Thunder Bay, Ontario--(Newsfile Corp. - October 21, 2025) - Thunder Gold Corp. (TSXV: TGOL) (FSE: Z25) (OTCQB: TGOLF) ("Thunder Gold" or the "Company") is pleased to announce that Micon International Limited ("MICON") has been contracted to complete an NI 43-101 Mineral Resource Estimate ("MRE") at the Company's 100%-owned, 2,500-hectare, Tower Mountain Gold Property, located 50 kilometres west of Thunder Bay, Ontario.

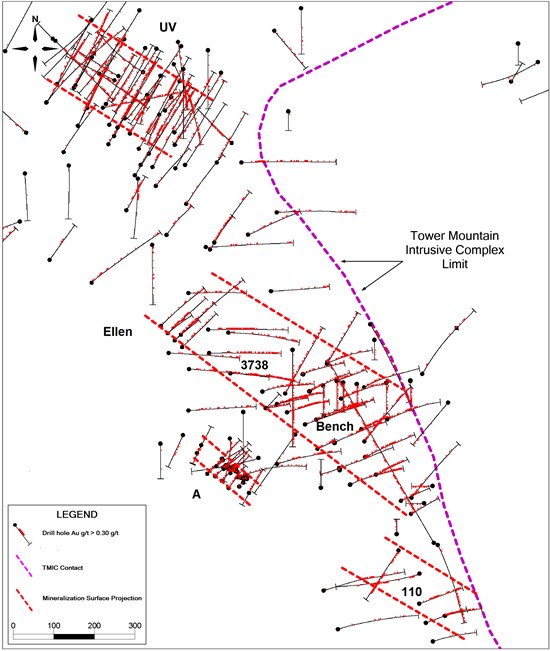

The MRE shall evaluate the UV, Bench, Ellen, A, 110 and 3738 targets, arrayed along the western contact of the Tower Mountain Intrusive Complex ("TMIC") over a total strike length of 1,800 metres representing 20% of the total strike length surrounding the TMIC. A total of 161 diamond drill holes (35,389 metres), have been completed in this area to test these targets (Reference Figure 1.0).

Key Highlights:

Estimated MRE completion January 2026.

MRE to evaluate the western contact, accounting for only 20% of the TMIC.

MRE to define a lower-capex gold resource that supports a pathway to open-pit production.

Phase Three Drill Program is on schedule with estimated completion October 31, 2025.

Phase Three results are estimated to be received by January 15, 2026.

Rising gold prices and the project's infrastructure advantages support rapid advancement toward development.

The Company's Phase 3 drill program (2,000 metres), currently 50% complete, is scheduled to conclude October 31, 2025. Approximately 70% of the Phase Three program targets gaps in the Company's conceptual exploration model for the western edge of the TMIC. Drill results are anticipated 4-6 weeks after the program terminates.

Wes Hanson, President and CEO states, "Initiating an NI 43-101 Mineral Resource Estimate is a pivotal milestone for Thunder Gold and the Tower Mountain project. Our team has always believed in the asset's scale, continuity and growth potential - and now we are taking the step to validate that conviction through an independent third-party assessment. The MRE will not only provide investors with the confidence we've held for years but will also advance our refined development strategy: to define a lower-capex gold resource that supports a pathway to open-pit production.

Results from our Phase Two drill program clearly demonstrated Tower Mountain's Tier One discovery potential and reinforced our decision to pursue an MRE. They also revealed meaningful opportunities to expand the mineralized footprint along the western TMIC contact through selective drilling, targeting gaps within our predictive model. We expect our Phase Three program to continue demonstrating strong continuity.

With exceptional infrastructure access, extremely low exploration costs and district-scale potential, Tower Mountain stands apart from most projects at this stage. These advantages not only allow us to work faster and more efficiently but also position us as an emerging gold developer capable of advancing meaningfully in the current market. We are eager to capitalize on the rising gold price, accelerate development, and deliver sustained long-term value for our shareholders."

FIGURE 1.0 DIAMOND DRILL PLAN - WESTERN CONTACT AREA - TOWER MOUNTAIN PROPERTY

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/271225_ba3e8a4524b288b2_001full.jpg

Historical drilling has largely focused along the western perimeter of the TMIC defining the UV, Ellen, 3738, Bench, A and 110 targets (Reference Figure 1.0). The targets extend, semi-continuously over 1,800 metres from the 110 target in the south to the UV target in the north.

