With a market cap of $30.2 billion, Willis Towers Watson Public Limited Company (WTW) is a leading global advisory, broking, and solutions company. The firm operates through two segments: Health, Wealth & Career, and Risk & Broking, providing integrated services that help clients manage risk, optimize benefits, and enhance organizational performance worldwide.

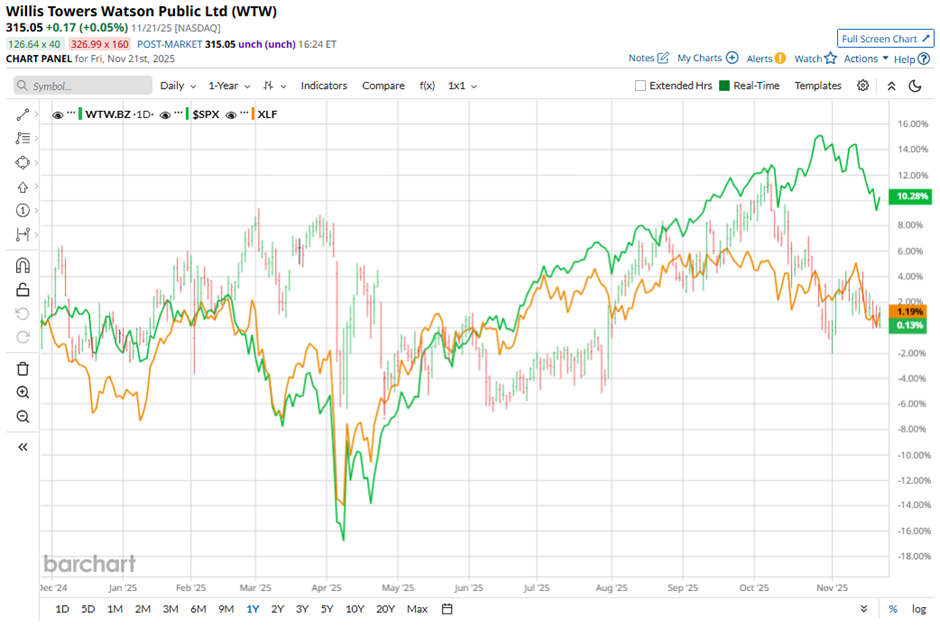

Shares of the London, the United Kingdom-based company have underperformed the broader market over the past 52 weeks. WTW stock has risen marginally over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11%. On a YTD basis, shares of the company are up slightly, compared to SPX’s 12.3% gain.

Looking closer, shares of the insurer have lagged behind the Financial Select Sector SPDR Fund’s (XLF) nearly 3% return over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $3.07 and revenue of $2.29 billion, shares of WTW fell marginally on Oct. 30 as the top-line was essentially flat year-over-year, largely due to the sale of the TRANZACT business. Investors also reacted to guidance, noting that the TRANZACT business, which contributed $1.14 to adjusted EPS in 2024, is no longer part of the portfolio, and the reinsurance joint venture with Bain Capital is expected to create a net headwind of about $0.10 per share. Additionally, the company flagged expected cash outflows from the Transformation program and macroeconomic uncertainty.

For the fiscal year ending in December 2025, analysts expect Willis Towers Watson’s adjusted EPS to decline marginally year-over-year to $16.87. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

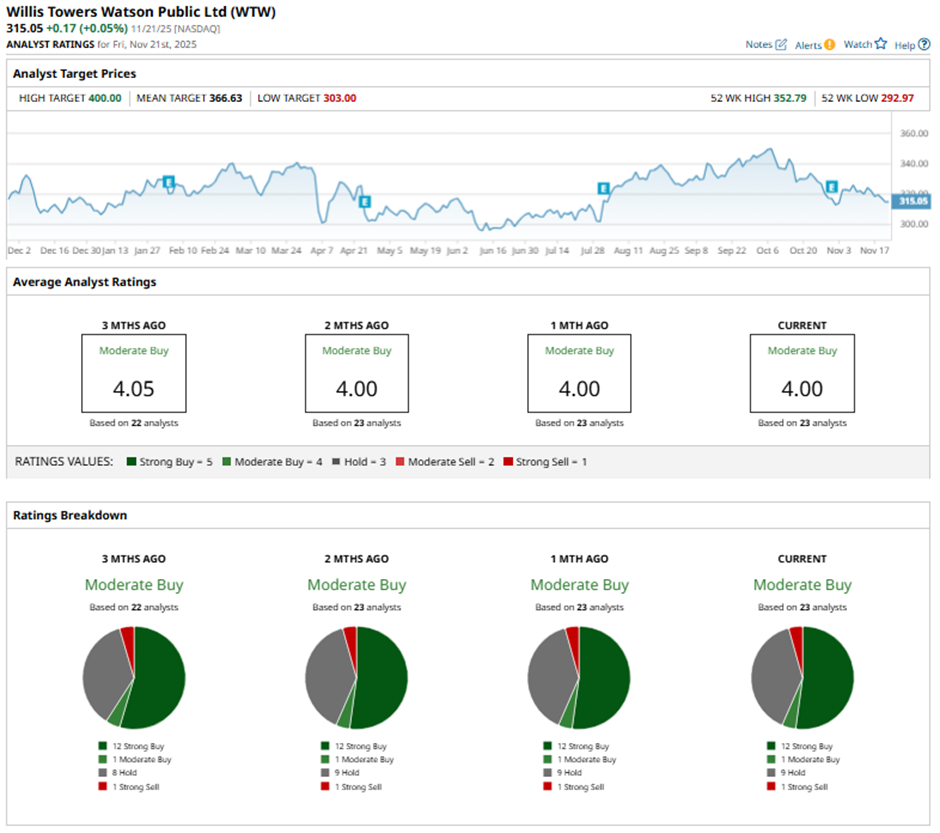

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Strong Sell.”

On Nov. 20, Barclays analyst Alex Scott cut the price target on WTW to $303 and reiterated an “Underweight” rating.

The mean price target of $366.63 represents a 16.4% premium to WTW’s current price levels. The Street-high price target of $400 suggests a nearly 27% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart