Genomic testing equipment manufacturer Bionano Genomics, Inc. (BNGO) is gaining traction with its third-generation optical mapping solution, Saphyr, which offers advanced capabilities crucial for genome research. As of the first quarter of 2023, the total installed base of Saphyr systems reached 259, representing a 47% increase over the same period last year.

Despite the growth in its top line, BNGO has yet to see an improvement in its bottom line. The company reported a net loss of $37.12 million for the first quarter of 2023, and Street analysts do not anticipate the firm becoming profitable in the near future.

Additionally, on May 30, 2023, BNGO received a notice from The Nasdaq Stock Market LLC stating that the company’s common stock had closed below the minimum required bid price of $1.00 per share for 30 consecutive trading days preceding the date of the notice. BNGO now has 180 calendar days from the date of the notice to regain compliance with the Minimum Bid Price Requirement.

Given these uncertainties, BNGO may be considered a high-risk investment. Let’s explore the metrics that shed light on the company’s challenges.

Analyzing BNGO’s Financial Performance: Net Income Deterioration Amidst Revenue Growth and Weak Margins

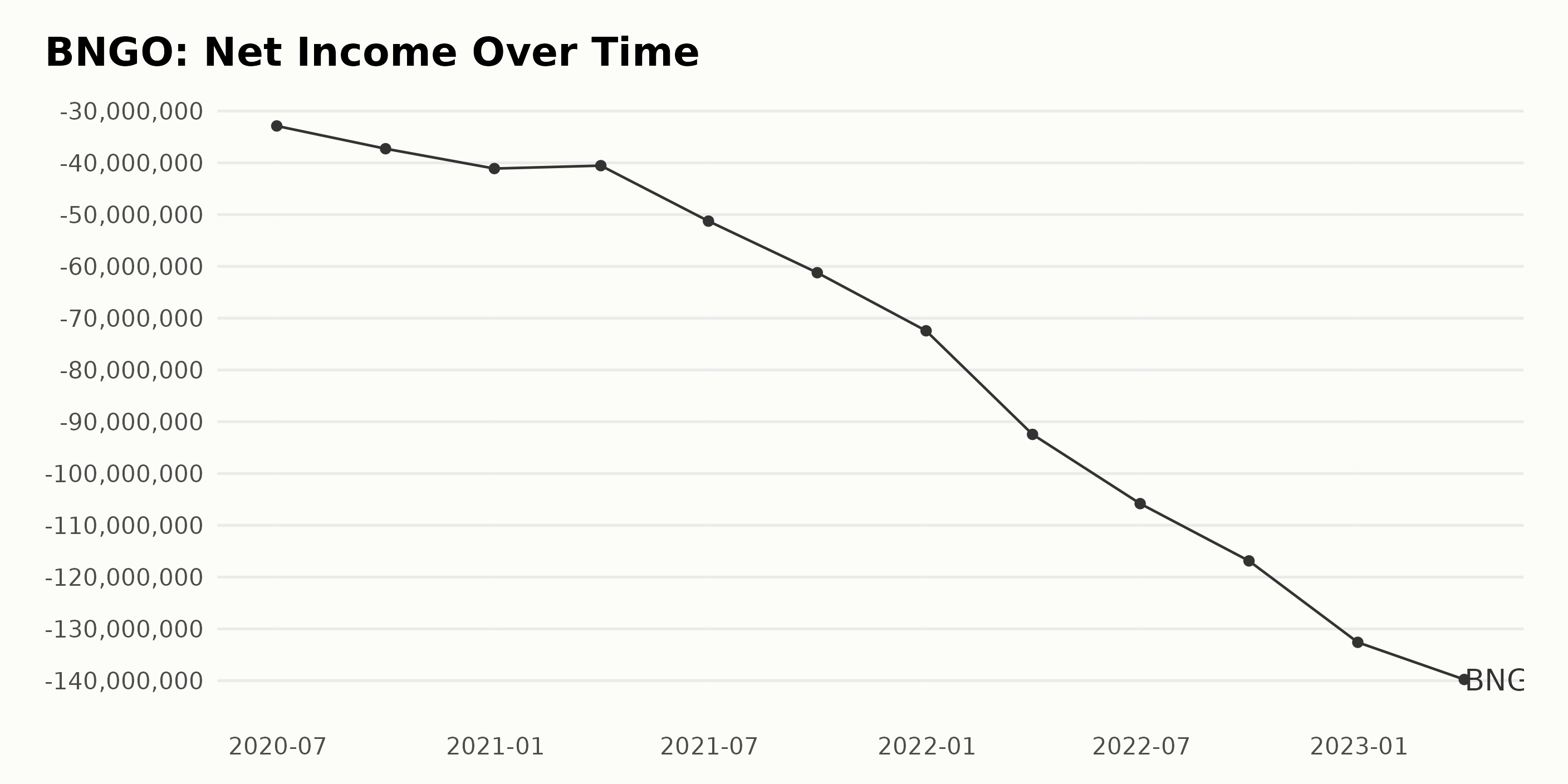

In this analysis, we will discuss the trend and fluctuations in the trailing-12-month net income of BNGO from June 2020 to March 2023.

- June 2020: -$32.88 million

- September 2020: -$37.28 million

- December 2020: -$41.11 million

- March 2021: -$40.54 million

- June 2021: -$51.26 million

- September 2021: -$61.22 million

- December 2021: -$72.44 million

- March 2022: -$92.44 million

- June 2022: -$105.81 million

- September 2022: -$116.87 million

- December 2022: -$132.60 million

- March 2023: -$139.77 million

From a general overview of the data, BNGO’s net income has shown a consistent negative trend with each passing quarter. Between June 2020 and March 2023, the net income has significantly increased its loss from -$32.88 million to a staggering -$139.77 million. The growth rate, which is calculated by measuring the last value from the first value, results in a loss increase of approximately $106.89 million during the period analyzed. While fluctuations occur in the data, the overall trend maintains an increasingly negative change, with more emphasis on the later quarters, suggesting that BNGO’s financial situation is deteriorating over time.

