Apple device management company, Jamf (NASDAQ: JAMF) announced better-than-expected revenue in Q3 CY2024, with sales up 11.7% year on year to $159.3 million. The company expects next quarter’s revenue to be around $162.4 million, close to analysts’ estimates. Its non-GAAP profit of $0.16 per share was in line with analysts’ consensus estimates.

Is now the time to buy Jamf? Find out by accessing our full research report, it’s free.

Jamf (JAMF) Q3 CY2024 Highlights:

- Revenue: $159.3 million vs analyst estimates of $157.5 million (1.1% beat)

- Adjusted EPS: $0.16 vs analyst expectations of $0.16 (in line)

- EBITDA: $29.51 million vs analyst estimates of $26.3 million (12.2% beat)

- Revenue Guidance for Q4 CY2024 is $162.4 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 77.4%, down from 79.9% in the same quarter last year

- Operating Margin: -10%, up from -22.3% in the same quarter last year

- EBITDA Margin: 18.5%, up from 10% in the same quarter last year

- Free Cash Flow Margin: 12%, up from 8.7% in the previous quarter

- Billings: $167 million at quarter end, up 6.1% year on year

- Market Capitalization: $2.26 billion

Company Overview

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ: JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

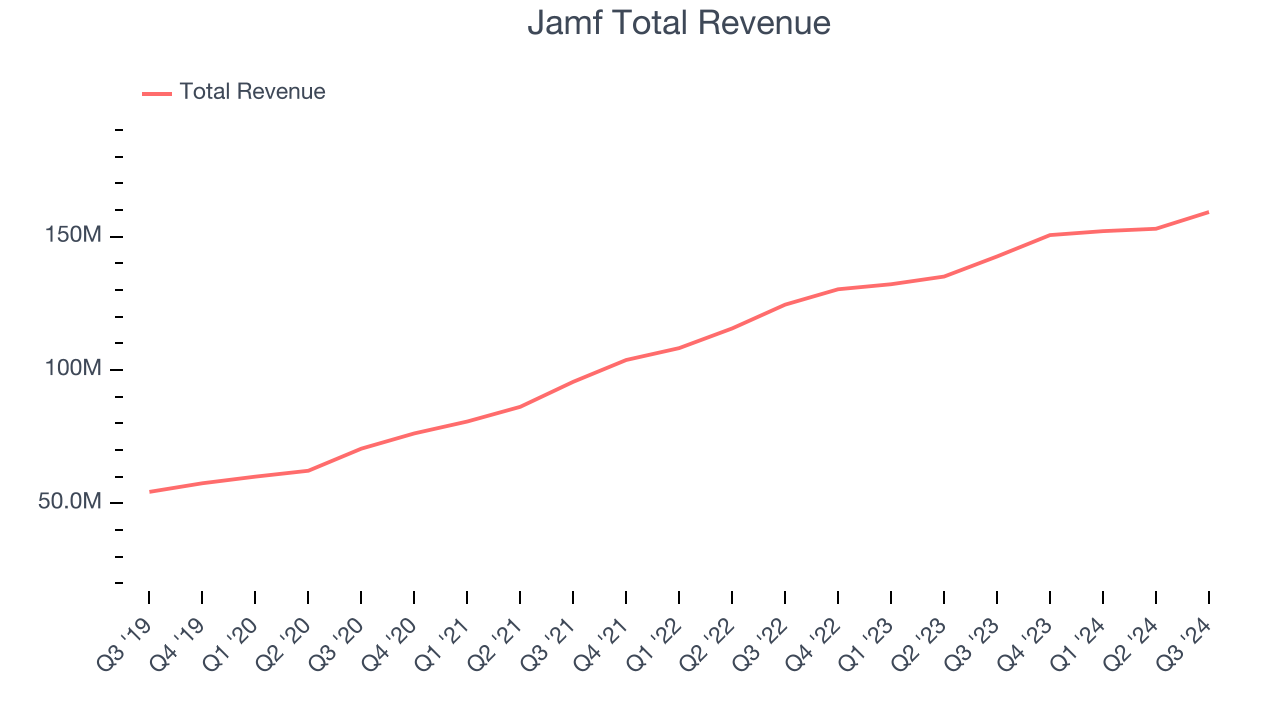

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, Jamf’s sales grew at a decent 22% compounded annual growth rate over the last three years. This is a useful starting point for our analysis.

