Mohawk Industries, Inc. (MHK), headquartered in Calhoun, Georgia, designs, manufactures, sources, distributes, and markets flooring products for residential and commercial applications and new construction markets. Valued at $6.8 billion by market cap, the company offers a broad range of products, including ceramic and porcelain tiles, natural stone, carpets, rugs, laminate, luxury vinyl tile, sheet vinyl, wood flooring, and countertops.

Shares of this flooring giant have underperformed the broader market over the past year. MHK has declined 20.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11%. In 2025, MHK stock is down 7.7%, compared to SPX’s 12.3% rise on a YTD basis.

Narrowing the focus, MHK’s underperformance is also apparent compared to the iShares U.S. Home Construction ETF (ITB). The exchange-traded fund has declined about 16.9% over the past year. Moreover, the ETF’s 4.8% losses on a YTD basis outshine the stock’s dip over the same time frame.

MHK's softer quarter was driven by weaker economic conditions and higher input costs, offsetting benefits from premium product sales and productivity initiatives. Management cited ongoing challenges in home furnishings, low consumer confidence, inflation, and hurricane impacts.

On Oct. 23, MHK reported its Q3 results, and its shares closed down by 7% in the following trading session. Its adjusted EPS of $2.67 fell short of Wall Street expectations of $2.68. The company’s revenue was $2.8 billion, topping Wall Street's $2.7 billion forecast. For Q4, MHK expects its adjusted EPS to be between $1.90 and $2.

For the current fiscal year, ending in December, analysts expect MHK’s EPS to decline 7.8% to $8.94 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

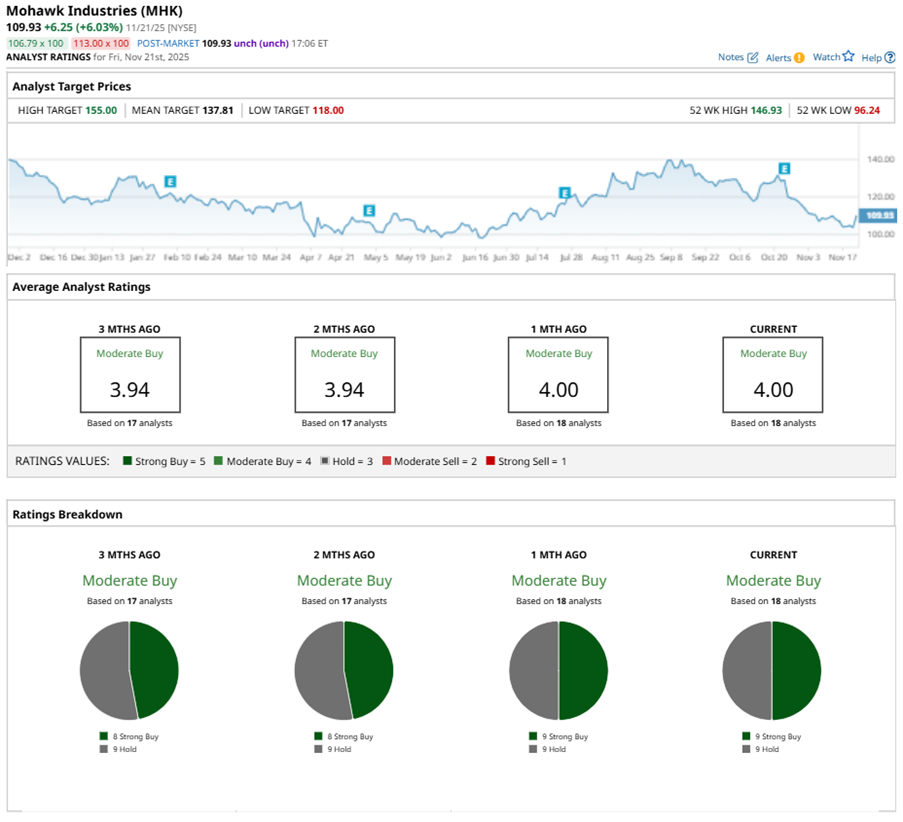

Among the 18 analysts covering MHK stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, and nine “Holds.”

This configuration is more bullish than two months ago, with eight analysts suggesting a “Strong Buy.”

On Nov. 19, Stephen Kim from Evercore ISI maintained a “Hold” rating on MHK with a price target of $118, implying a potential upside of 7.3% from current levels.

The mean price target of $137.81 represents a 25.4% premium to MHK’s current price levels. The Street-high price target of $155 suggests a notable upside potential of 41%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- GDP, Retail Sales and Other Can't Miss Items this Week

- Chevron's Latest 5-Yr Plan Implies a Major Dividend Hike - CXX Stock Looks Cheap

- Wall Street Is Betting on a Nuclear Renaissance. Here Are the 3 Top-Rated Nuclear Energy Stocks to Buy Now.

- The Saturday Spread: Using Data Science to Pick Out the Most Compelling Discounts (NVO, SOFI, FAST)