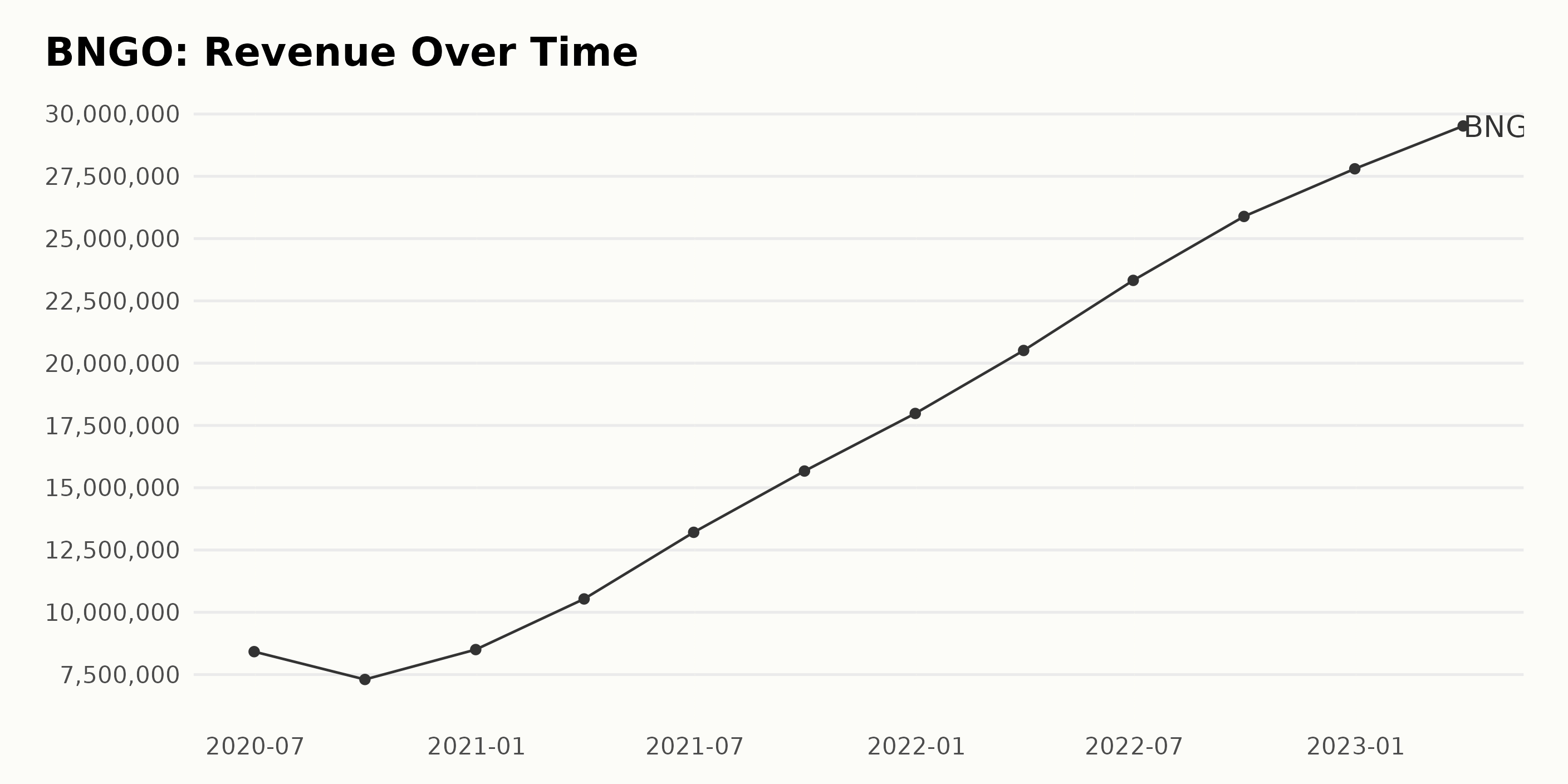

The trailing-12-month revenue of BNGO shows a consistent growth trend over the given time frame. Here are some key details:

- June 2020: $8.42 million

- September 2020: $7.30 million

- December 2020: $8.50 million

- March 2021: $10.54 million

- June 2021: $13.21 million

- September 2021: $15.67 million

- December 2021: $17.98 million

- March 2022: $20.51 million

- June 2022: $23.32 million

- September 2022: $25.89 million

- December 2022: $27.80 million

- March 2023: $29.52 million

The most recent data point in March 2023 shows a revenue of $29.52 million. Comparing the last value to the first one in June 2020, we see a growth rate of approximately 251% over the analyzed period. Emphasizing the more recent data, it is evident that BNGO has experienced continued revenue growth from 2021 through 2023.

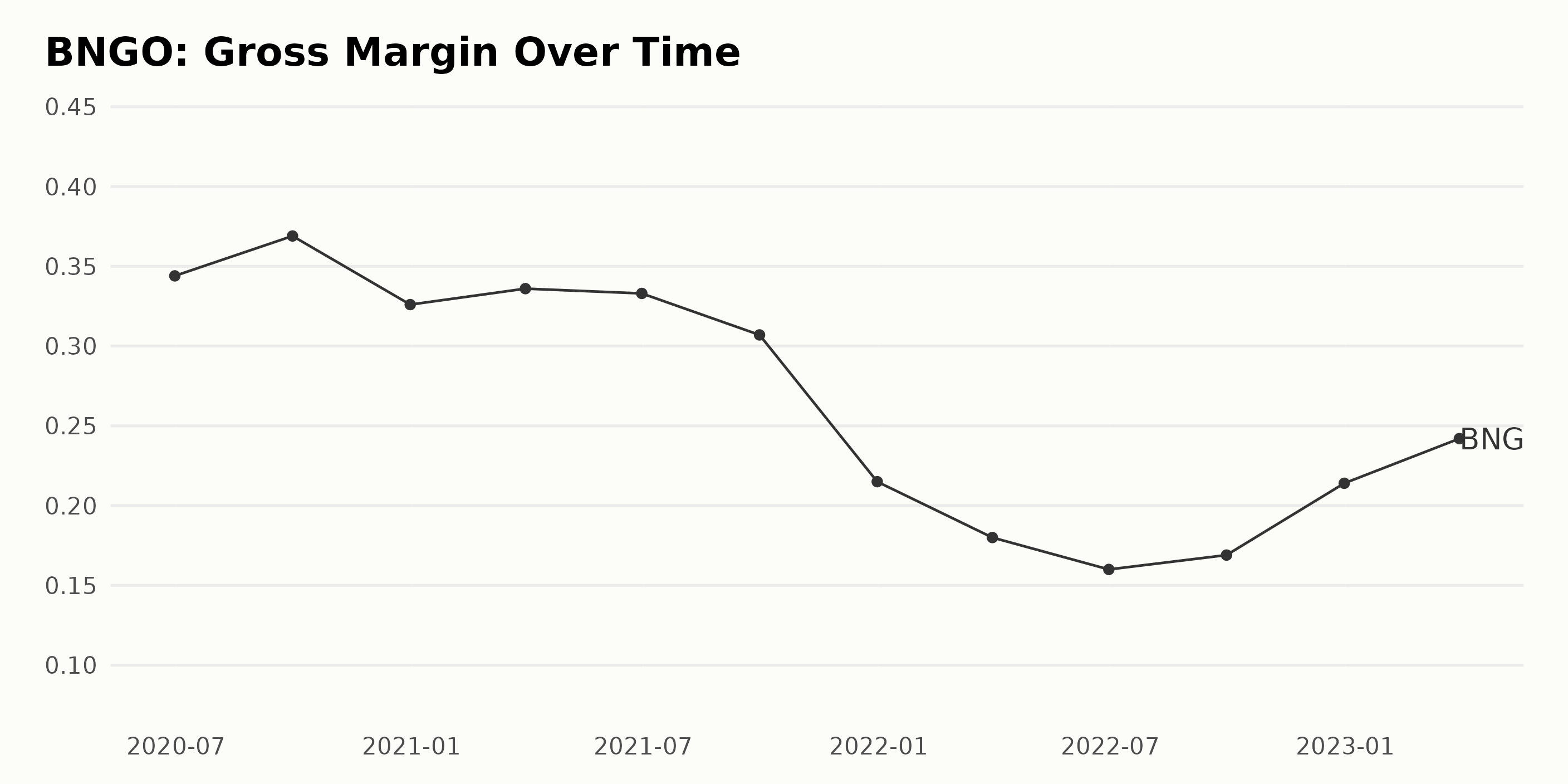

BNGO’s gross margin has experienced fluctuations and a general downward trend over the time series provided. Here are the key points:

- June 2020: Gross Margin was 34.4%

- September 2020: Slight increase to 36.9%

- December 2020: Dropped to 32.6%

- March 2021: Increased slightly to 33.6%

- June 2021: Decreased marginally to 33.3%

- September 2021: Fell to 30.7%

- December 2021: Significant drop to 21.5%

- March 2022: Further decline to 18.0%

- June 2022: Reached its lowest point at 16.0%

- September 2022: Bounced back slightly to 16.9%

- December 2022: Increased to 21.4%

- March 2023: Ended at its highest point since September 2021 at 24.2%

Comparing the first data point (34.4% in June 2020) with the last one (24.2% in March 2023), BNGO’s gross margin has decreased by approximately 10.2 percentage points during this period. However, it is important to note the recent upward trend between December 2022 and March 2023, when the gross margin increased from its lowest point to 24.2%.

The trend and fluctuations of the Analyst Price Target for BNGO can be summarized as follows: -

- From November 2021 to January 2022, the Analyst Price Target remained stable at $12.

- The target was reduced slightly to $11 between January 28, 2022, and April 8, 2023.

- It dropped significantly to $9.5 on April 15, 2022, and further to $7.5 by April 22, 2022.

- The target stayed at $7.5 from April 2022 until December 16, 2022, when it marginally decreased to $7.4.

- By December 23, 2022, the target fell to $7 and remained at this level until January 20, 2023.

- From January 20, 2023, the target started declining steadily, reaching $6 by February 3, 2023, and maintained until May 19, 2023.

- The target experienced a significant decrease to $4.8 on May 19, 2023, and steadied at $4.62 by June 2, 2023.

The last value in the series, reported on June 27, 2023, was $3. The Analyst Price Target for BNGO exhibited a general decreasing trend over the given period. The growth rate, calculated by measuring the last value ($3) from the first value ($12), is -75%. Greater emphasis should be placed on more recent data, particularly the last value of $3 on June 27, 2023.

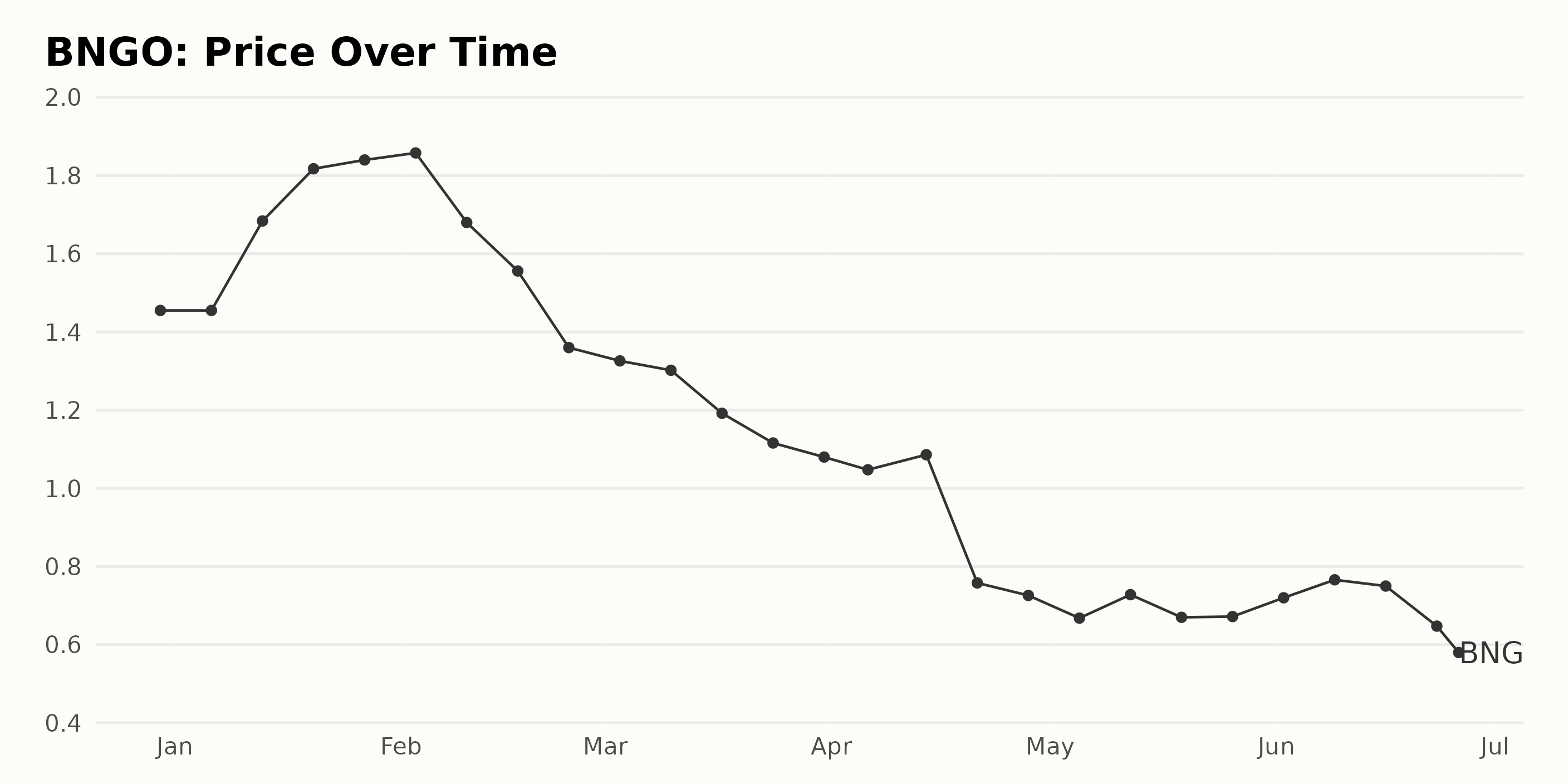

BNGO Share Price: Initial Surge Followed by Steady Decline from February to June 2023

The share price trend indicates that BNGO experienced an initial increase in its share price, reaching a peak of $1.86 on February 3, 2023. After that, the share price started to decline steadily, with periodic small rebounds. By June 26, 2023, the share price had dropped to $0.57, indicating a decelerating trend. Here is a chart of BNGO’s price over the past 180 days.

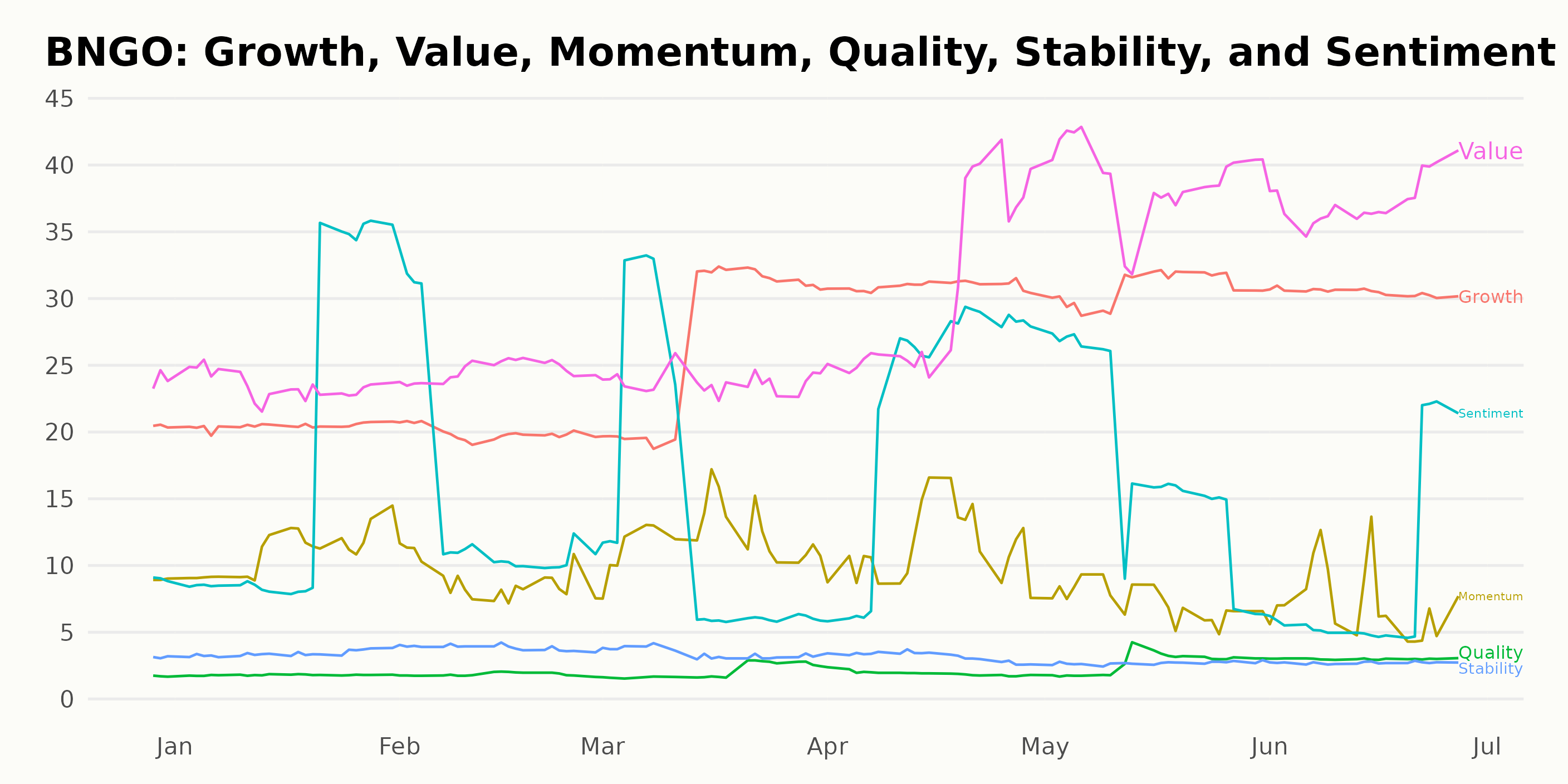

Analyzing BNGO’s POWR Ratings

BNGO has an overall F rating, translating to a Strong Sell in our POWR Ratings system. It also has an F grade in Stability and Quality and a D in Momentum and Sentiment. It is ranked #375 out of the 383 stocks in the Biotech category.

Here are some highlights of BNGO’s rank in the Biotech category throughout the mentioned period:

- December 31, 2022: Rank 377 out of 384

- January 7, 2023: Rank 384 out of 384

- March 25, 2023: Rank 383 out of 384

- April 29, 2023: Rank 378 out of 384

- May 27, 2023: Rank 373 out of 384

- June 24, 2023: Rank 380 out of 384

It is important to note that lower rank values denote a superior position among peers. In this case, BNGO often ranks near the bottom of the Biotech category of stocks, indicating underperformance compared to other companies in its industry group.

Stocks to Consider Instead of Bionano Genomics, Inc. (BNGO)

Other stocks in the Biotech sector that may be worth considering are Biogen Inc. (BIIB), Gilead Sciences Inc. (GILD), and Alkermes plc (ALKS) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

BNGO shares were trading at $0.57 per share on Tuesday afternoon, down $0.00 (-0.26%). Year-to-date, BNGO has declined -60.96%, versus a 14.41% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Should You Watch Bionano Genomics (BNGO) this Week? appeared first on StockNews.com