This quarter, Jamf reported year-on-year revenue growth of 11.7%, and its $159.3 million of revenue exceeded Wall Street’s estimates by 1.1%. Management is currently guiding for a 7.8% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and indicates the market is factoring in some success for its newer products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

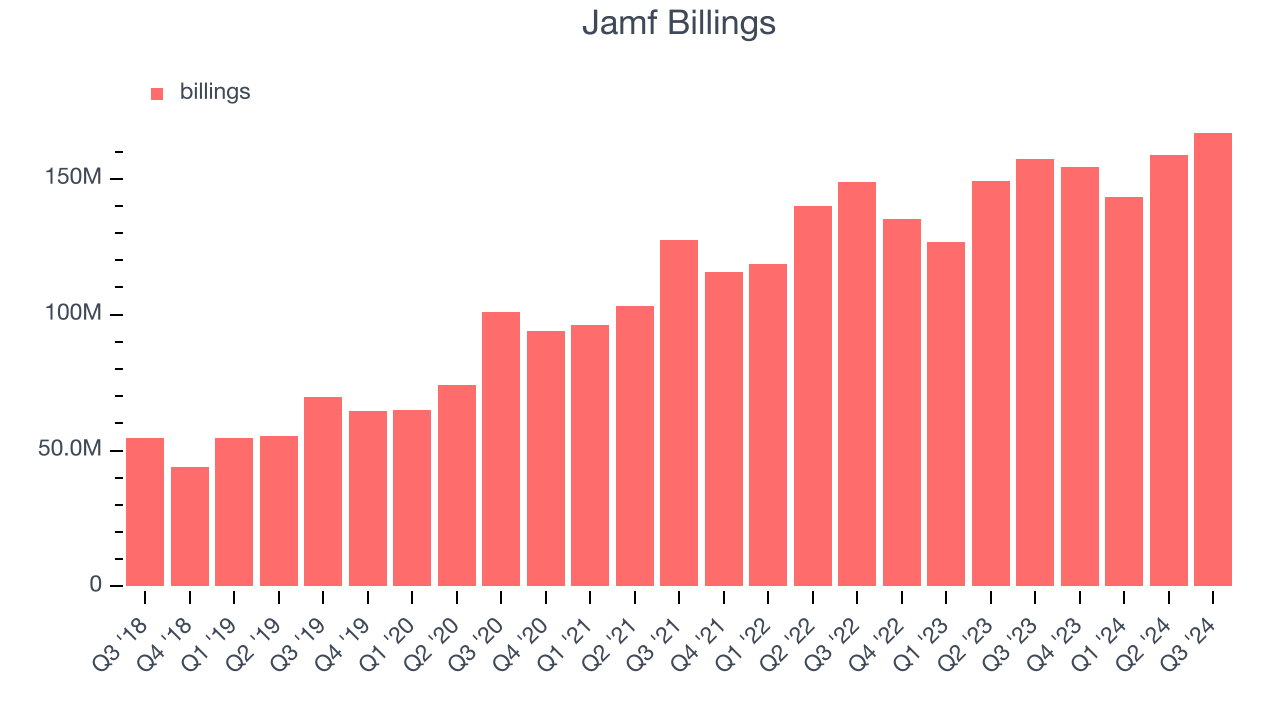

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Jamf’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Jamf’s billings growth has slightly underperformed the sector, averaging 9.8% year-on-year increases and coming in at $167 million in the latest quarter. This alternate topline metric has been growing slower than revenue, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Jamf to acquire new customers as its CAC payback period checked in at 118.5 months this quarter. The company’s performance indicates that it operates in a competitive market and must continue investing to maintain its growth trajectory.

Key Takeaways from Jamf’s Q3 Results

We were impressed by how significantly Jamf blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its billings missed analysts’ expectations and its gross margin decreased. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The market seemed to focus on the negatives, and the stock traded down 2.9% to $16.88 immediately after reporting.

Is Jamf an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.