Over the last six months, Amalgamated Financial’s shares have sunk to $28.90, producing a disappointing 5.4% loss - a stark contrast to the S&P 500’s 10.4% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy AMAL? Find out in our full research report, it’s free for active Edge members.

Why Does AMAL Stock Spark Debate?

Founded in 1923 by labor unions seeking a financial institution aligned with worker values, Amalgamated Financial (NASDAQGM:AMAL) operates a values-oriented bank that provides commercial banking, trust services, and investment management to socially responsible organizations and individuals.

Two Positive Attributes:

1. Increasing Net Interest Margin Juices Financials

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, Amalgamated Financial’s net interest margin averaged 3.5%, climbing by 16.3 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

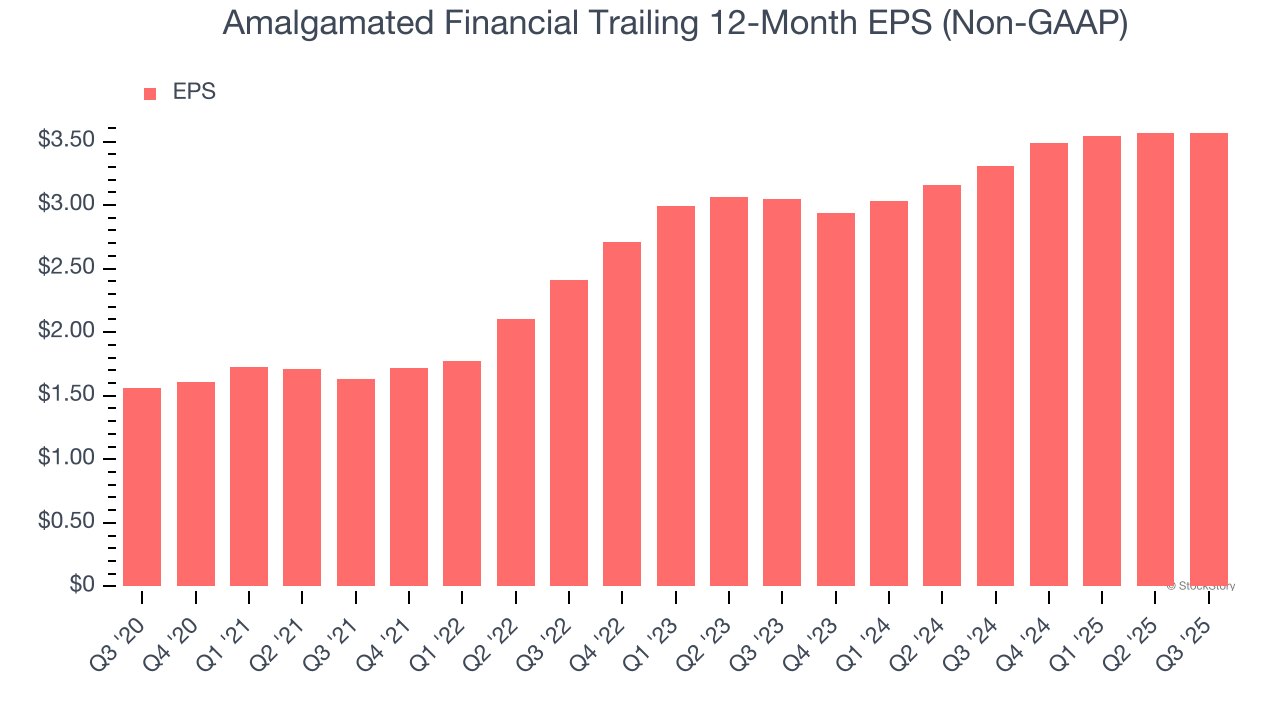

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Amalgamated Financial’s EPS grew at an astounding 18% compounded annual growth rate over the last five years, higher than its 9.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

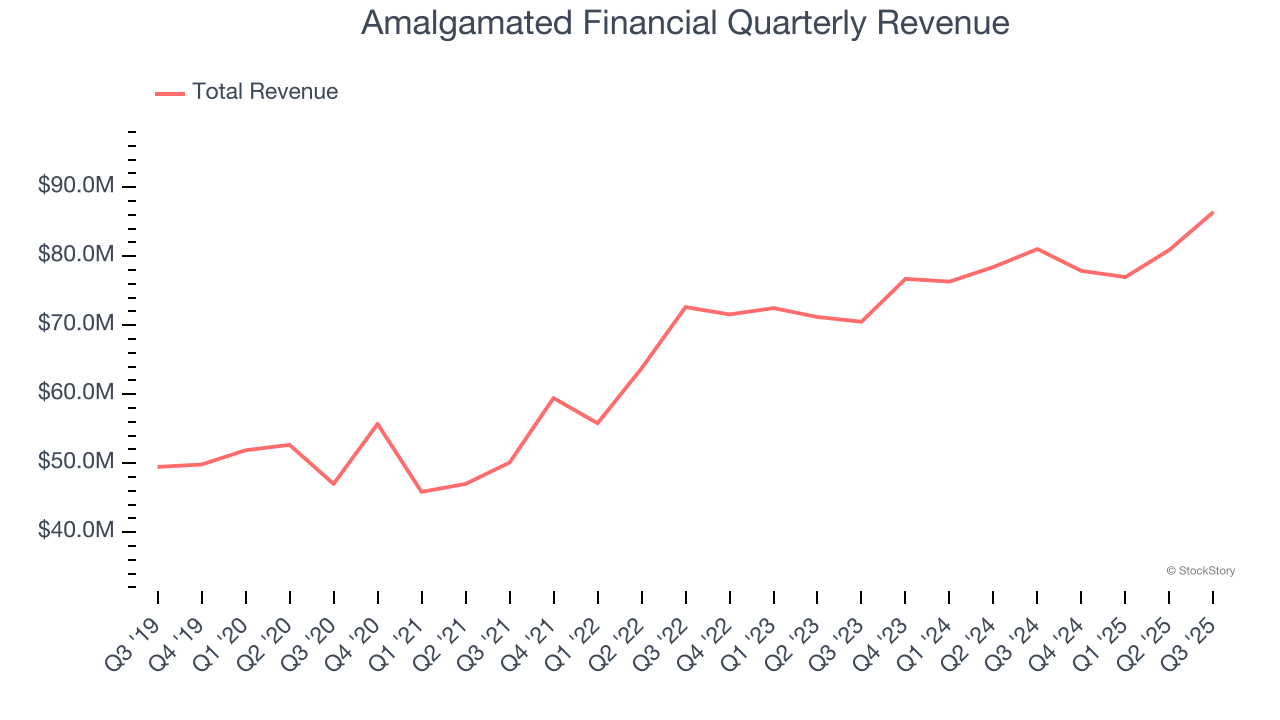

Long-Term Revenue Growth Disappoints

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Unfortunately, Amalgamated Financial’s 9.9% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the banking sector, but there are still things to like about Amalgamated Financial.

Final Judgment

Amalgamated Financial has huge potential even though it has some open questions. With the recent decline, the stock trades at 1× forward P/B (or $28.90 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.