With a market cap of $30.2 billion, United Airlines Holdings, Inc. (UAL) provides air transportation services for passengers and cargo across the United States, Canada, the Atlantic, the Pacific, and Latin America. The company also offers ground handling, flight training, maintenance services, and operates a frequent flyer program.

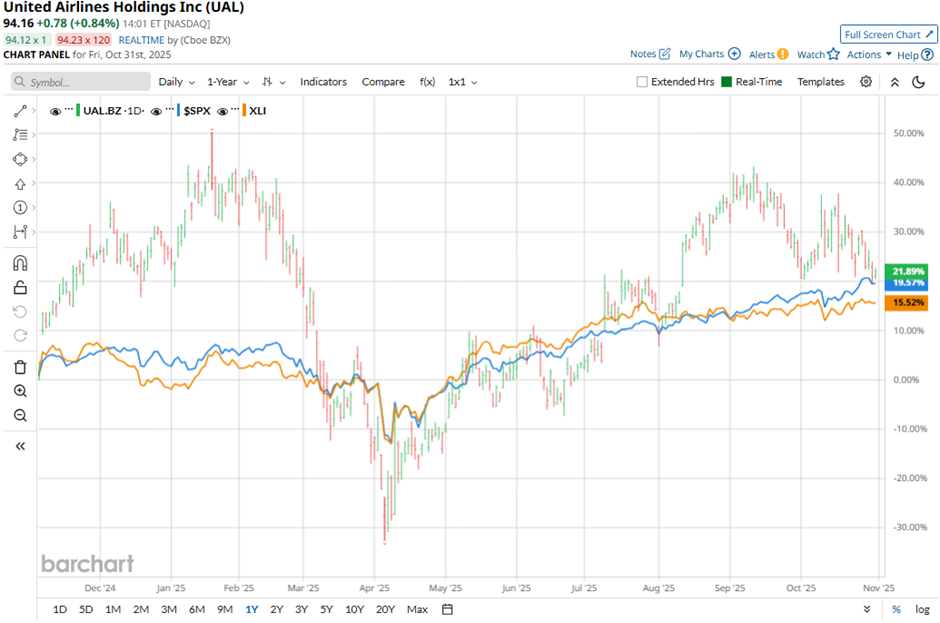

Shares of the Chicago, Illinois-based company have underperformed the broader market over the past 52 weeks. UAL stock has returned 16.6% over this time frame, while the broader S&P 500 Index ($SPX) has increased 17.3%. In addition, shares of the company are down 3.4% on a YTD basis, compared to SPX’s 15.9% gain.

However, shares of the company have outpaced the Industrial Select Sector SPDR Fund’s (XLI) 14.1% rise over the past 52 weeks.

Shares of UAL fell 5.6% on Oct. 16 because Q3 2025 revenues of $15.2 billion missed the estimate. Investors were also concerned that adjusted EPS of $2.78, while above estimates, declined 16.5% year-over-year, and key metrics like consolidated load factor and revenue per available seat mile weakened. Additionally, cash and cash equivalents dropped sharply to $6.73 billion.

For the fiscal year ending in December 2025, analysts expect United Airlines’ adjusted EPS to rise over 1% year-over-year to $10.72. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

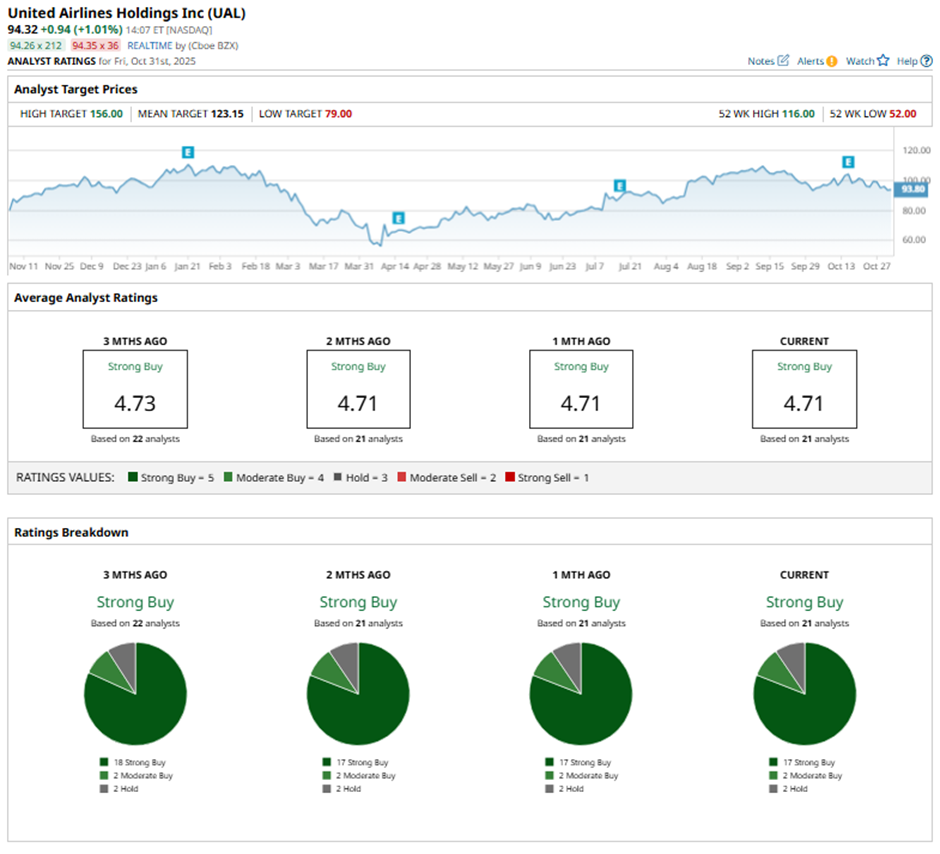

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buys,” and two “Holds.”

On Oct. 16, J.P. Morgan analyst Jamie Baker reaffirmed a “Buy” rating on United Airlines Holdings and set a price target of $156.

The mean price target of $123.15 represents a 30.6% premium to UAL’s current price levels. The Street-high price target of $156 suggests a 65.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?

- Netflix Just Announced a 10-for-1 Stock Split. Should You Buy NFLX Stock Here?

- Qualcomm Is Becoming an AI Company. That Means Earnings on November 5 Could Supercharge QCOM Stock.