As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the investment banking & brokerage industry, including Evercore (NYSE: EVR) and its peers.

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

The 16 investment banking & brokerage stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.2% while next quarter’s revenue guidance was in line.

While some investment banking & brokerage stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4% since the latest earnings results.

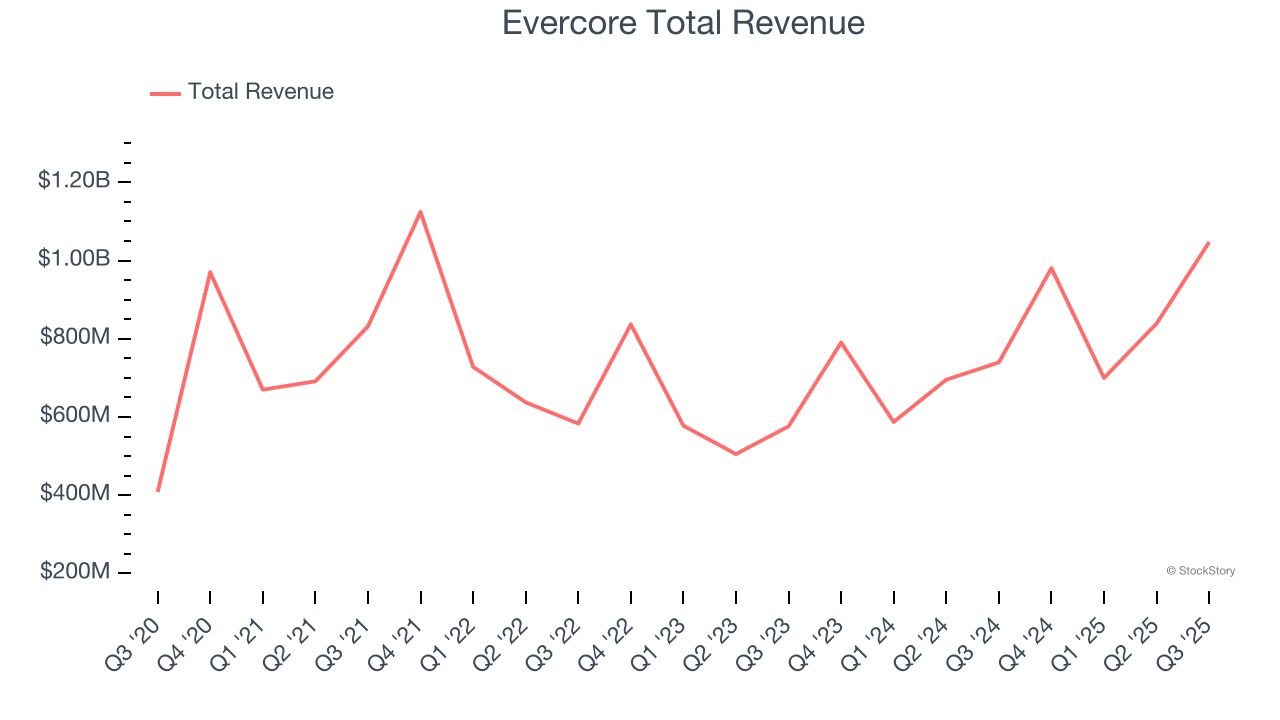

Evercore (NYSE: EVR)

Founded in 1995 as a boutique advisory firm focused on independence and client trust, Evercore (NYSE: EVR) is an independent investment banking firm that provides strategic advisory, capital markets, and wealth management services to corporations, financial sponsors, and high-net-worth individuals.

Evercore reported revenues of $1.05 billion, up 41.6% year on year. This print exceeded analysts’ expectations by 6.9%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ Investment Banking segment estimates and an impressive beat of analysts’ EBITDA estimates.

Unsurprisingly, the stock is down 4.2% since reporting and currently trades at $308.24.