UV target

Drilling has established gold mineralization along a northwesterly trending corridor measuring 400 metres along strike with an estimated width of 200 metres. Mineralization is interpreted to be sub-vertical and is currently drill-traced from surface to a maximum depth of 300 metres. Historical drilling has been completed to a nominal drill spacing of 25 metres. Mineralization is open to the northwest and at depth.

Ellen target

Drilling has established gold mineralization along a northwesterly trending corridor measuring 100 metres along strike with an estimated width of 200 metres. Mineralization is interpreted to be sub-vertical and is currently drill-traced from surface to a maximum depth of 200 metres. Historical drilling has been completed to a nominal drill spacing of 25 metres. Mineralization remains open at depth and the Ellen target trends into the 3738 target to the southeast.

Bench target

Drilling has established gold mineralization along a northwesterly trending corridor measuring 500 metres along strike with an estimated width of 300 metres. Mineralization is interpreted to be sub-vertical and is currently drill-traced to a maximum depth of 500 metres. Historical drilling has been completed to a nominal drill spacing of 50 metres. Mineralization remains open at depth and is interpreted to transition into the 3738 Target to the northwest. To the southeast, the Bench target is interpreted to be fault offset 200 metres to the southwest, expressed as the 110 target.

3738 target

Drilling has established gold mineralization along a northwesterly trending corridor between the Bench and Ellen Target, an approximate 250 metres along strike with an estimated width of 300 metres. Mineralization sub-crops near surface, is interpreted to be sub-vertical and is currently drill-traced to a maximum depth of 400 metres. Historical drilling has been completed to a nominal drill spacing of 100 metres. Mineralization remains open at depth and is interpreted to transition into the 3738 Target to the northwest. To the southeast, the Bench target is interpreted to be fault offset 200 metres to the southwest, expressed as the 110 Target.

A Target

Drilling has established high grade gold mineralization along a northwesterly trending corridor measuring 150 metres along strike with an estimated width of 100 metres. Mineralization outcrops at surface and is interpreted to be sub-vertical, currently drill-traced to a maximum depth of 125 metres. Historical drilling has been completed to a nominal drill spacing of 25 metres. Mineralization remains open in all directions.

110 Target

Drilling has established gold mineralization along a northwesterly trending corridor measuring 200 metres along strike with an estimated width of 150 metres. Mineralization outcrops at surface and is interpreted to be sub-vertical, currently drill-traced to a maximum depth of 300 metres. Historical drilling has been completed to a nominal drill spacing of 50 metres. Mineralization remains open in all directions.

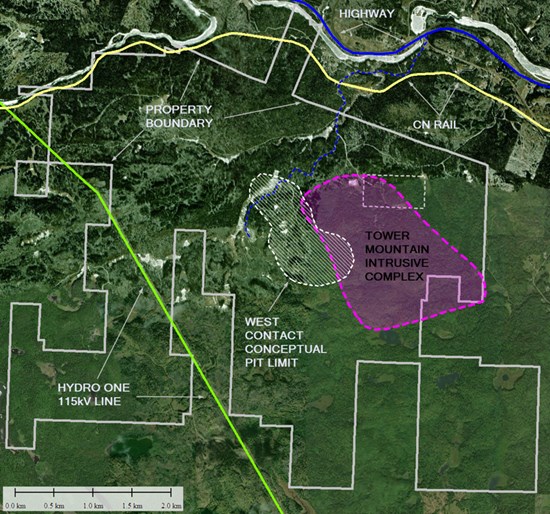

Infrastructure (Reference Figure 2.0)

The Tower Mountain Property is located 40 kilometres west of the port city of Thunder Bay, ON. The Trans-Canada highway provides year-round access to the property via a 4.0 kilometre secondary road. The main east-west CN rail line, with an existing siding, crosses the secondary road accessing the property. The existing main hydro transmission line is located 2.0 kilometres west of the conceptual pit limit. The Company's conceptual pit limit is currently 2.0 kilometres south of the Matawin River and Trans-Canada highway and 1.5 kilometres from the CN rail line.

