As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at real estate services stocks, starting with Offerpad (NYSE: OPAD).

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 14 real estate services stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 7.8% below.

Thankfully, share prices of the companies have been resilient as they are up 5.8% on average since the latest earnings results.

Offerpad (NYSE: OPAD)

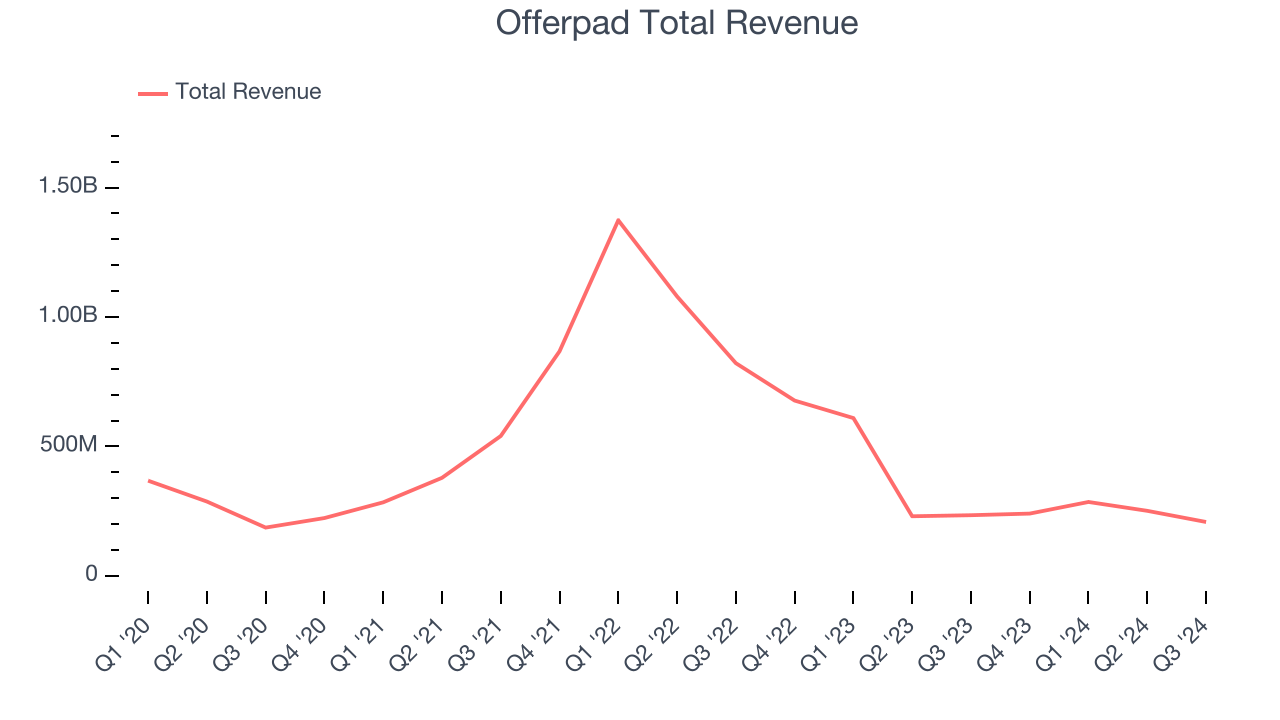

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE: OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad reported revenues of $208.1 million, down 11.2% year on year. This print exceeded analysts’ expectations by 1.7%. Despite the top-line beat, it was still a disappointing quarter for the company with revenue guidance for next quarter missing analysts’ expectations.

“During the third quarter, we delivered revenue at the high end of our guidance. We’ve expanded our asset-light services, strengthened partnerships, and optimized our organization,” said Brian Bair, Offerpad’s CEO.

Offerpad delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 19.9% since reporting and currently trades at $3.92.

Read our full report on Offerpad here, it’s free.

Best Q3: The Real Brokerage (NASDAQ: REAX)

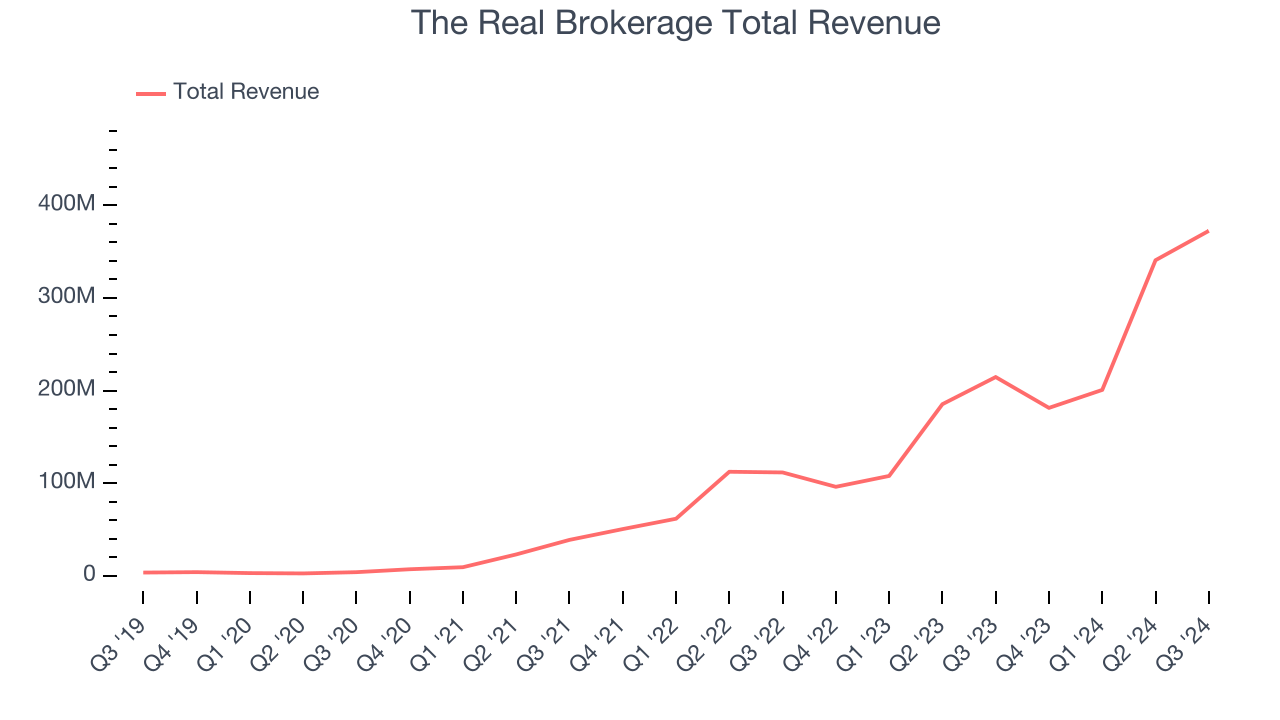

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ: REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $372.5 million, up 73.5% year on year, outperforming analysts’ expectations by 7.4%. The business had an incredible quarter with an impressive beat of analysts’ earnings and EBITDA estimates.

The Real Brokerage achieved the fastest revenue growth among its peers. The market seems content with the results as the stock is up 3% since reporting. It currently trades at $5.81.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Anywhere Real Estate (NYSE: HOUS)

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE: HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Anywhere Real Estate reported revenues of $1.54 billion, down 3.1% year on year, falling short of analysts’ expectations by 5.7%. It was a disappointing quarter as it posted a miss of analysts’ operating margin estimates.

Anywhere Real Estate delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $3.97.

Read our full analysis of Anywhere Real Estate’s results here.

eXp World (NASDAQ: EXPI)

Founded in 2009, eXp World (NASDAQ: EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

eXp World reported revenues of $1.23 billion, up 1.5% year on year. This result came in 3.4% below analysts' expectations. Overall, it was a softer quarter as it also logged a miss of analysts’ earnings estimates.

The stock is down 1.2% since reporting and currently trades at $14.22.

Read our full, actionable report on eXp World here, it’s free.

Compass (NYSE: COMP)

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE: COMP) is a digital-first company operating a residential real estate brokerage in the United States.

Compass reported revenues of $1.49 billion, up 11.7% year on year. This result was in line with analysts’ expectations. Overall, it was a very strong quarter as it also recorded optimistic EBITDA guidance for the next quarter and an impressive beat of analysts’ earnings estimates.

The stock is up 20.4% since reporting and currently trades at $6.70.

Read our full, actionable report on Compass here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.