Precious metals were the best-performing sector of the commodities market in Q3, rising 20.32%. Over 2025’s first nine months, the composite, including gold, silver, platinum, and palladium, moved 55.92% higher. In late October 2025, prices have continued to soar. In my October 14, 2025, Barchart article recapping the precious metals and GLTR ETF price action in Q3 and the first nine months of 2025, I concluded:

The trend is always a trader’s or investor’s best friend, and it remains bullish for precious metals in October 2025. GLTR is a product that trades on the NYSE Arca and enables market participants to diversify precious metals exposure. I rate GLTR a hold at the current price level, as even the most aggressive bullish trends rarely move in straight lines. However, any pullback or correction could be a golden buying opportunity.

Remember, every price correction in gold has been a buying opportunity for over a quarter of a century.

Gold, silver, platinum, and palladium prices were lower than the October 13 prices on October 29. The risk of buying these metals at the current price levels has increased, but the price action continues to flash a critical warning signal.

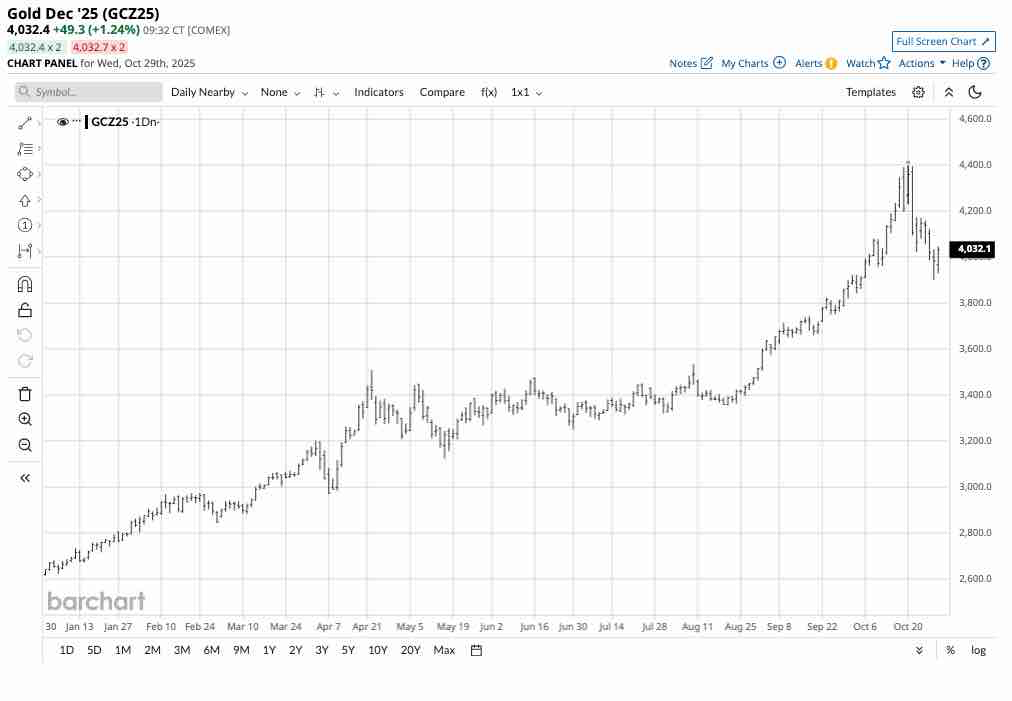

Gold: New highs and a correction

COMEX gold futures reached a new record peak at $4,398 per ounce on October 17, 2025.

As the daily continuous year-to-date chart highlights, gold ran out of upside steam at just below $4,400 per ounce, and corrected to $3,901.30 on October 28. The 11.3% stopped at just above the $3,900 level, with gold rebounding to over $4,000 on October 29.

