In my October 28, 2025, recap of the energy sector in Q3 on Barchart, I concluded with:

Crude oil is the leading energy commodity that continues to power the world. U.S. energy policy, OPEC+ production increases, seasonality, and the potential for a more peaceful Middle East favor lower crude oil prices in Q4. A move below the $55.12 critical technical support on the continuous NYMEX crude oil futures contract could ignite substantial technical selling, leading to a test of the $50 per barrel level, or lower. Oil products, coal, and ethanol are likely to follow crude oil prices over the coming weeks and months.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

After trading to a low of $55.96 per barrel on the nearby December NYMEX WTI futures contract on October 20, 2025, crude oil rebounded to a high of $62.59 on October 24 as sanctions on Russia raised supply concerns. With the price back around the $60 level, crude oil prices could be heading lower over the coming weeks.

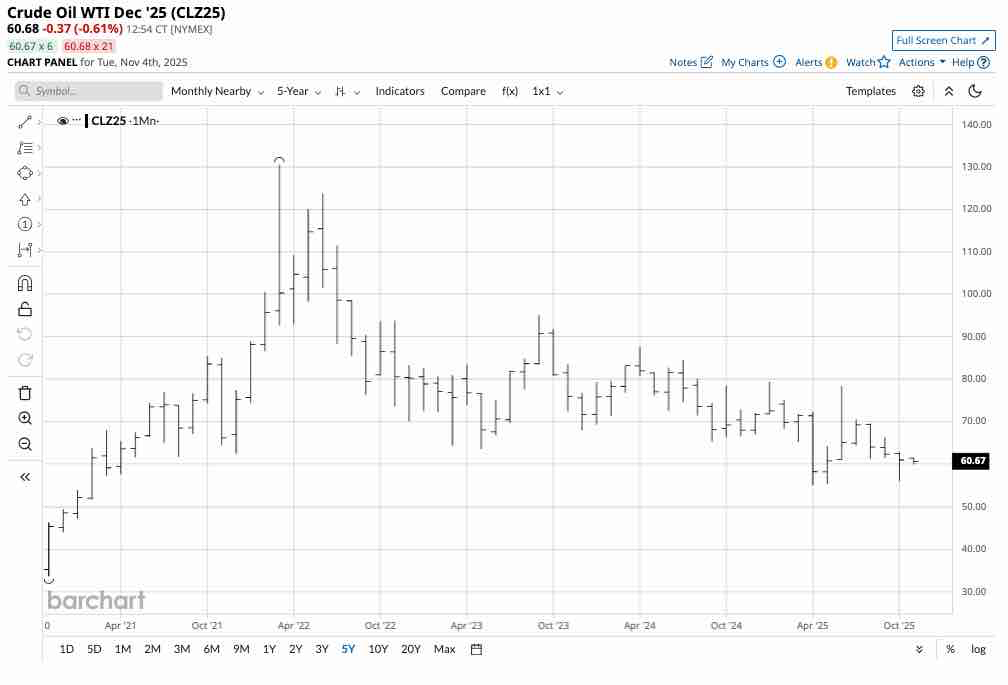

The bearish trend remains intact with critical support at the low from April 2025

While nearby NYMEX crude oil prices have created at least a temporary floor at just above $55 per barrel, the long-term trend remains lower.

The monthly five-year continuous contract chart highlights the energy commodity’s bearish path of least resistance since the high in March 2022.

Seasonality favors the downside

In my September 25, 2025, Barchart article on oil product prices, I pointed out that “Gasoline is a seasonal fuel. Prices tend to peak during spring and summer and decline during late fall and winter as poor weather conditions cause drivers to put fewer miles on their odometers.”

Since gasoline is the most ubiquitous oil product, prices tend to reach seasonal lows in the coming months.

U.S. energy policy and OPEC+ production remain bearish

U.S. energy policy did an about-face in early 2025 as President Trump’s administration supports a “drill-baby-drill” and “frack-baby-frack” approach to oil and gas production and consumption. The former administration had supported alternative and renewable fuels, while inhibiting fossil fuel production and consumption to combat climate change. As of the week ending October 24, 2025, U.S. oil production was 13.644 million barrels per day, which was higher than at the end of 2024. The current administration believes increasing traditional energy production will keep prices stable, lower inflation, and make the United States energy independent. Moreover, it will take pricing power away from OPEC+, the international oil cartel and Russia, and eventually increase U.S. petroleum export revenue.

Over the past months, OPEC+ has gradually increased its output to maintain market share. Therefore, U.S. energy policy and the cartel’s increased production have kept prices stable near the bottom end of the trading range, maintaining an overall bearish trend.