FIGURE 2.0 TOWER MOUNTAIN PROPERTY - EXISTING INFRASTRUCTURE

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/271225_ba3e8a4524b288b2_002full.jpg

Quality Assurance and Quality Control

Diamond drilling utilizes NQ diameter tooling. The core is received at the on-site logging facility where it is, photographed, logged for geotechnical, physical properties and geological data. Samples are identified, recorded, and cut in half by wet diamond saw. Half the core is sent for assay at an accredited laboratory with the remaining half core stored on site. A standard sample length of 1.5 meters is typically employed, varying only at major lithological contacts. Certified standards and blanks are randomly inserted into the sample stream and constitute approximately 10% of the sample stream. Certified standards and blank performance is monitored with any failures evaluated and investigated to determine if said failure is a result of error during submission. Any unexplained failures are identified and the five samples preceding and following the failure are re-assayed. In addition, standards and blanks are inserted into the re-assayed interval stream to monitor analytical performance. Samples are shipped to the Activation Laboratories Ltd. facility in Thunder Bay, Ontario, where sample preparation and analyses are completed. All samples are analyzed for gold using a 30-gram lead collection fire assay fusion (FA) with an atomic absorption (AAS) finish. All assay results greater than 5.0 g/t Au are re-assayed using a gravimetric analysis. All assays greater than 30.0 g/t Au are re-assayed using screen metallics where a representative 1000-gram sample is split sieved at 149µm. Assays are performed on the entire +149 µm fraction and two splits of the -149 µm fraction. A final assay is calculated based on the weight of each size fraction.

Qualified Person

Technical information in this news release has been reviewed and approved by Wes Hanson, P.Geo., President and CEO of Thunder Gold Corp., who is a Qualified Person under the definitions established by National Instrument 43-101.

About the Tower Mountain Gold Property

The 100%-owned Tower Mountain Gold Property is located adjacent to the Trans-Canada highway, approximately 50-km west of the international port city of Thunder Bay, Ontario. The 2,500-hectare property surrounds the largest, exposed, intrusive complex in the eastern Shebandowan Greenstone Belt where most known gold occurrences have been described as occurring either within, or proximal to, intrusive rocks. Gold at Tower Mountain is localized within extremely altered rocks surrounding the Tower Mountain Intrusive Complex, a multi-phase, long duration intrusive complex that control gold distribution on the Property. Historical drilling has established anomalous gold extending out from the intrusive contact for over 500 metres along a 1,800-metre strike length, to depths of over 500 metres from surface. The remaining 75% of the perimeter surrounding the intrusion shows identical geology, alteration, and geophysical response, offering a compelling exploration opportunity.

About Thunder Gold Corp.

Thunder Gold is advancing the Tower Mountain Project in Thunder Bay, Ontario - an emerging gold system with the scale, consistency and quality to support a long-life, open-pit operation. Results from our disciplined drill programs have consistently reinforced confidence in the continuity and predictability of the discovery, while highlighting significant potential for expansion across multiple zones of the Tower Mountain Intrusive Complex.

To crystallize this value, Thunder Gold is now advancing toward its first NI 43-101 Mineral Resource Estimate, with the strategic objective of defining a lower-capex, near-surface gold resource that can support a realistic development pathway. This milestone is expected to provide third-party validation of the asset's scale and longevity, while positioning Tower Mountain more competitively among its peers.

With industry-leading drilling costs, existing infrastructure and access to a skilled local workforce, Tower Mountain represents a rare combination of size, scalability and cost-effective growth.

At Thunder Gold, our vision is clear: to unlock a discovery with the potential to become a transformational Canadian gold project - delivering long-term value for shareholders while contributing to the future of Canada's mining industry.

For more information, please visit: www.thundergoldcorp.com.

On behalf of the Board of Directors,

Wes Hanson, P.Geo., President and CEO

For further information contact:

Wes Hanson, CEO

(647) 202-7686

whanson@thundergoldcorp.com

Kaitlin Taylor, Investor Relations

IR@thundergoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (collectively, "forward-looking statements"). Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. All statements, other than statements of historical fact, are forward-looking statements and are based on predictions, expectations, beliefs, plans, projections, objectives and assumptions made as of the date of this news release, including without limitation; anticipated results of geophysical drilling programs, geological interpretations and potential mineral recovery. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty or reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise any forward-looking statements, other than as required by applicable law, to reflect new information, events or circumstances, or changes in management's estimates, projections or opinions. Actual events or results could differ materially from those anticipated in the forward-looking statements or from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271225