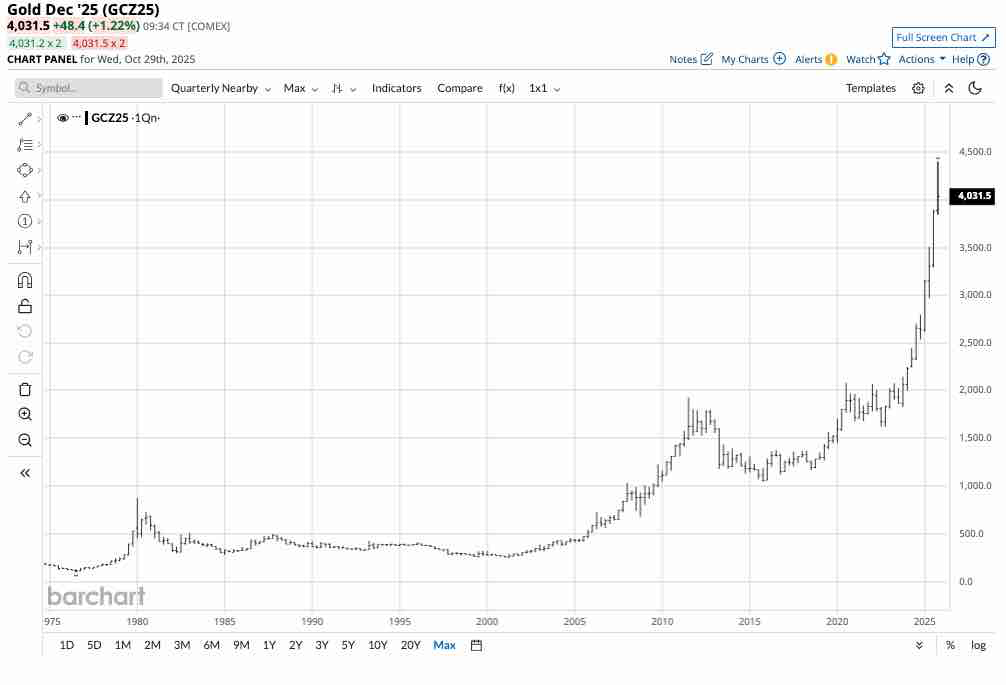

The quarterly chart shows that the long-term bullish trend remains firmly intact.

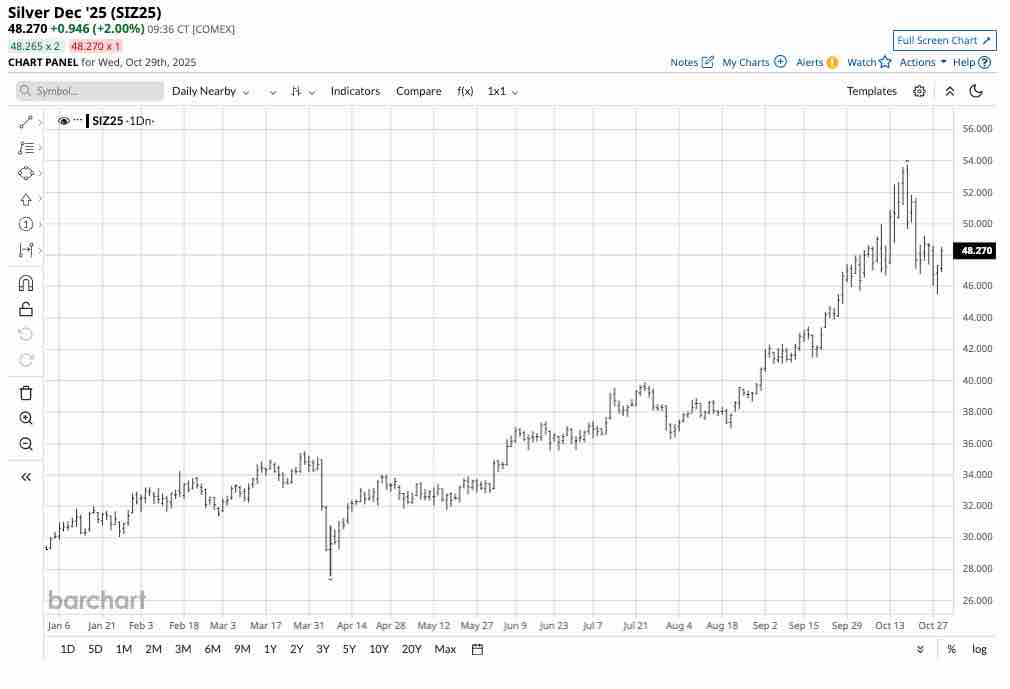

Silver joins gold at record levels and corrects

COMEX silver futures reached a new record peak at $53.765 per ounce on October 17, 2025.

As the daily continuous year-to-date chart highlights, silver ran out of upside steam at just below $53.80 per ounce, and corrected to $45.51 on October 28. The 15.4% stopped at just above the $45.50 level, with silver rebounding to over $48 on October 29.

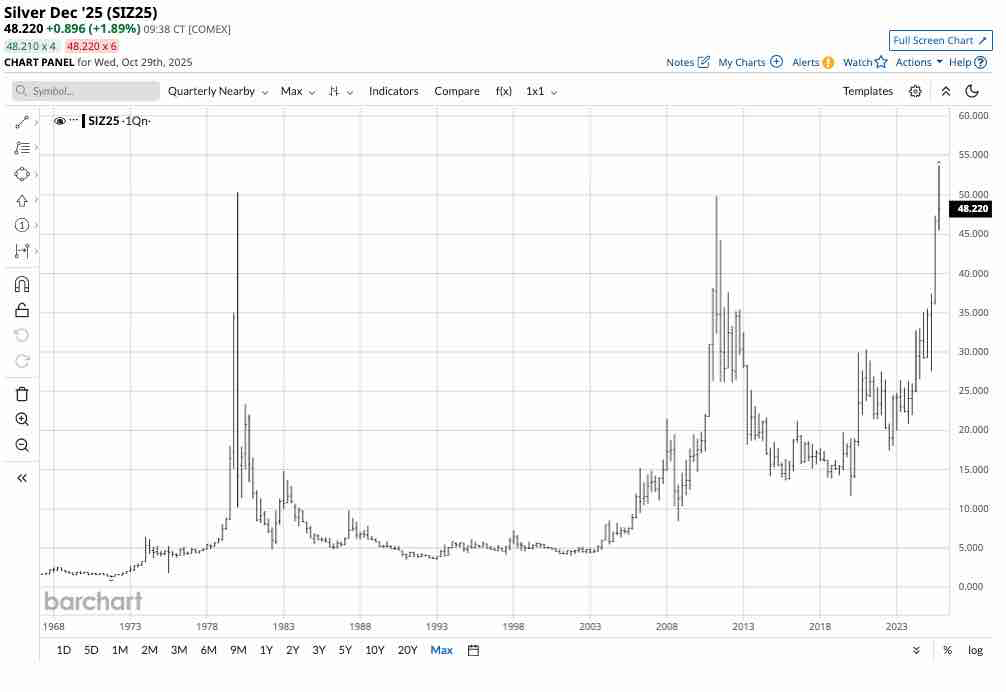

The quarterly chart shows that the long-term bullish trend remains firmly intact.

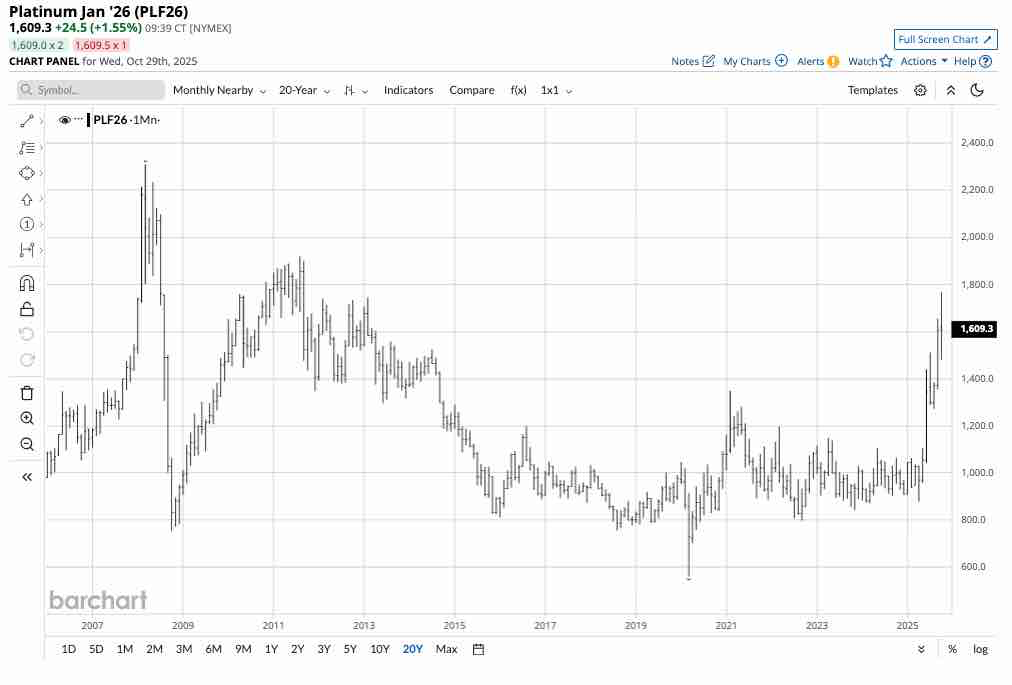

Platinum remains in a bullish trend despite a selloff

NYMEX platinum futures reached $1,770 per ounce on October 16, 2025, the highest price since September 2011.

