With a market cap of $236.5 billion, RTX Corporation (RTX) is a leading aerospace and defense company. It operates through three major segments: Collins Aerospace; Pratt & Whitney; and Raytheon, providing advanced systems and services to commercial, military, and government customers globally.

Shares of the Arlington, Virginia-based company have significantly outperformed the broader market over the past 52 weeks. RTX stock has jumped 45.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 17.4%. Moreover, shares of the company are up 53.3% on a YTD basis, compared to SPX’s nearly 16% increase.

Focusing more closely, shares of the aerospace and defense company has outpaced the Industrial Select Sector SPDR Fund’s (XLI) 14.3% return over the past 52 weeks and a 17.4% YTD gain.

Shares of RTX climbed 7.7% on Oct. 21 after the company reported Q3 2025 adjusted EPS of $1.70 and revenue of $22.48 billion, above forecasts. The company also raised its full-year adjusted EPS outlook to $6.10 - $6.20 and revenue guidance to $86.5 billion - $87 billion, reflecting confidence in strong demand. Growth was driven by a 10% rise in defense sales, particularly Patriot systems, and 16% higher sales at Pratt & Whitney, benefiting from booming aerospace demand.

For the fiscal year ending in December 2025, analysts expect RTX’s adjusted EPS to grow 7.9% year-over-year to $6.18. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

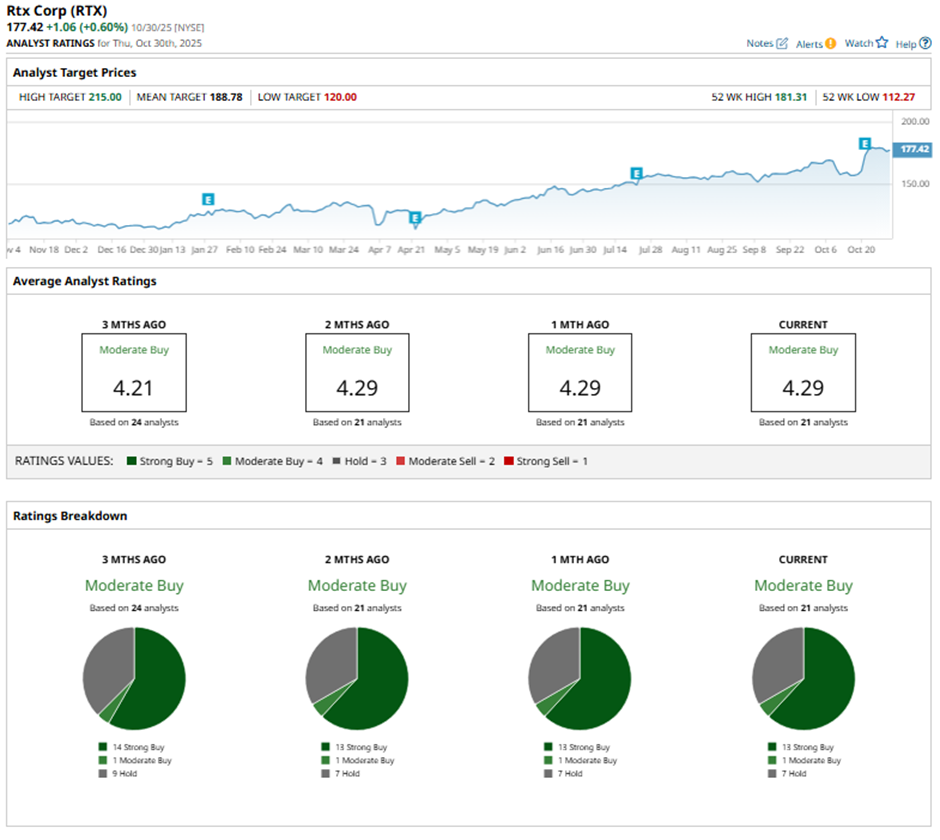

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is slightly less bullish than three months ago, with 14 “Strong Buy” ratings on the stock.

On Oct. 27, BofA analyst Ronald Epstein raised RTX’s price target to $215 and maintained a “Buy” rating.

The mean price target of $188.78 represents a 6.4% premium to RTX’s current price levels. The Street-high price target of $215 suggests a 21.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Is Paying Its First-Ever Dividend. Should You Snap Up PYPL Stock Now?

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever