Agricultural and farm machinery company AGCO (NYSE:AGCO) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 24.8% year on year to $2.60 billion. The company’s full-year revenue guidance of $12 billion at the midpoint came in 3.5% below analysts’ estimates. Its GAAP profit of $0.40 per share was also 58% below analysts’ consensus estimates.

Is now the time to buy AGCO Corporation? Find out by accessing our full research report, it’s free.

AGCO Corporation (AGCO) Q3 CY2024 Highlights:

- Revenue: $2.60 billion vs analyst estimates of $2.9 billion (10.4% miss)

- EPS: $0.40 vs analyst estimates of $0.95 (-$0.55 miss)

- The company dropped its revenue guidance for the full year to $12 billion at the midpoint from $12.5 billion, a 4% decrease

- Gross Margin (GAAP): 23.2%, down from 27% in the same quarter last year

- Operating Margin: 4.4%, down from 12.3% in the same quarter last year

- Free Cash Flow was -$59.8 million, down from $447 million in the same quarter last year

- Market Capitalization: $7.31 billion

"We continue to execute against our Farmer-First strategy focused on enhancing profitability through the cycle with our three high-margin initiatives, recent portfolio moves and aggressive actions to control expenses including our ongoing restructuring program," said Eric Hansotia, AGCO's Chairman, President and Chief Executive Officer.

Company Overview

With a history that features both organic growth and acquisitions, AGCO (NYSE:AGCO) designs, manufactures, and sells agricultural machinery and related technology.

Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

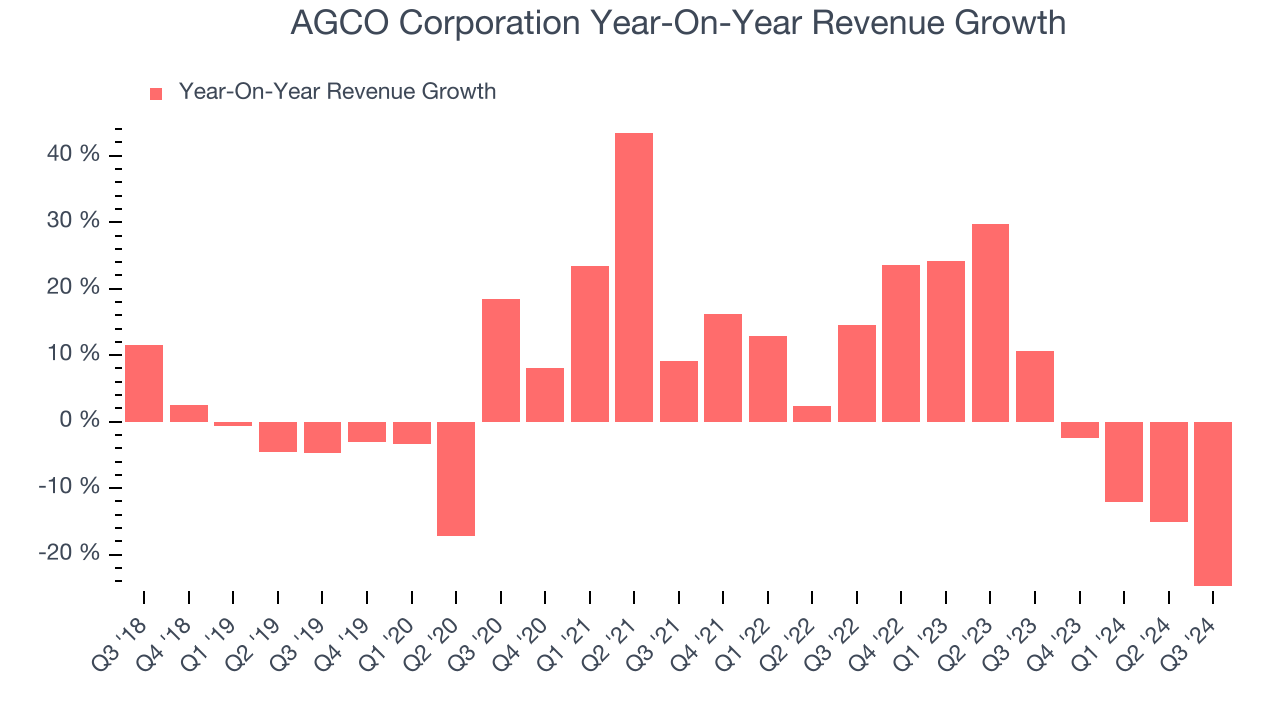

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, AGCO Corporation’s 6.6% annualized revenue growth over the last five years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AGCO Corporation’s recent history shows its demand slowed as its annualized revenue growth of 2.8% over the last two years is below its five-year trend.

This quarter, AGCO Corporation missed Wall Street’s estimates and reported a rather uninspiring 24.8% year-on-year revenue decline, generating $2.60 billion of revenue.

Looking ahead, sell-side analysts expect revenue to decline 5.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and shows the market thinks its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

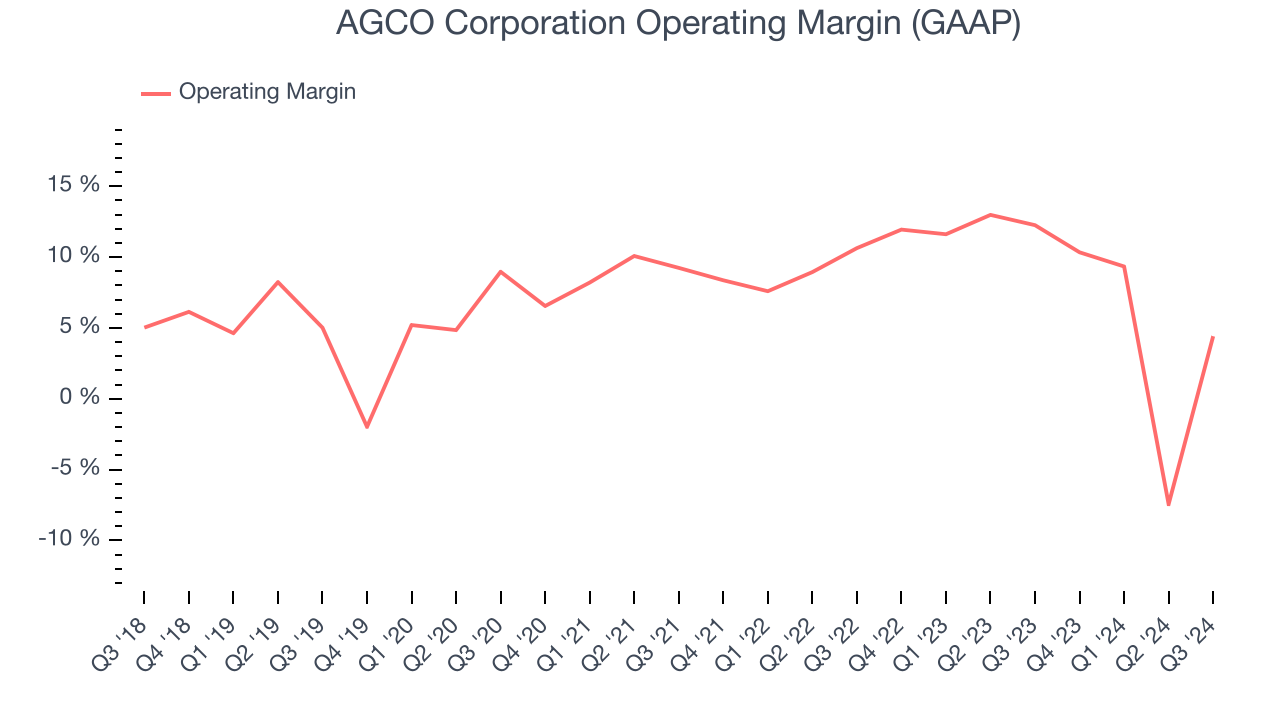

Operating Margin

AGCO Corporation was profitable over the last five years but held back by its large cost base. Its average operating margin of 8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, AGCO Corporation’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