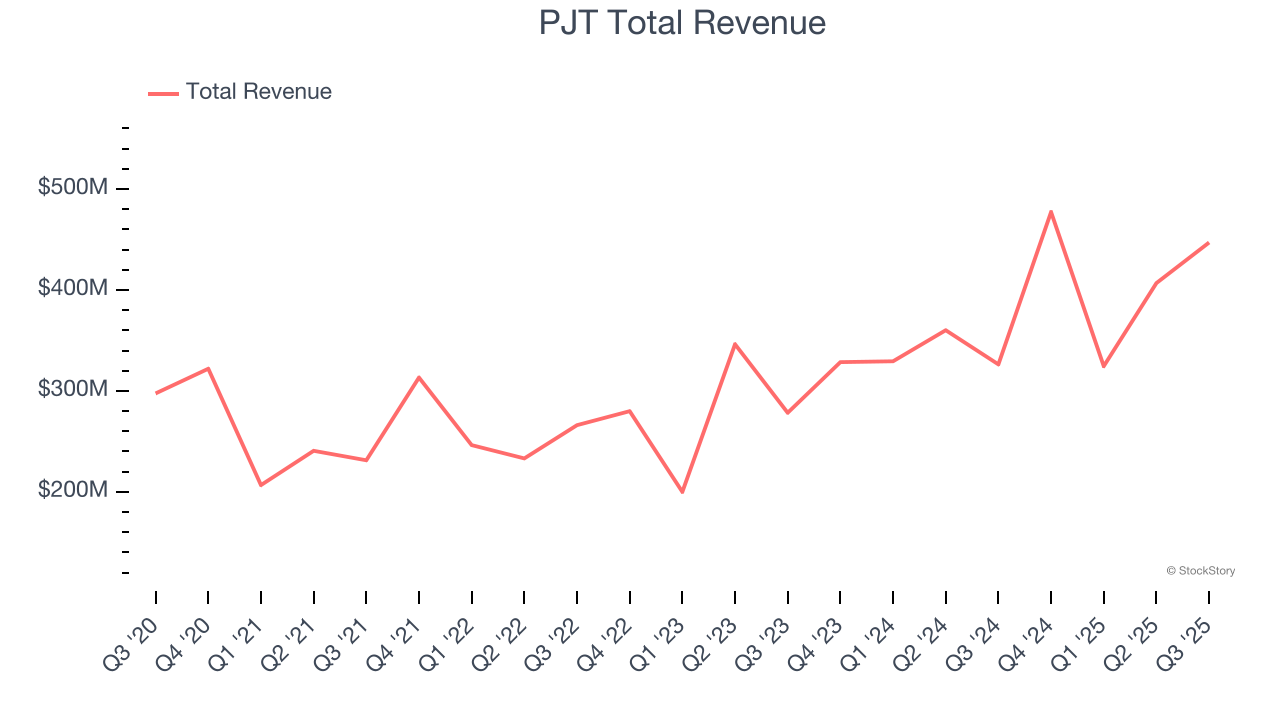

Best Q3: PJT (NYSE: PJT)

Spun off from Blackstone in 2015 and founded by former Morgan Stanley executive Paul J. Taubman, PJT Partners (NYSE: PJT) is an advisory-focused investment bank that provides strategic advice, restructuring services, and fundraising solutions to corporations, boards, and investment firms.

PJT reported revenues of $447.1 million, up 37% year on year, outperforming analysts’ expectations by 15.6%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

PJT achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.6% since reporting. It currently trades at $165.05.

Is now the time to buy PJT? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Perella Weinberg (NASDAQ: PWP)

Founded in 2006 by veteran investment bankers Joseph Perella and Peter Weinberg during a wave of boutique advisory firm launches, Perella Weinberg Partners (NASDAQ: PWP) is a global independent advisory firm that provides strategic and financial advice to corporations, financial sponsors, and government institutions.

Perella Weinberg reported revenues of $164.6 million, down 40.8% year on year, falling short of analysts’ expectations by 8.4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

Perella Weinberg delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 6.9% since the results and currently trades at $17.55.

Read our full analysis of Perella Weinberg’s results here.

Morgan Stanley (NYSE: MS)

Founded in 1924 during the post-WWI economic boom by former JP Morgan partners, Morgan Stanley (NYSE: MS) is a global financial services firm that provides investment banking, wealth management, and investment management services to corporations, governments, institutions, and individuals.

Morgan Stanley reported revenues of $18.22 billion, up 18.5% year on year. This print beat analysts’ expectations by 9.2%. It was an incredible quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The stock is up 4.2% since reporting and currently trades at $163.56.

Read our full, actionable report on Morgan Stanley here, it’s free for active Edge members.

Charles Schwab (NYSE: SCHW)

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE: SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

Charles Schwab reported revenues of $6.14 billion, up 26.6% year on year. This number surpassed analysts’ expectations by 2.2%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The stock is down 4.2% since reporting and currently trades at $90.36.

Read our full, actionable report on Charles Schwab here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.