M&T Bank Corporation (MTB) is a major regional bank headquartered in Buffalo, New York, serving individuals, businesses, and commercial clients across the Northeast and Mid-Atlantic regions. Known for its conservative risk management and strong community banking focus, MTB offers a wide range of services, including loans, deposits, wealth management, and commercial banking solutions. It is currently valued at $28.1 billion by market capitalization.

Shares of this leading regional bank have underperformed the broader market over the past year. MTB has declined 14.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 10.5%. However, in 2025, MTB stock is down 2.8%, compared with the SPX’s 11.2% YTD gain.

Zooming in further, MTB has also trailed the iShares U.S. Regional Banks ETF (IAT). The exchange-traded fund has fallen 8.9% over the past year and 1.9% in 2025.

On Oct. 16, M&T Bank posted its Q3 2025 results, and despite delivering solid fundamentals, the stock slid 3.5% after the announcement. The bank reported an EPS of $4.87 on an adjusted basis, topping expectations. Net interest margin improved to 3.68% and average loans grew to $136.5 billion. Fee income hit record levels, and operating efficiency improved, reflected in a 53.6% efficiency ratio.

For the current fiscal year, ending in December, analysts expect MTB’s EPS to grow 12.4% to $16.72 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

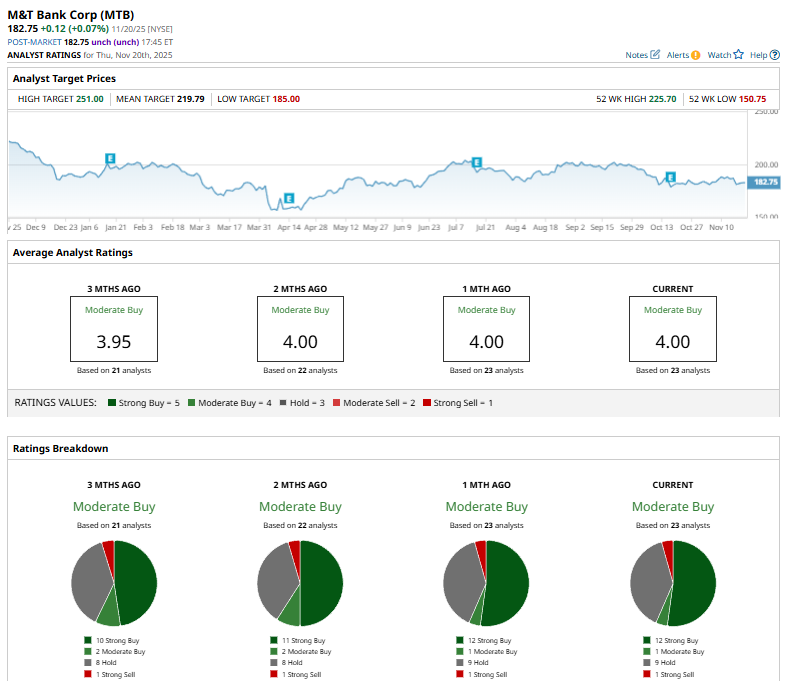

Among the 23 analysts covering MTB stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Strong Sell.”

The configuration is bullish than two months ago when the stock had 11 “Strong Buy” ratings.

On Oct. 17, Truist Financial analyst Brian Foran reaffirmed his “Buy” rating on M&T Bank.

The mean price target of $219.79 represents a 20.3% premium to MTB’s current price levels. The Street-high price target of $251 suggests an upside potential of 37.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Learn How to Read These Smart Money Warning Signs as Commitments of Traders Data Comes Back Online

- ConocoPhillips' 3.84% Dividend Yield Implies COP Stock Could be 24% Undervalued

- Is This Outstanding AI Stock Under $250 Ready to Soar?

- UnitedHealth Stock: ‘Big,’ ‘Fat,’ and ‘Rich,’ or an Undervalued S&P 500 Buy Here?