Irving, Texas-based Caterpillar Inc. (CAT) is a leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Valued at a market cap of $265.2 billion, the company’s products support infrastructure development, mining, energy, and transportation projects globally, serving governments, contractors, and industrial customers.

Companies valued at $200 billion or more are typically classified as “mega-cap stocks,” and CAT fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the farm & heavy construction machinery industry. With a strong global dealer network, a resilient end-market presence, and continued investment in technology and sustainability, Caterpillar remains a cornerstone of the industry.

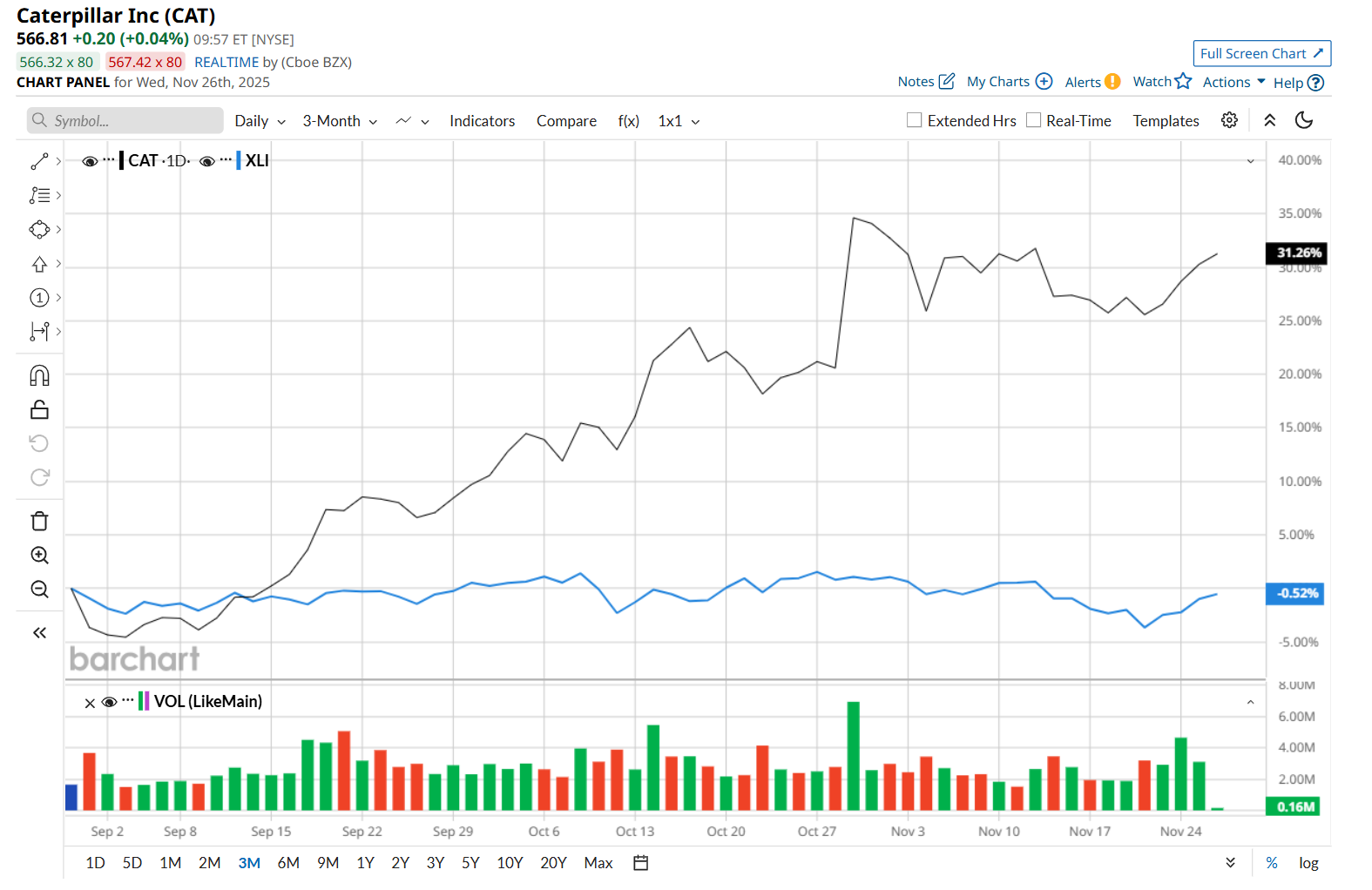

This farm & heavy construction machinery company is currently trading 4.8% below its 52-week high of $596.21, reached on Oct. 29. Shares of CAT have rallied 31.9% over the past three months, considerably outpacing the Industrial Select Sector SPDR Fund’s (XLI) marginal drop during the same time frame.

Moreover, on a YTD basis, shares of CAT are up 57.3%, compared to XLI’s 15.5% rise. In the longer term, CAT has soared 39.9% over the past 52 weeks, notably outperforming XLI’s 5.9% uptick over the same time frame.

To confirm its bullish trend, CAT has been trading above its 200-day moving average since mid-June and has remained above its 50-day moving average since early May.

Shares of Caterpillar rose 11.6% on Oct. 29 after the company released its impressive Q3 earnings results. Due to higher sales volume, mainly driven by growth in sales of equipment to end users, the company’s overall revenue improved 9.5% year-over-year to $17.6 billion, surpassing consensus estimates by 5.3%. Meanwhile, its adjusted earnings of $4.95 per share fell 4.3% from the same period last year, but handily topped analyst estimates of $4.52.

CAT has also outperformed its rival, Deere & Company (DE), which gained 4% over the past 52 weeks and 13.2% on a YTD basis.

Given CAT’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 23 analysts covering it. The company is trading 5.6% above its mean price target of $599.10.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?