The monthly continuous futures contract chart illustrates platinum’s bullish trend and the correction that took the rare precious metal 16.3% lower to a low of $1,481.20 on October 22. Platinum futures were trading above the $1,600 level at the end of October, and remained in a bullish trend.

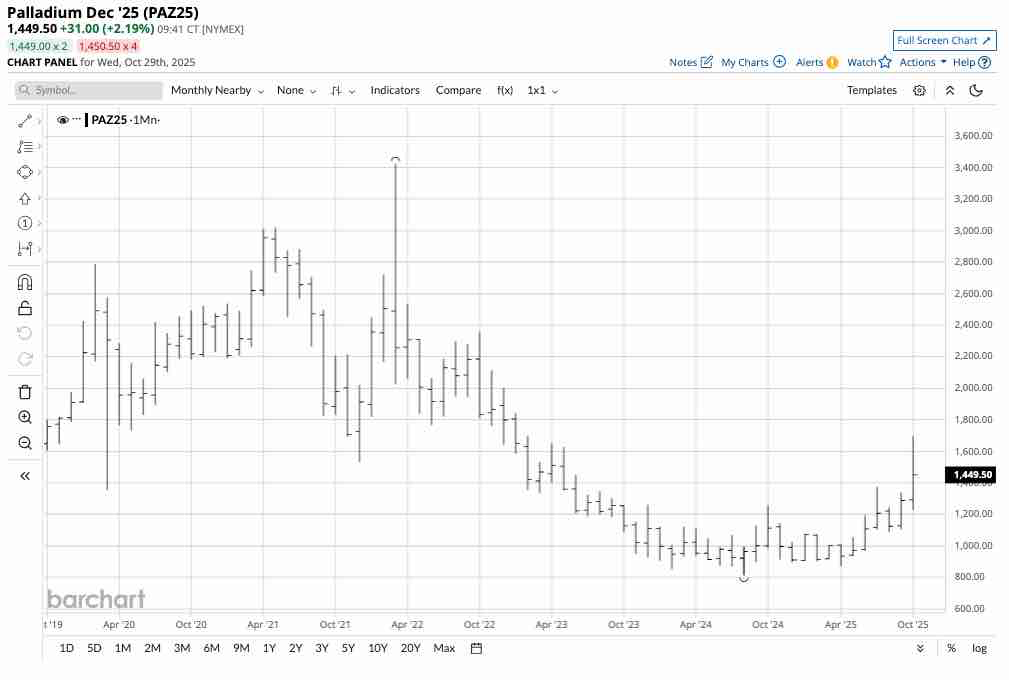

Palladium is also a bull in late October, regardless of a pullback

NYMEX palladium futures reached $1,695 per ounce on October 16, 2025, the highest price since February 2023.

The monthly continuous futures contract chart illustrates palladium’s bullish trend and the correction that took the precious metal 20% lower to a low of $1,356.50 on October 28. Palladium futures were trading near the $1,450 level on October 29 and remained in a bullish trend.

The precious metals tell us that fiat currencies are out of favor

The bullish price action in gold, silver, platinum, and palladium had been parabolic over the past months, but even the most aggressive bull markets experience pullbacks.

When gold traded around $300 per ounce, a significant daily move in the futures market was typically $25, or over 8%. At the most recent high of $4,398, an 8% move was over $350 per ounce. On October 21, gold futures declined from $4,359.40, the October 20 closing level, to a low of $4,093, a 6.1% decline. Therefore, the percentage declines in gold, as well as silver, platinum, and palladium over the past sessions have not been out of the ordinary as higher prices translate to more substantial price swings, but the percentages have not been atypical.

The epic rallies in precious metals signal that fiat currency values are deteriorating. Gold, the world’s oldest means of exchange, is now the second-leading reserve asset held by worldwide central banks, second only to the U.S. dollar, the world’s reserve currency. The bottom line is that the bull markets remain intact, which is a commentary on the purchasing power of fiat foreign exchange instruments in late October 2025. However, as precious metal prices rise, the odds of periodic corrections increase, which will be significant on a nominal basis but should remain within historical norms. New highs require caution. Buying the metals on rallies increases risks, as buying on price weakness has been optimal over the past months and years.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should We Be Cautious with Precious Metals?

- How Much Lower Will Silver Prices Go?

- Silver to $100? Here’s What That Would Mean for Gold Prices, Based on the Gold-Silver Ratio

- I Warned that $50 Silver Was Pivotal. What to Watch Now – and How to Trade – as Gold and Silver Prices Experience Extreme Volatility.