBITDA growth was 177% to $742 million. Besides the headline numbers, the following points are notable.

First, the average revenue per user increased by 82% YOY to $191. This healthy ARPU growth supported EBITDA margin expansion coupled with cash flow upside.

Further, Robinhood continued to gain market share in equities, options, crypto, and the margin markets. Product offering diversification coupled with investments in advancing the platform to deliver higher value is likely to ensure that Robinhood continues to gain market share.

Amidst these positives, it’s important to note that Bitcoin (BTCUSD) has corrected significantly from highs in the recent past. If the correction sustains, the company’s crypto trading volume is likely to be impacted. However, this concern is offset to some extent by the point that central banks globally are pursuing expansionary monetary policies. As interest rates trend lower, it’s likely to be positive for risky asset classes like equities, commodities, and cryptocurrencies.

Diversification Driven Growth

From a medium- to long-term perspective, diversification is a key growth catalyst for Robinhood. For example, the company reported $100 million or more in annualized revenue from one business segment in 2019. This increased to nine business segments in 2024 and further to 11 business segments in 2025 YTD. For the current year, Bitstamp and Prediction Markets are new segments with more than $100 million in annualized revenue.

In addition to these, Robinhood has been aggressively pursuing regional diversification. In the recent conference call, the company indicated that in the next 10 years, the target is to derive 50% of revenue from outside the U.S.

Importantly, as of Q3 2025, Robinhood reported a cash buffer of $4.3 billion. Further, with $3.8 billion in available lines of credit, the total liquidity is robust at $7.8 billion. This gives the company flexibility for aggressive organic growth coupled with potential merger & acquisitions.

What Analysts Say About HOOD Stock

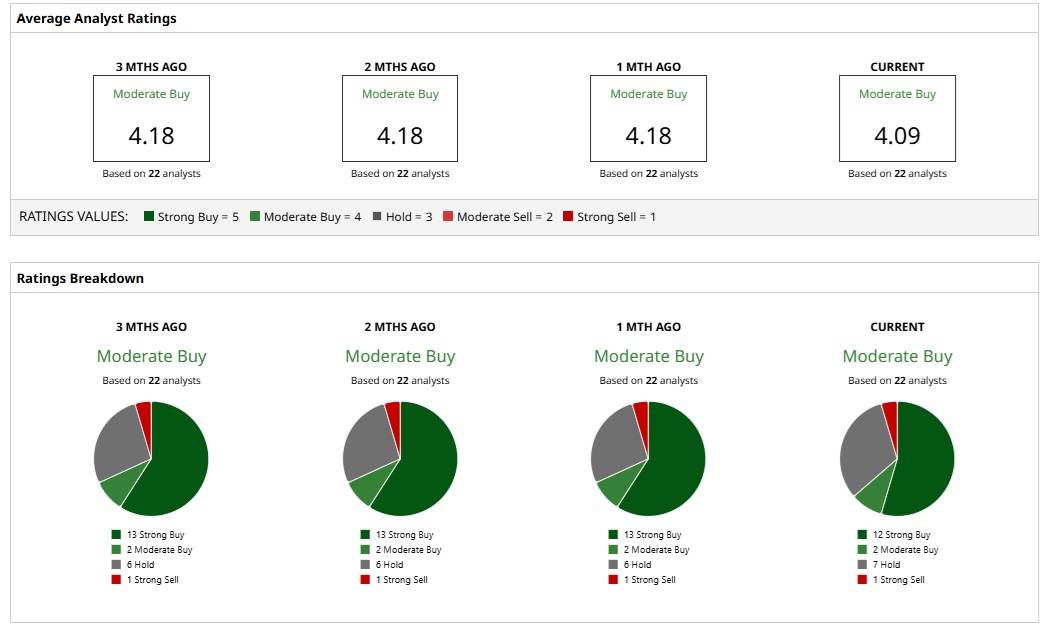

Based on the rating of 22 analysts, HOOD stock is a consensus “Moderate Buy.”

While 12 analysts give a “Strong Buy” rating, two are “Moderate Buy” and seven are “Hold.” Only a single analyst views the stock as a “Strong Sell.”

Overall, based on the ratings, analysts have a mean price target of $155.16. This implies upside potential of 36%. Further, the most bullish price target of $180 implies upside potential of 58%.

Notably, Robinhood has delivered earnings surprise for the last four quarters. If this trend sustains, it’s likely that HOOD stock will witness further re-rating and renewed uptrend.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Highest-Yielding Dividend Aristocrats to Buy Today

- Watch These 3 Chart Indicators for Early Warning Signs That the Bull Market is Over

- JEPI, the Covered Call ETF That Started a Mania, Is a Fallen Star. Here’s What Comes Next.

- Tesla Is Looking for ‘Exceptional Ability’ in AI Chips. Does That Make TSLA Stock a Buy Here?