Geopolitics can cause periodic rallies that could be selling opportunities

Since the Middle East and Russia are two of the world’s leading oil-producing regions, geopolitical turbulence in the regions can cause sudden price spikes when hostilities create supply concerns. In June 2025, the U.S. attack on Iranian nuclear capacity caused NYMEX nearby crude oil prices to spike to $78.40 per barrel, but the rally was short-lived. The latest rally that took prices from $56.35 to nearly $63 per barrel occurred because of increasing U.S. sanctions on Russia as the war in Ukraine continues. The bottom line is that geopolitical events can cause crude oil prices to move higher, but none of these events over the past few years have caused the energy commodity to break out of the bearish trend since the highs of 2022.

How low can crude oil go?

It is virtually impossible to pick tops in bull markets or bottoms in bear markets, as prices can move to levels that defy fundamental and technical analysis.

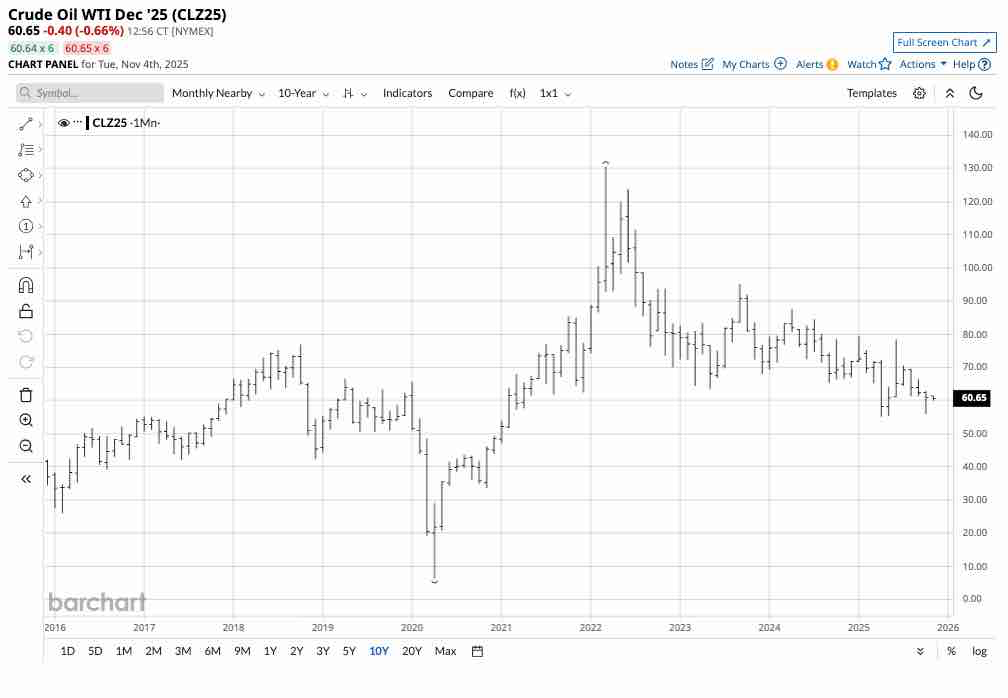

The monthly ten-year continuous contract chart shows that crude oil prices plunged to a low of $6.50 per barrel in April 2020 as the global pandemic gripped markets across all asset classes. Spot crude oil prices dropped below zero, entering negative territory, in April 2020, as there was nowhere to store the energy commodity due to evaporating demand.

I remain bearish on the prospects for crude oil prices over the coming months as the market transitions into winter, U.S. energy policy increases production, and OPEC+ continues to ramp up output. The most direct route for a short risk position is the NYMEX or ICE futures for WTI and Brent crude oil. Meanwhile, the Bloomberg Ultrashort Crude Oil -2X ETF (SCO) is a liquid product that appreciates when the nearby NYMEX crude oil futures decline. At around $18 per share, SCO had over $90 million in assets under management. SCO trades an average of over 1.459 million shares daily and charges a 0.95% management fee. As it is a leveraged ETF product, SCO is only appropriate for short-term bearish risk positions as it experiences time decay. Creating the leverage requires options and swaps that decline when crude oil prices rally or remain stable. Therefore, a long position in SCO for those expecting lower oil prices requires both time and price stops to protect capital.

NYMEX crude oil’s price remains above the $55 support level in early November 2025. However, a break below support could trigger a sudden surge of technical sellers, overwhelming buyers, and causing a spike to $50 or lower. Considering the price action in 2020, $40 is not an unreasonable downside target.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart