Industrial manufacturer Standex (NYSE:SXI) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 6.4% year on year to $189.8 million. Its non-GAAP profit of $1.91 per share was 14.4% above analysts’ consensus estimates.

Is now the time to buy Standex? Find out by accessing our full research report, it’s free.

Standex (SXI) Q4 CY2024 Highlights:

- Revenue: $189.8 million vs analyst estimates of $188.8 million (6.4% year-on-year growth, 0.5% beat)

- Adjusted EPS: $1.91 vs analyst estimates of $1.67 (14.4% beat)

- Adjusted EBITDA: $39.6 million vs analyst estimates of $40.22 million (20.9% margin, 1.6% miss)

- Operating Margin: 4.5%, down from 15.9% in the same quarter last year

- Free Cash Flow Margin: 1.1%, down from 10.8% in the same quarter last year

- Market Capitalization: $2.24 billion

Commenting on the quarter's results, President and Chief Executive Officer David Dunbar said, "Following solid operational performance in the fiscal first quarter, we delivered the highest sales since the divestment of the Refrigeration business in April 2020 and record adjusted operating margin in the fiscal second quarter. These improvements reflected solid operational performance from core businesses and contribution from the recent Amran/Narayan acquisition. Completed in the quarter, this was the largest acquisition in the history of the Company and its sales exceeded our expectations. The continued strength of the electrical grid end market positions us well for continued growth and margin improvement in the second half of fiscal 2025."

Company Overview

Holding over 500 patents globally, Standex (NYSE:SXI) is a manufacturer and distributor of industrial components for various sectors.

Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

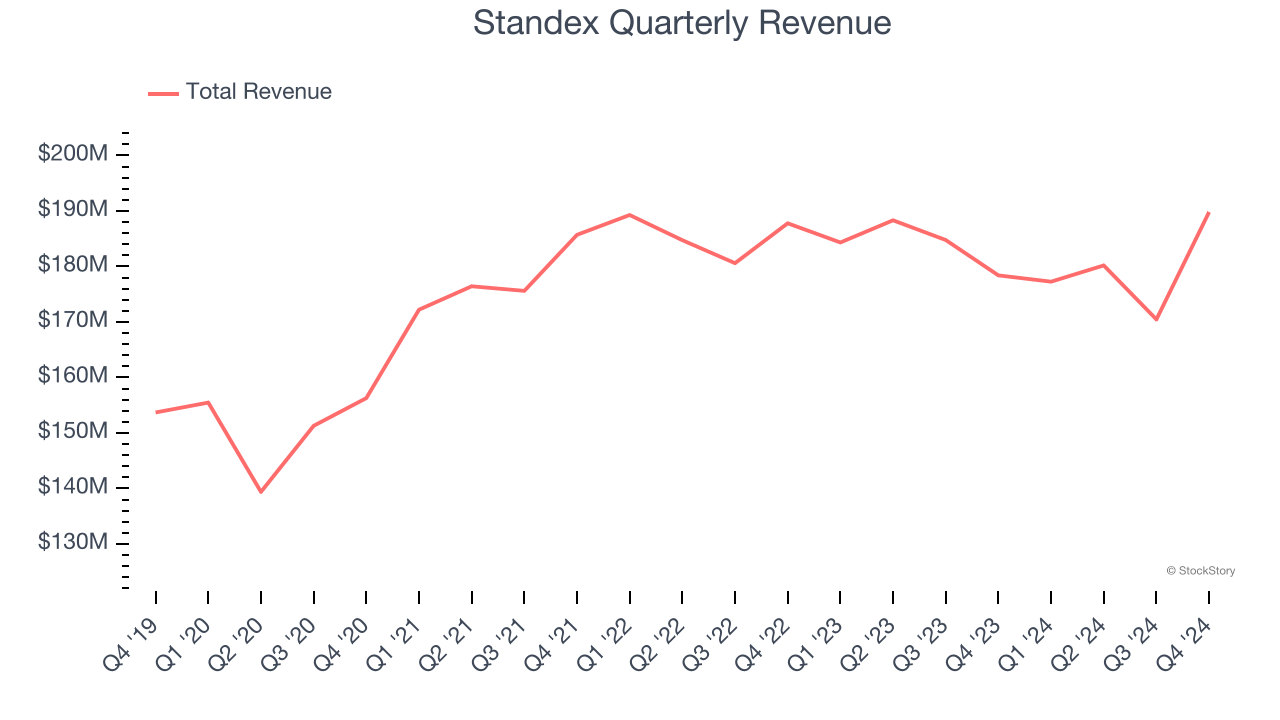

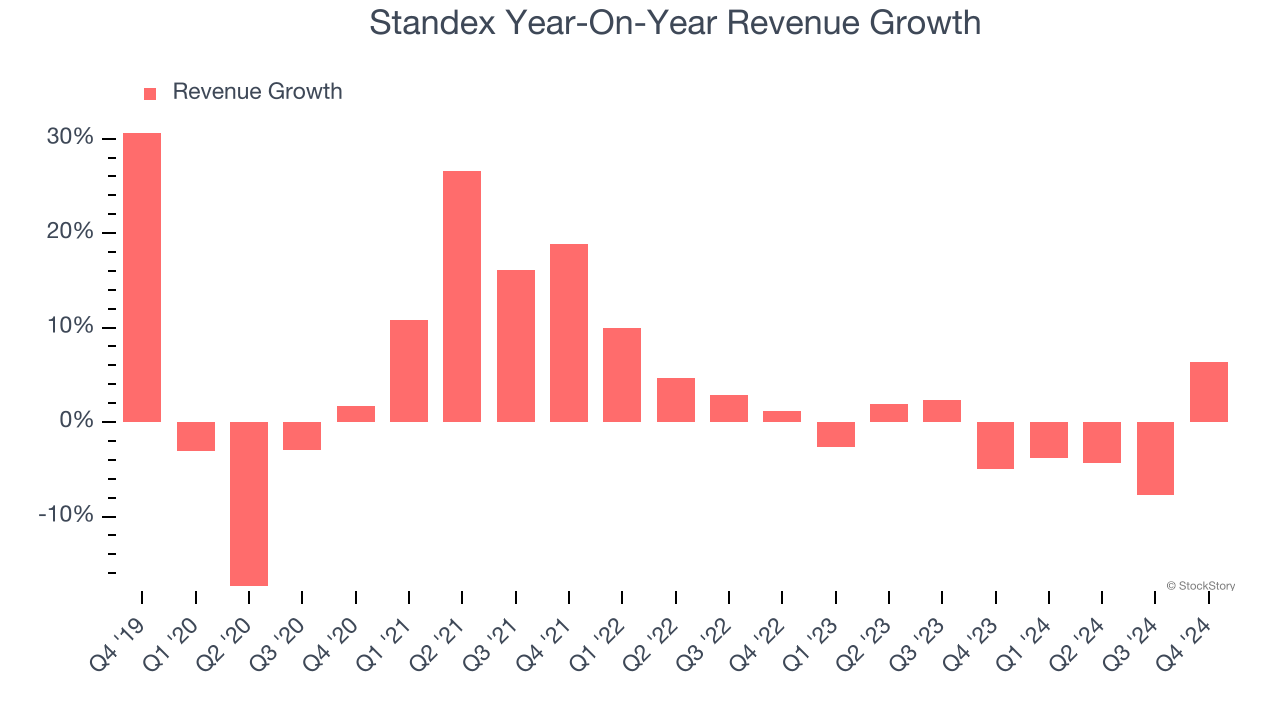

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Standex grew its sales at a sluggish 2.4% compounded annual growth rate. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Standex’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.7% annually.

This quarter, Standex reported year-on-year revenue growth of 6.4%, and its $189.8 million of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 17.4% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

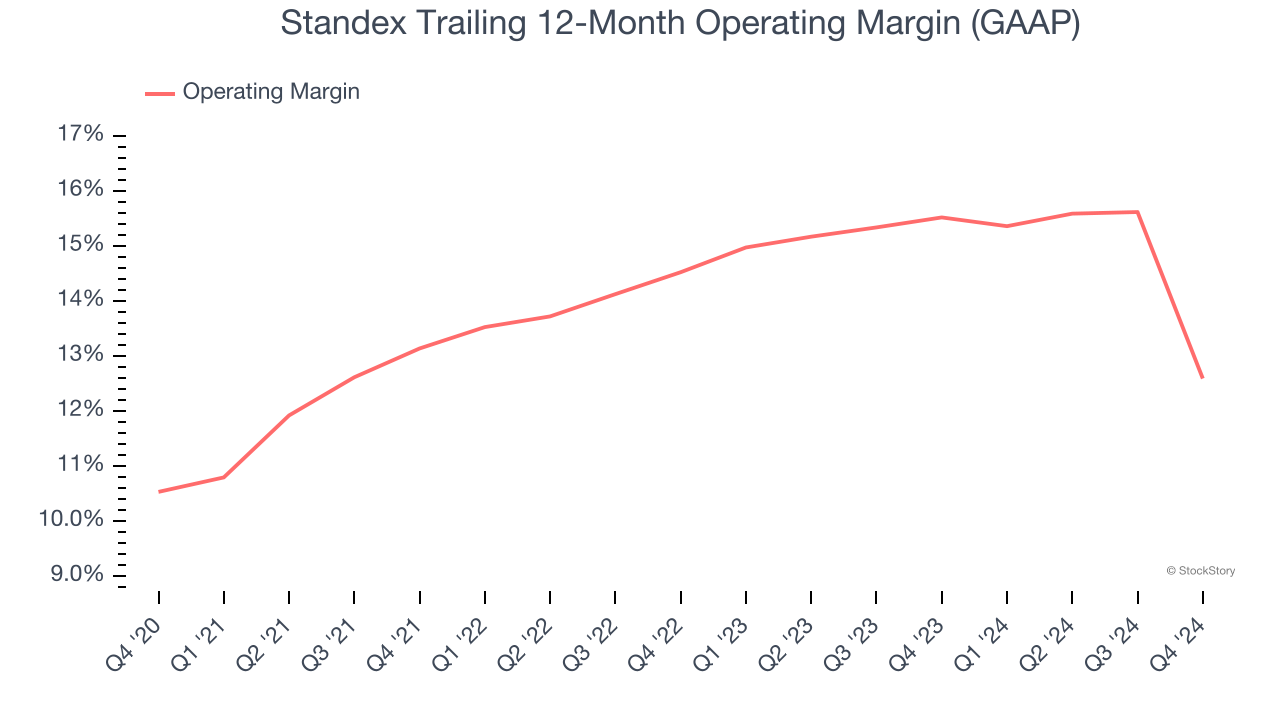

Standex has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Standex’s operating margin rose by 2.1 percentage points over the last five years, showing its efficiency has improved.

In Q4, Standex generated an operating profit margin of 4.5%, down 11.5 percentage points year on year. Since Standex’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

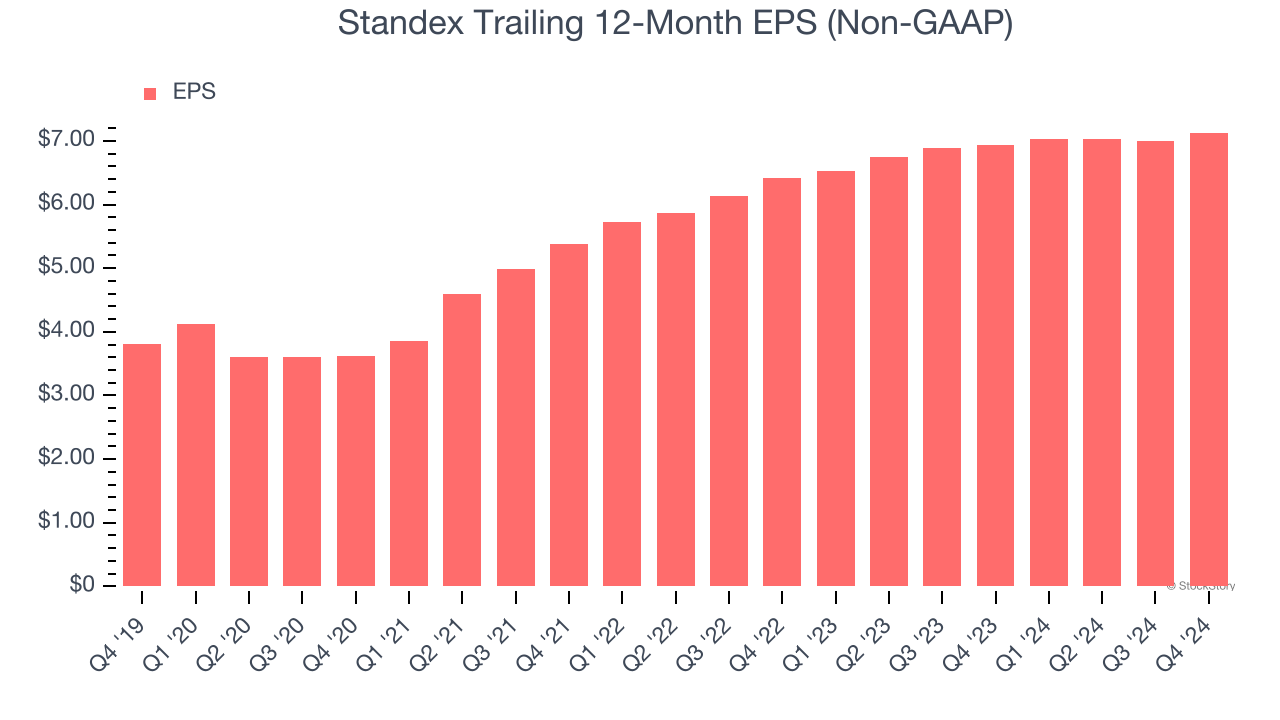

Standex’s EPS grew at a remarkable 13.4% compounded annual growth rate over the last five years, higher than its 2.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

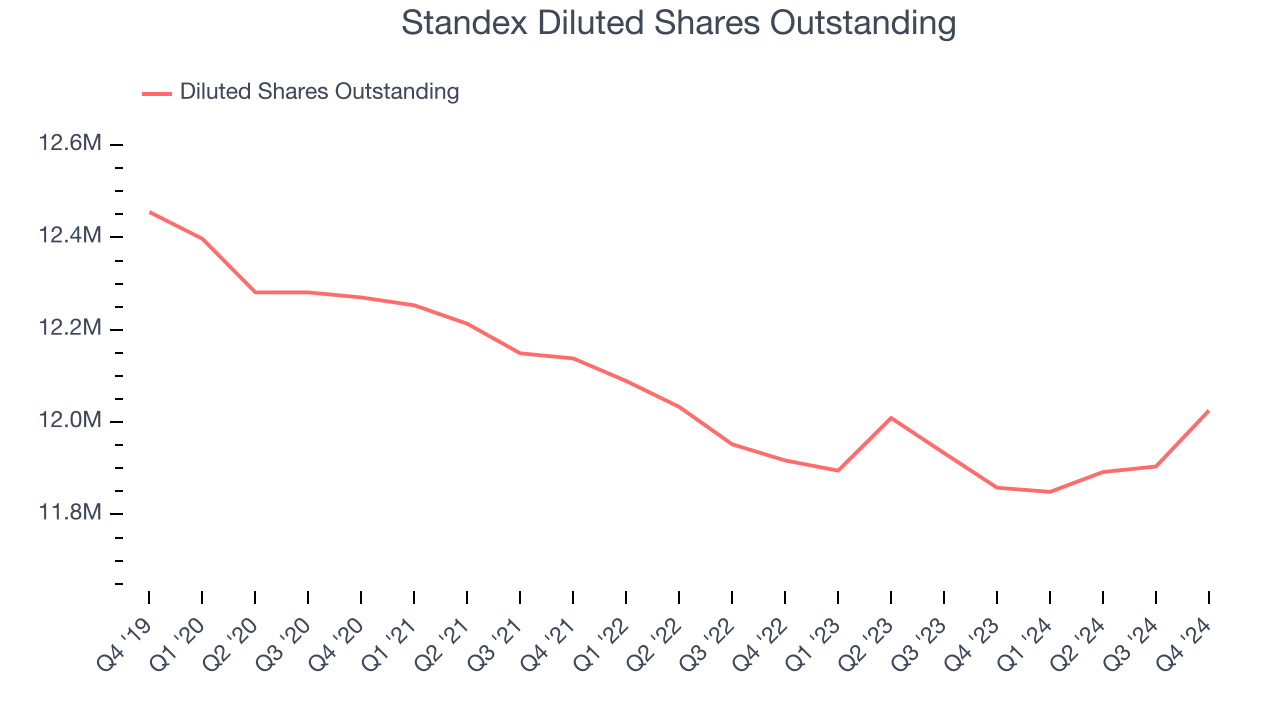

Diving into Standex’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Standex’s operating margin declined this quarter but expanded by 2.1 percentage points over the last five years. Its share count also shrank by 3.5%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Standex, its two-year annual EPS growth of 5.4% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Standex reported EPS at $1.91, up from $1.78 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Standex’s full-year EPS of $7.13 to grow 19.8%.

Key Takeaways from Standex’s Q4 Results

We enjoyed seeing Standex exceed analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock remained flat at $186.56 immediately following the results.

Is Standex an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.