TaxFree RV, a vehicle registration specialist operating since 2005, announces that recreational vehicle owners can reduce annual registration costs to a fraction of other states' fees through Montana Limited Liability Company formation. The company reports that Montana's annual registration fees for RVs typically range from $200 to $800, compared to thousands of dollars charged annually in states with personal property taxes on vehicles.

The announcement comes as RV owners nationwide face rising registration and property tax costs in their home states. Montana charges no sales tax on vehicle purchases and no annual personal property tax on vehicles, resulting in substantially lower ongoing costs for RV owners. States such as California, Texas, and Arizona impose annual property taxes that can exceed $5,000 for high-value motorhomes, while Montana's flat fee structure remains consistent regardless of vehicle value.

"Montana's annual registration fees represent significant savings compared to states that calculate fees based on vehicle value or impose personal property taxes," said Henry Jordan, a spokesperson for TaxFree RV. "A $500,000 motorhome registered in Montana might cost $400 annually, while the same vehicle in other states could incur thousands in annual fees and taxes."

The registration process through Montana LLC formation has gained adoption among RV owners seeking to reduce both initial purchase taxes and ongoing registration expenses. Recent data indicates that RV owners switching from high-tax states to Montana registration save an average of $2,000 to $8,000 annually on registration and property tax fees alone. These savings compound over the typical 10 to 20-year ownership period of recreational vehicles.

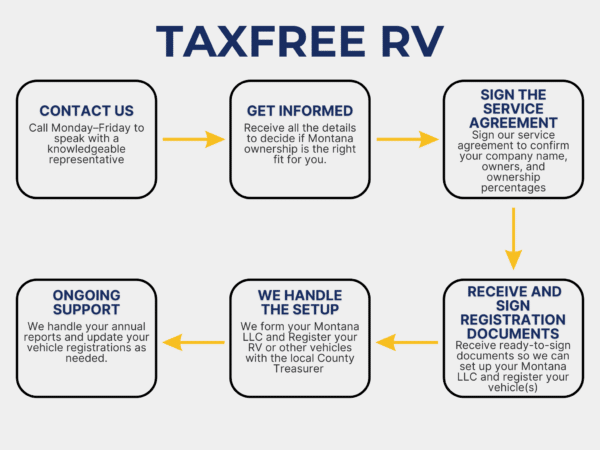

RV Registration with TaxFree RV involves establishing a Montana LLC that becomes the legal owner of the vehicle. This structure eliminates sales tax on the initial purchase and reduces annual registration to Montana's low flat-fee system. The company handles all documentation remotely, including LLC formation, vehicle title transfer, and registration with the appropriate Montana county. The process typically completes within 30 days without requiring travel to Montana.

Montana's fee structure applies uniformly to various RV types, from travel trailers to luxury motorhomes. The state calculates registration fees based on vehicle age and weight rather than market value, resulting in predictable annual costs. This contrasts with value-based systems in other states, where fees fluctuate with market conditions and depreciation schedules.

Recent interstate commerce developments have clarified the legal framework for out-of-state vehicle registration through business entities. Federal court decisions have upheld the right of businesses to register vehicles in states where they are incorporated, providing legal precedent for the Montana LLC registration method.

"The cost differential between Montana and other states has become more pronounced as vehicle values have increased," Jordan added. "We're seeing particular interest from owners in states with high property tax rates who face annual bills exceeding their monthly RV payments."

https://www.youtube.com/watch?v=2Q_N7-uNG_I

TaxFree RV provides registration services for motorhomes, fifth wheels, travel trailers, and specialty vehicles. The company maintains registered agent services for client LLCs and manages annual reporting requirements. Since 2005, the company has facilitated Montana registrations for thousands of vehicle owners, focusing on compliance with Montana regulations and interstate commerce laws.

###

For more information about TaxFree RV, contact the company here:

TaxFree RV

Henry Jordan

888‑441‑5741

sales@taxfreerv.com

9 S. Broadway Ave., Suite F

Red Lodge, MT 59068