The electric revolution is taking on a new form, and Tesla (TSLA) is no longer looking simply to drive the world forward. The company wants to shape a reality where “sustainable abundance” is within reach. This bold pivot is led by Elon Musk, who now positions Tesla at the forefront of robotics, artificial intelligence, and autonomous driving.

According to Morgan Stanley Research, the global humanoid robotics market could reach about five trillion dollars by 2050, with widespread adoption expected to heat up through the next decades. TSLA stock has also responded, notching a 1.7% gain over the last month as investors weigh the true scope of this transformation.

The stakes could not be higher, with Tesla’s future woven into robotaxis, intelligent machines, and the promise of a “sustainable abundance.” This leads to a pressing question. Does TSLA’s future hold more risk or reward for those willing to buy and hold? Let’s find out if Tesla can put their money where their mouth is.

Strong Financials Power Tesla’s Pivot

Tesla, the Texas-based technology and transportation company, designs, manufactures, and sells electric vehicles, energy storage systems, solar panels, robotics platforms, and integrated artificial intelligence products.

Price action remains commanding as shares now trade at $453, up 12% year-to-date (YTD) and 76% in the last twelve months.

The value placed on Tesla easily eclipses industry standards with a market capitalization of $1.5 trillion, a forward price/earnings ratio of 369.73x, and a price/sales ratio of 14.77x, while the sector’s median P/E stands at 17.73x and the median price/sales at 0.97x. This means investors are paying a premium for Tesla’s innovative edge, justified by its aggressive pivot towards new growth domains.

Tesla’s latest earnings report, released Oct. 22, revealed a 12% revenue rise in the third quarter. The total reached $28.10 billion, beating analyst estimates by $1.7 billion. This improvement came after two straight quarters of decline, signaling a speedy recovery. Automotive revenue moved up 6% to $21.2 billion, driven by solid demand for Model Y and notable delivery growth across Greater China, APAC, North America, and EMEA.

Expiration of federal tax credits added momentum as buyers rushed to secure incentives before they vanished, boosting deliveries beyond 497,000 vehicles and production past 447,000 units, both new records. Revenue from regulatory credits dropped to $417 million, a decrease of 44%, but stronger core sales made up for the decline.

Tesla’s adjusted earnings per share stood at fifty cents, falling short of analysts’ expected fifty-four cents. Net income slid 37% year-over-year to $1.37 billion. The dip resulted from lower EV prices and a 50% jump in operating expenses.

Meanwhile, their third quarter saw a record free cash flow of nearly $4 billion and over $41 billion in total cash and investments on hand. This strong operational base is critical for Tesla as it shifts from pure automotive to a sustainable abundance powerhouse.

Tesla’s Next-Gen Growth Catalysts

Innovation is the lifeblood of Tesla’s push for sustainable abundance, and the latest chip deal with Samsung Electronics (SMSN.L.EB) is proof of how serious Musk’s ambitions have become. Tesla secured a $16.5 billion agreement for Samsung to build next-generation self-driving chips in Texas and has committed to an oversupply of AI hardware for upcoming robotaxi fleets, data centers, and energy products.

Tesla’s robotaxi program has moved from concept to reality. Pilots are now running in Austin, and commercial launches in several major U.S. cities are on the horizon. Over six billion FSD miles have already been logged, confirming the scalability of Tesla’s new FSD V14 software, and the company claims more than a quarter-million unsupervised robotaxi miles in Austin alone. Musk expects true unsupervised autonomy by year-end in key markets, and the paid FSD customer base is already about 12% of Tesla’s entire fleet.

Meanwhile, Optimus stands to be more than a side project. The humanoid robot initiative is rapidly advancing, with the V3 prototype due by early 2026 and mass production targeting one million units annually. Tesla sees the initiative as a defining moment for operational automation and new lines of business that reach far beyond vehicles. The company’s vertical integration, from chips to robotics and energy, is expected to cement leadership in intelligent mobility and AI-powered infrastructure over the next decade.

Analysts’ Expectations for Tesla’s Path

Looking into Tesla’s earnings estimates, the numbers suggest a dramatic year for both growth and contraction. For the quarter ending December 2025, analysts are expecting Tesla to post earnings of $0.33 per share, with March 2026 projected at $0.35. Fiscal 2025 consensus lands at $1.14, which is noticeably softer than last year's $2.04.

Earnings this quarter could fall by 50% from last year’s mark, yet the following period is set for a robust recovery with growth of 133.33%. Looking at the full year, Tesla could see earnings slip 44.12%, but then rebound forcefully by 68.42% in the next cycle.

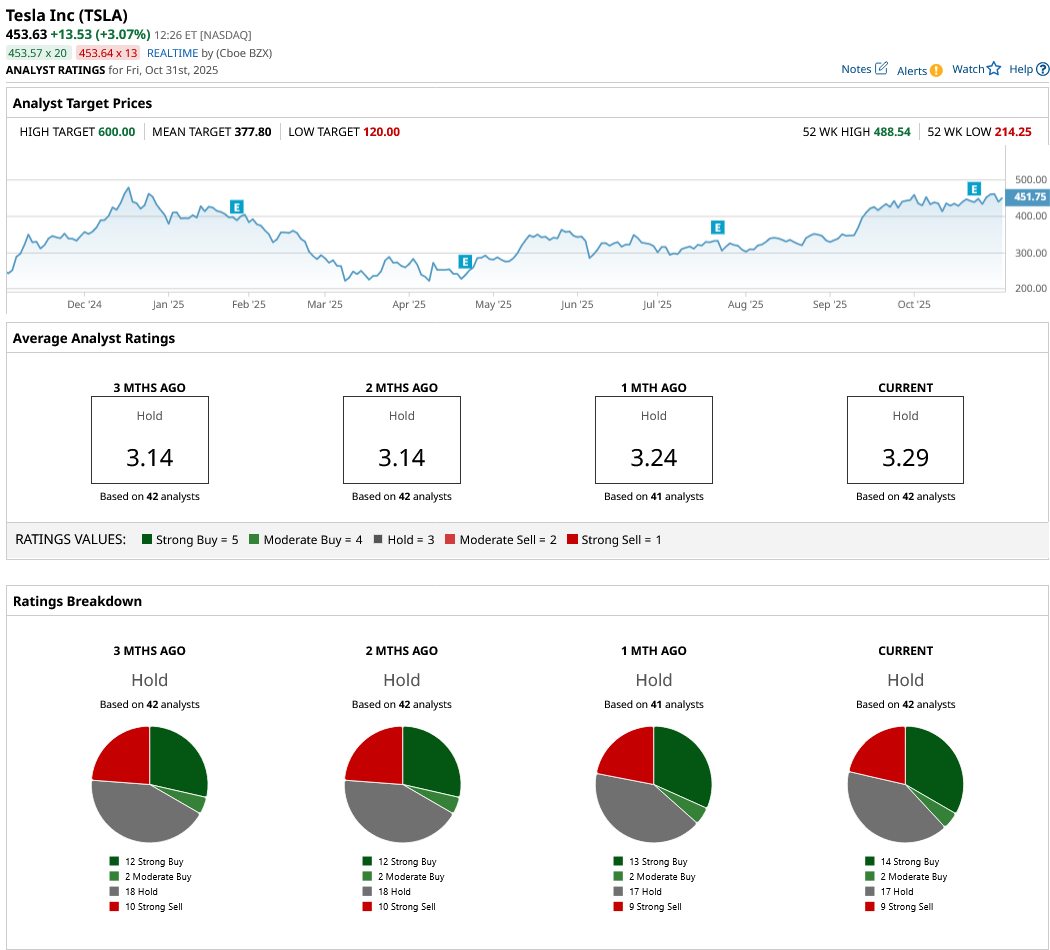

When it comes to ratings, Wall Street remains unsure about what Tesla’s transformation means for investors. The 42 analysts surveyed keep the stock rated a consensus “Hold.” The average price target stands at $377.80, which is actually about 17% downside from its current trading level of about $453.

Analysts like Stifel’s Stephen Gengaro have leaned bullish, increasing his target to $483. Confidence is growing in the company’s ability to further the FSD rollout and capitalize on the emerging robotaxi market. Gengaro splits out $213 per share for FSD, $140 for robotaxis, and $29 for Optimus, reflecting the broad array of bets embedded in TSLA’s future. But he also cautions that delivering truly unsupervised Full Self-Driving nationwide remains ambitious, if not a stretch in the short term.

Conclusion

Tesla has shifted gears, but the question for buy-and-hold investors is still simple. If Tesla delivers on its AI and autonomy bets, shares could keep climbing, especially as new products find their stride. But execution risk is real, and a stumble could spark sharp swings. Odds favor gradual upside from here, as long as innovation stays ahead of the competition.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 'Aggressive' Spending Spooks Meta Platforms Investors. Should You Buy the Dip in META Stock?

- A $135 Billion Reason to Buy Microsoft Stock Now

- 3 Options Strategies. 3 Unusually Active Options. 3 Long-Term Stocks to Buy.

- Amazon Stock Popped on Earnings. Options Data Tells Us AMZN Could Be Headed Here Next.