This quarter, AGCO Corporation generated an operating profit margin of 4.4%, down 7.8 percentage points year on year. Since AGCO Corporation’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

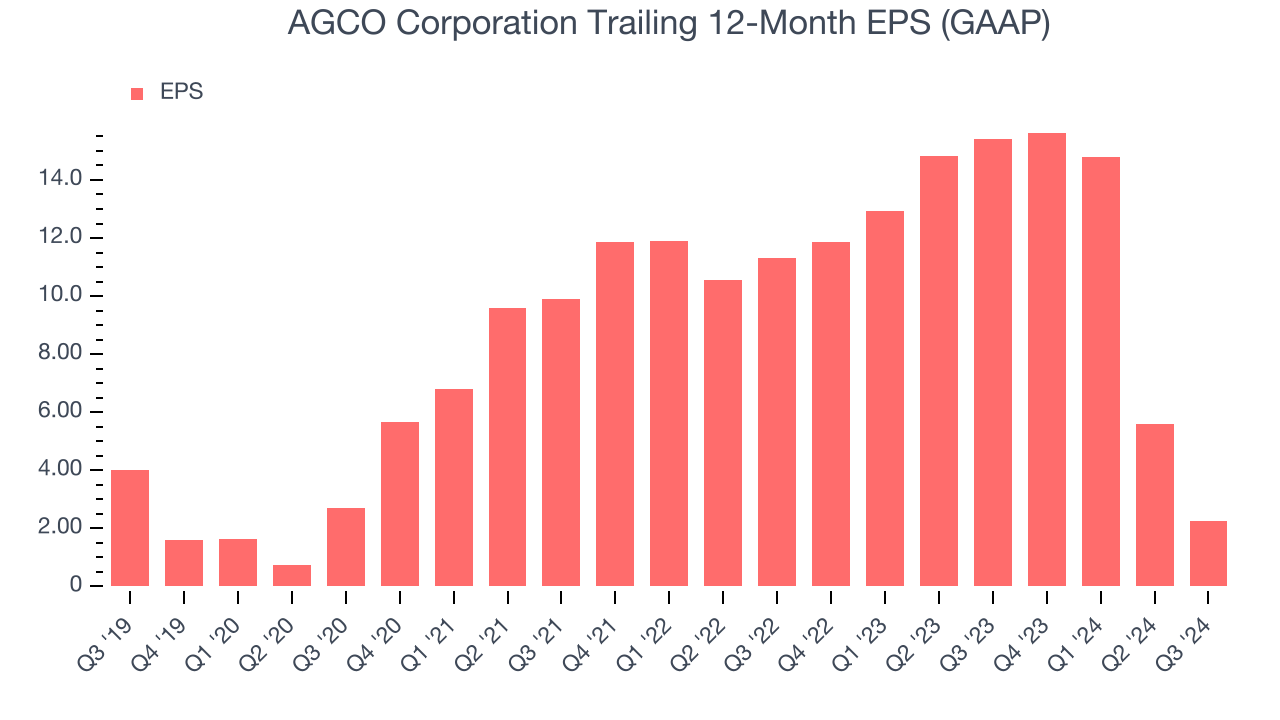

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for AGCO Corporation, its EPS declined by 10.8% annually over the last five years while its revenue grew by 6.6%. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

AGCO Corporation’s two-year annual EPS declines of 55.3% were bad and lower than its 2.8% two-year revenue growth.In Q3, AGCO Corporation reported EPS at $0.40, down from $3.74 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects AGCO Corporation’s full-year EPS of $2.27 to grow by 198%.

Key Takeaways from AGCO Corporation’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EPS missed Wall Street’s estimates. It also lowered its full-year revenue guidance. Overall, this quarter could have been better. The stock traded down 3.9% to $94 immediately following the results.

AGCO Corporation’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.