Labcorp Holdings Inc. (LH), headquartered in Burlington, North Carolina, is a leading global provider of comprehensive laboratory services. The company operates across two main segments: Diagnostics Laboratories and Biopharma Laboratory Services, offering a wide range of tests, from blood chemistry and microbiology to advanced gene-based and esoteric diagnostics. Labcorp’s market capitalization is about $21.7 billion.

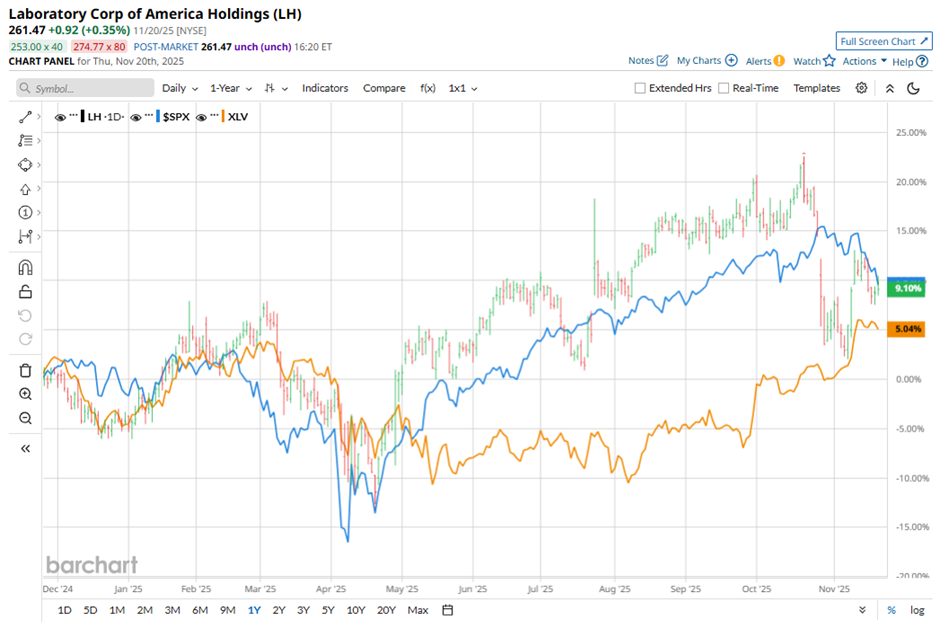

Shares of the medical laboratory operator have slightly underperformed the broader market. Over the past 52 weeks, LH stock has rallied by 9.9%, while the broader S&P 500 Index ($SPX) has gained 10.5%. However, the stock rose 14% on a YTD basis, compared to SPX’s 11.2% surge.

Looking closer, the medical laboratory operator has outpaced the Health Care Select Sector SPDR Fund’s (XLV) 6% increase over the past 52 weeks and 10.1% YTD.

LH stock has been rising in 2025, largely driven by strong execution in its diagnostics business and bullish investor sentiment. There is a growing demand for high-value specialty tests (oncology, neurology, women’s health), aided by its key integration and AI-driven efficiency initiatives.

The company also delivered robust Q3 results on Oct. 28, with adjusted EPS of $4.18, up 19.4% from the prior year quarter. However, the stock plunged about 5.8% on the day of the earnings announcement and 4.5% on the following day. The softer reaction appears to be driven by the fact that while earnings outperformed, the company trimmed its full-year revenue growth guidance to 7.4% to 8% range, which may have triggered investor caution.

For the fiscal year ending in December 2025, analysts expect Labcorp’s adjusted EPS to grow 12% year over year to $16.32. The company’s earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

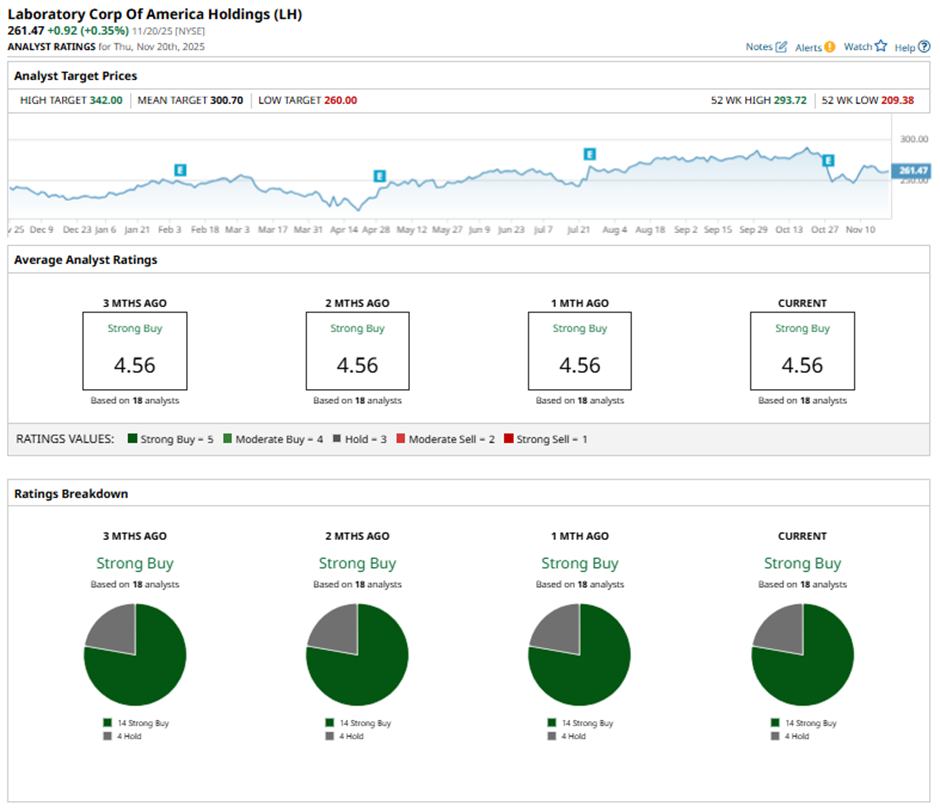

Among the 18 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 14 “Strong Buy” ratings and four “Holds.”

This configuration has remained largely consistent over the past few months.

This month, JP Morgan’s analyst Lisa Gill maintained an “Overweight” rating on Labcorp Holdings and raised her price target to $317.

While the mean price target of $300.70 suggests an upside potential of 15%, the Street-high price target of $342 implies the stock could rally as much as 30.8% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart